grinvalds/iStock through Getty Photos

As turbulent fairness markets remind traders of the significance of fundamentals, we’ve recognized a preferred progress inventory with fundamentals that can’t justify its high-flying valuation. HubSpot, Inc. (NYSE:HUBS) is within the Hazard Zone.

HubSpot helps companies streamline their advertising, gross sales, and repair capabilities via its buyer relationship administration platform. In fact, software program platforms to maximise productiveness and handle buyer relationships are neither new, nor distinctive. Proudly owning HUBS is extraordinarily dangerous given the corporate’s:

- free money move burning income progress

- competitors from giant incumbents

- commoditized trade

- inferior profitability to friends

- present valuation implies income will develop at a 38% CAGR via 2030 and market share will enhance over six occasions the present stage

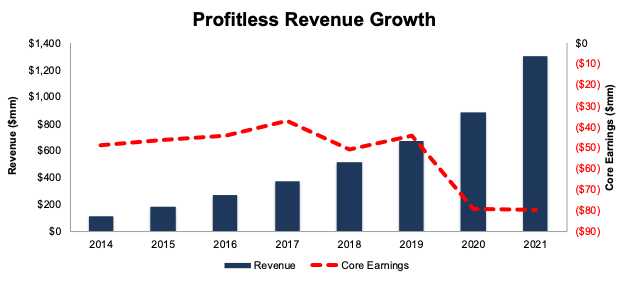

Increased Revenues And Increased Losses

HubSpot’s fast income progress has gained traders’ consideration. The corporate has grown income 37% compounded yearly since 2016, and administration’s steerage for 2022 income implies 33% year-over-year (YoY) progress on the midpoint.

Nonetheless, HubSpot’s quick top-line progress has include no enchancment within the backside line. Per Determine 1, HubSpot’s Core Earnings have fallen YoY in three of the previous 4 years and from -$49 million in 2014 to -$80 million in 2021.

Determine 1: HubSpot’s Income & Core Earnings Since 2014

HUBS Income and Core Earnings (New Constructs, LLC)

Prime-Line Development Was Already Slowing

Accelerated adoption of ecommerce and cloud-based options drove income progress for HubSpot and lots of related companies, corresponding to Squarespace (SQSP) and Shopify (SHOP) to file ranges in 2021. Nonetheless, this file progress glosses over the truth that, previous to 2021, HubSpot’s progress was slowing. In reality, the corporate’s YoY income progress price slowed every year from 2016 to 2020.

Administration has quietly acknowledged that 2021 was an outlier 12 months and that income progress is more likely to gradual. The midpoint of administration’s steerage implies income progress of 33% YoY in 2022, which is nicely beneath the 47% YoY progress in 2021 and extra according to the 31% YoY progress in 2020. With rising inflation, the tip of ultra-loose Fed coverage, and ongoing international provide chain disruptions, the expectations baked into HubSpot’s valuation look unrealistic – particularly coming off an outlier 12 months for progress.

Already Low Market Share

As a CRM platform, HubSpot faces competitors from a lot bigger firms, in addition to smaller, area of interest choices. This mix of opponents creates an intensely aggressive atmosphere and more and more commoditized market. In such a market, there are solely two sorts of firms that may create lasting earnings:

- Massive firms with a number of merchandise/companies that provide CRM as an add-on to different choices that already generate vital money flows (suppose Microsoft [MSFT] or Oracle [ORCL])

- The biggest and “most scaled” CRM firms that maintain extra pricing energy and a capability to take market share from smaller opponents [think Salesforce.com (CRM)].

HubSpot doesn’t match into both class. It’s a very small participant within the international CRM market. Estimates for HubSpot’s market share (proven beneath) differ by supply, however one factor is evident, HubSpot’s market share is nicely beneath Salesforce.com, which has ~35% market share.

- 1.9% in 2022 by Slintel

- 0.3% in 2022 by Datanyze

- 2.2% in 2021 by Fortune Enterprise Insights

- 1.3% in 2020 by Gartner

Along with Salesforce.com, tech giants SAP (SAP), Oracle (ORCL), Adobe (ADBE), and Microsoft (MSFT) personal a mixed 61% of the CRM market (per Slintel).

Given its small market share, quite a few opponents, and costly valuation, HubSpot reminds us of one other Hazard Zone choose, Squarespace (SQSP).

Litany of Rivals Create Extra Impediment to Earnings

The competitors isn’t restricted to only the big tech firms listed above. Provided that HubSpot presents advertising, gross sales, and buyer assist companies, its competitors is ever-growing as there are few obstacles to entry within the software-as-a-service trade. Beneath, we record among the many firms competing with HubSpot throughout every of its finish markets.

- Marketo Have interaction (owned by Adobe)

- Oracle Eloqua

- Dynamics 365 (owned by Microsoft)

- Salesforce CRM

- SAP CRM

- Zendesk (ZEN)

- Freshworks (FRSH)

- Mailchimp (owned by Intuit (INTU))

- Monday.com (MNDY)

- Klayvio

- Sage CRM

- Freshsales

- Zoho CRM

- SugarCRM

- Agile CRM

- Thryv

- Keap

- Bitrix24

- Copper

- Insightly

- Pipedrive

- Redtail CRM

Given the big record of opponents, HubSpot’s greatest aggressive benefit has been its capability to lose cash by spending closely on gross sales and advertising whereas charging low (beneath prices) costs to draw customers.

The underside line is that charging costs which might be too low to generate earnings isn’t a sustainable technique long-term, particularly when the product supplied is essentially the identical as what will be discovered at any variety of different firms. As a verified software program evaluate on G2 famous, HubSpot is a “jack of all trades and grasp of none.” HubSpot’s software program isn’t specialised sufficient to beat area of interest merchandise. So, it should compete within the normal enterprise productiveness software program market, which is dominated by bigger corporations towards whom HubSpot has not had success competing thus far.

The market is shedding endurance and punishing unprofitable firms whose essential “aggressive benefit” is entry to giant quantities of capital that allows them to outspend competitors.

HubSpot Isn’t the Least expensive Choice…

Bulls argue that HubSpot is charging decrease costs to construct market share, and as soon as it has sufficient market share, it is going to increase costs and grow to be very worthwhile. The issue with that argument is that HubSpot isn’t the most affordable possibility for the phase of the promote it targets, which limits its capability to lift costs.

ImpactPlus, which helps firms streamline gross sales and advertising, notes that whereas HubSpot could also be cheaper or similar to Salesforce’s enterprise options, it’s seemingly extra pricey for small- and medium-sized enterprises than utilizing alternate options like MailChimp and Squarespace. For instance, HubSpot’s web site builder begins at $23/month for its starter plan, whereas Squarespace’s base plan begins at $14/month. HubSpot’s advertising instruments begin at $45/month whereas MailChimp’s Necessities plan begins at $11/month and its Customary plan begins at $17/month (excludes each firms’ free plans).

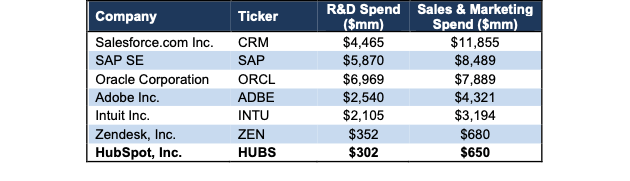

…and Doesn’t Outspend Bigger Rivals

HubSpot can’t deploy as a lot capital, relative to opponents, to develop its product and market its platform. Per Determine 2, HubSpot’s analysis & improvement (R&D) and gross sales & advertising spend in 2021 rank beneath its largest opponents and much more specialised firms corresponding to Zendesk (ZEN).

With decrease spending on R&D, HubSpot dangers opponents growing new companies/options that its platform can not match. As famous within the firm’s 2021 10-Okay, “if we’re unable to develop new functions that tackle our clients’ wants, or to reinforce and enhance our platform in a well timed method, we might not be capable to preserve or enhance market acceptance of our platform.”

As we’ll present beneath, HubSpot should drastically enhance market share if it has any hope of attaining the expectations baked into its inventory value.

Determine 2: HubSpot’s R&D and Gross sales & Advertising Spend Vs. Friends: TTM

HUBS R&D Spend Vs. Friends (New Constructs, LLC)

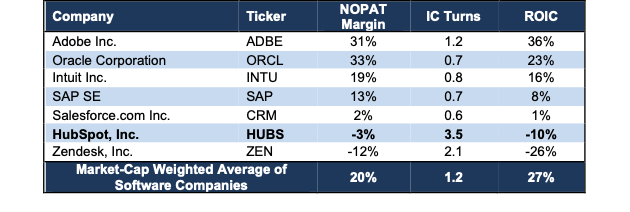

HubSpot Additionally Has A few of The Worst Margins

Given its lack of market share, intense competitors, money burn and better costs, HubSpot can’t afford to get right into a pricing battle. Per Determine 3, HubSpot’s -10% return on invested capital and -3% web working revenue after-tax margin are second to final among the many publicly traded opponents listed above. The one firm with worse profitability than HubSpot is prior Hazard Zone choose Zendesk.

Determine 3: HubSpot’s Profitability Vs. Friends: TTM

HUBS Profitability Vs. Friends (New Constructs, LLC)

And Margins Aren’t Anticipated to Enhance

We advocate traders ignore an organization’s chosen non-GAAP metrics when analyzing profitability, as they have a tendency to overstate true earnings and will be extremely deceptive. That mentioned, we discover some clues as to the place margins are headed in administration’s steerage for non-GAAP metrics. In 2021, HubSpot’s non-GAAP working margin reached 9% (in comparison with -3% NOPAT margin). In 2022, the midpoint of administration’s steerage for non-GAAP working revenue and income implies a 9% non-GAAP working margin. Administration is signaling no enchancment to margins in 2022, however HubSpot’s inventory is priced for vital enchancment in margins, as we’ll present beneath.

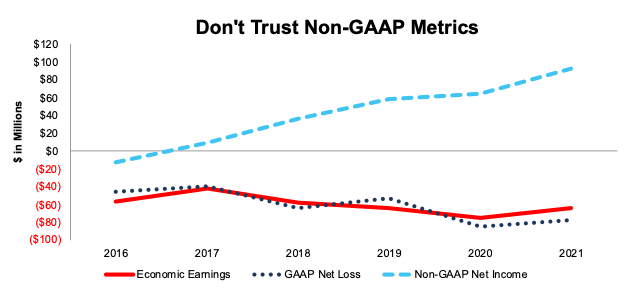

Right here’s How Deceptive Non-GAAP Profitability Is

As with many unprofitable firms, HubSpot makes use of flawed non-GAAP metrics corresponding to non-GAAP working revenue and non-GAAP web revenue, which paint a rosier image of the corporate’s operations. Non-GAAP metrics enable administration vital leeway in eradicating precise prices of the enterprise to current a extra optimistic view.

In 2021, HubSpot eliminated, amongst different gadgets, $167 million (13% of income) in stock-based compensation to calculate its non-GAAP web revenue. In spite of everything of HubSpot’s changes, non-GAAP web revenue in 2021 is $92 million, up from -$13 million in 2016. Financial earnings, which take away uncommon good points/losses and modifications to the stability sheet, are -$65 million in 2021 and down from -$57 million in 2016. See Determine 4.

Determine 4: HubSpot’s Financial Earnings vs. GAAP and Non-GAAP Web Earnings: 2016 – 2021

HUBS Financial Earnings vs. Non-GAAP Web Earnings (New Constructs, LLC)

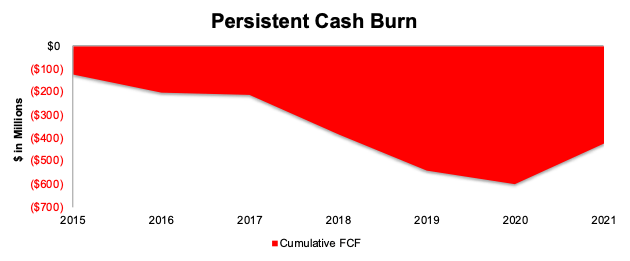

A Rising Money Bonfire

HubSpot’s working bills have been larger than 100% of income in every of the previous six years and the corporate has additionally burned via a major chunk of free money move over the identical time.

The corporate’s FCF was adverse in yearly from 2015-2020. Even after producing constructive FCF for the primary time in 2021 (in what was a standout 12 months for a lot of expertise firms), the corporate’s cumulative FCF since 2015 is -$424 million (2% of market cap).

2021’s constructive FCF might turn into an outlier as HubSpot seems to be to increase its presence internationally and incur heavy working bills, together with analysis and improvement, to take care of a product suite on par with opponents.

Determine 5: HubSpot’s Cumulative Free Money Stream: 2015 – 2021

HUBS Money Burn Since 2015 (New Constructs, LLC)

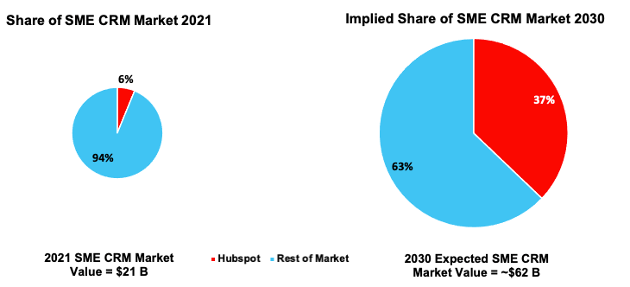

Inventory Worth Requires Main Market Share Features

Driving HubSpot’s progress story is the elevated adoption of CRM suites as companies adapt to an more and more omni-channel market.

Going ahead, the CRM market is anticipated to develop 13% compounded yearly from 2022-2030. Whereas robust, the expansion within the international CRM market is nowhere close to the income progress ranges embedded in HubSpot’s valuation, as we’ll present beneath. HubSpot should develop a lot quicker than the general CRM market, which suggests taking vital market share from incumbents, regardless of decrease profitability and smaller scale.

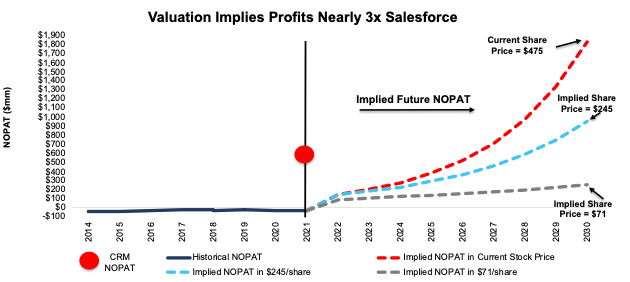

Priced to Be Extra Worthwhile Than Salesforce

Beneath we use our reverse discounted money move mannequin to research the longer term money move expectations baked into HubSpot’s inventory value. We additionally present two further situations to spotlight the draw back potential in shares if HubSpot’s income grows at extra life like charges.

DCF State of affairs 1: to Justify the Present Inventory Worth

If we assume HubSpot’s:

- NOPAT margin rises to eight% (greater than triple Salesforce’s 2021 [1] NOPAT margin and far greater than HubSpot’s -3% 2021 NOPAT margin) in 2022 via 2030 and

- income grows at a 38% CAGR (vs. 2021 – 2023 consensus estimate CAGR of 30%) via 2030, then

the inventory is value $475/share right this moment – equal to the present inventory value.

On this state of affairs, HubSpot generates $22.9 billion in income in 2030 or 86% of Salesforce’s 2021 income and 145% of Adobe’s 2021 income. Per Determine 6, at $22.9 billion, HubSpot’s share of the worldwide small & medium enterprises (SME) CRM market[2] in 2030 would equal 37%, up from 6%[3] in 2021. We take a look at the implied market share of the worldwide SME CRM market as a result of HubSpot’s focus is on SME, which vary from 2 to 2,000 staff.

On this state of affairs, HubSpot’s NOPAT in 2030 is $1.8 billion, or almost 3x Salesforce’s 2021 NOPAT. In fact, HubSpot might want to obtain that progress whereas competing with Salesforce, Microsoft, Oracle and all the opposite opponents on the record above.

Determine 6: HubSpot’s 2021 Market Share Vs. 2030 Implied Market Share

HUBS DCF Implied Market Share (New Constructs, LLC)

Notice that firms that develop income by 20%+ compounded yearly for such an extended interval are unbelievably uncommon. The money flows expectations in HubSpot’s share value are unrealistically excessive, which signifies draw back danger is far bigger than upside potential.

DCF State of affairs 2: Shares Are Value $245 at Consensus Development

We carry out a second DCF state of affairs to spotlight the draw back danger to proudly owning HubSpot ought to it develop at consensus income estimates. If we assume HubSpot’s:

- NOPAT margin rises to eight% in 2022 via 2030,

- income grows at consensus estimates in 2022 and 2023, and

- income grows 27% every year from 2024 via 2030 (continuation of 2023 consensus estimate), then

the inventory is value $245/share right this moment – or 48% beneath the present inventory value. On this state of affairs, HubSpot generates $11.8 billion in income in 2030 or 104% of Intuit’s 2021 income and greater than triples its market share from 6% in 2021 to 19% in 2030. Moreover, this state of affairs implies HubSpot generates $947 million in NOPAT in 2030, which is 149% of Salesforce’s 2021 NOPAT, and nicely above HubSpot’s -$38 million NOPAT in 2021.

DCF State of affairs 3: HUBS Has 85%+ Draw back

Our final DCF state of affairs exhibits the draw back danger ought to HubSpot develop income on the consensus expectations for market progress and margins merely double Salesforce’s. If we assume HubSpot’s:

- NOPAT margin rises to 4.8% (double Salesforce’s 2021 NOPAT margin) in 2022 via 2030,

- income grows at consensus estimates in 2022 and 2023, and

- income grows 13% a 12 months (equal to international CRM market forecast via 2030) from 2024 – 2030, then

the inventory is value simply $71/share right this moment – an 85% draw back to the present inventory value. This state of affairs nonetheless implies HubSpot will increase market share of the worldwide SME CRM market from 6% in 2021 to eight% in 2030 and generates $248 million in NOPAT in 2030, in comparison with -$38 million NOPAT in 2021.

Determine 7 compares HubSpot’s historic NOPAT to its implied NOPAT in every of the above DCF situations. We additionally embody Salesforce’s 2021 NOPAT for comparability.

Determine 7: HubSpot’s Historic and Implied Income: DCF Valuation Eventualities

HUBS DCF Implied NOPAT (New Constructs, LLC)

Every of the above situations additionally assumes HubSpot grows income, NOPAT, and FCF with out rising working capital or mounted belongings. This assumption is very unlikely however permits us to create best-case situations that exhibit the expectations embedded within the present valuation. For reference, HubSpot’s invested capital has grown 12% compounded yearly since 2014. If we assume HubSpot’s invested capital will increase at the same historic price in DCF situations 2-3 above, the draw back danger is even bigger.

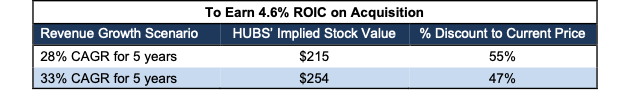

Acquisition Would Be a Destruction of Capital

Usually the biggest danger to any bear thesis is what we name “silly cash danger,” which implies an acquirer is available in and buys HubSpot on the present, or greater, share value regardless of the inventory being overvalued. Given our evaluation above, the one believable justification for HUBS buying and selling at such a excessive value is the expectation that one other firm will purchase it. Rumors surfaced that Amazon AWS staff had pitched buying HubSpot in August 2021, however nothing got here of the information and neither firm has commented.

We expect Amazon is not going to be fascinated by shopping for HubSpot till its valuation comes approach down – for all the explanations we offered above. In fact, stranger issues have occurred than firms getting acquired at foolishly excessive premiums, so Silly Cash danger all the time exits. Nonetheless, we expect it’s essential to quantify how excessive the acquisition hopes priced into the inventory are.

Strolling By means of the Acquisition Math

First, traders have to know that HubSpot has liabilities that make it costlier than the accounting numbers would initially counsel:

- $713 million in whole debt (3% of market cap)

- $204 million in excellent worker inventory choices (1% of market cap).

After adjusting for all liabilities, we are able to mannequin a number of buy value situations. For this evaluation, we selected Amazon as a possible acquirer of HubSpot, however readers can use nearly any firm to do the identical evaluation. The important thing variables are the weighted common value of capital and ROIC for assessing worth creation at completely different hurdle charges.

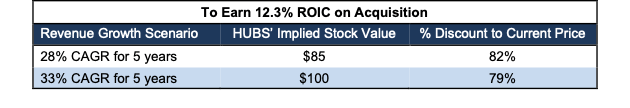

There are limits on how a lot Amazon ought to pay for HubSpot to earn a correct return, given the NOPAT or free money flows being acquired. Figures 8 and 9 present what we expect Amazon ought to pay for HubSpot to make sure it doesn’t destroy shareholder worth. Even in essentially the most optimistic of acquisition situations, HubSpot is value lower than its present share value.

Every implied value relies on a ‘aim ROIC’ and completely different ranges of income progress. In State of affairs 1, we use 33% income progress in Yr 1 and 27% in Yr 2, which equal consensus estimates. Within the first state of affairs, we prolong the 2023 consensus estimate of 27% to years three via 5. Within the second state of affairs, we use 33% in years one via 5. We use the upper estimates in state of affairs two for instance a best-case state of affairs that assumes HubSpot grows income quicker for longer whereas being built-in inside Amazon’s present enterprise.

We optimistically assume HubSpot achieves a ten% NOPAT margin, which is above its 2021 margin of -3%, and double Amazon’s 2021 margin. We additionally optimistically assume that Amazon can develop HubSpot’s income and NOPAT with out spending any working capital or mounted belongings past the unique buy value, which is unlikely however creates a best-case state of affairs, nonetheless.

Determine 8: Implied Acquisition Costs for Worth-Impartial Deal – State of affairs 1

HUBS Acquisition State of affairs 1 (New Constructs, LLC)

Determine 8 exhibits the implied values for HubSpot assuming Amazon desires to realize an ROIC on the acquisition that equals its WACC of 4.6%. This state of affairs represents the utmost value that may be paid to keep away from worth destruction. Even when HubSpot can develop income by 33% compounded yearly for 5 years and obtain a ten% NOPAT margin, the corporate is value simply $254/share. It’s value noting that any deal that solely achieves a 4.6% ROIC wouldn’t be accretive to worth, because the return on the deal would equal Amazon’s WACC.

Determine 9: Implied Acquisition Costs to Create Worth – State of affairs 2

HUBS Acquisition State of affairs 2 (New Constructs, LLC)

Determine 9 exhibits the implied values for HubSpot assuming Amazon desires to realize an ROIC on the acquisition that equals 12%, its present ROIC. Acquisitions accomplished at these costs could be accretive to Amazon’s shareholders. On this best-case progress state of affairs, the implied worth is much beneath HubSpot’s present value. With out vital will increase within the margin and/or income progress assumed on this state of affairs, an acquisition of HubSpot at its present value destroys vital shareholder worth.

Earnings Miss and Increasing Losses May Ship Shares Decrease

HubSpot has beat earnings expectations in every of the previous 20 quarters. In accordance with Zacks, in each 2020 and 2021, consensus estimates begin excessive and fall all year long, which signifies HubSpot is thrashing a decrease bar every consecutive quarter. As an example, in January 2019, consensus estimates for 2020 referred to as for earnings of $1.73/share. On the finish of 2019, estimates had fallen to $1.62/share, and on the finish of 3Q20, estimates for 2020 earnings had fallen to only $0.95/share. 2021 estimates comply with the same path.

Nonetheless, 2022 is a unique image. In February 2021, consensus estimates referred to as for earnings of $2.17/share in 2022. As of March 22, 2022, consensus estimates for 2022 earnings have risen to $2.40/share. A miss on this atmosphere, on the again of rising expectations, may ship shares tumbling.

Ought to HubSpot’s 2021 progress show to be the outlier and income progress charges proceed their prior downward development, traders might falter of their perception of this progress story and ship shares right down to a stage extra according to the corporate’s fundamentals.

What Noise Merchants Miss With HUBS

As of late, fewer traders take note of fundamentals and the crimson flags buried in monetary filings. As a substitute, as a result of proliferation of noise merchants, the main focus tends towards technical buying and selling developments whereas high-quality basic analysis is missed. Right here’s a fast abstract for noise merchants when analyzing HUBS:

- lack of a moat in a extremely aggressive trade leading to minimal market share

- adverse margins and miniscule R&D spend relative to competitors

- cash-burning operation

- valuation implies the corporate will probably be almost 3x extra worthwhile than Salesforce, the present trade chief

Executives Get Compensated Whereas Destroying Shareholder Worth

HubSpot’s executives obtain annual money bonuses, that are tied to the achievement of annual recurring income and non-GAAP working revenue objectives. Moreover, executives obtain inventory choices and restricted inventory items, neither of that are tied to any efficiency measure.

By tying government compensation to metrics that don’t have any correlation to creating shareholder worth, HubSpot’s executives have been rewarded whereas destroying shareholder worth. Financial earnings, the true money flows of the enterprise, have by no means been constructive and declined from -$59 million in 2015 to -$65 million in 2021.

HubSpot ought to hyperlink government compensation with bettering ROIC, which is straight correlated with creating shareholder worth, so shareholders’ pursuits are correctly aligned with executives’ pursuits.

Don’t Purchase What Insiders are Promoting

Over the previous 12 months, insiders have bought 41 thousand shares and bought 249 thousand shares for a web impact of 208 thousand shares bought. If insiders are promoting, why shouldn’t you?

There are presently 2.3 million shares bought quick, which equates to five% of shares excellent and slightly below three days to cowl. The variety of shares bought quick has remained flat since final month.

Important Particulars Present in Monetary Filings by Our Robo-Analyst Expertise

Beneath are specifics on the changes we make based mostly on Robo-Analyst findings in HubSpot’s 10-Okay:

Earnings Assertion: we made $75 million of changes, with a web impact of eradicating $35 million in non-operating bills (3% of income).

Steadiness Sheet: we made $1.5 billion of changes to calculate invested capital with a web lower of $1.2 billion. One of many largest changes was $1.3 billion in extra money. This adjustment represented 84% of reported web belongings.

Valuation: we made $2.2 billion of changes to shareholder worth for a web impact of accelerating shareholder worth by $391 million. Other than whole debt, one of the notable changes to shareholder worth was $204 million in excellent worker inventory choices. This adjustment represents 1% of HubSpot’s market cap.

Unattractive Funds That Maintain HUBS

The next funds obtain our Unattractive-or-worse score and allocate considerably to HUBS:

- Evolutionary Tree Innovators Fund (INVTX, INVNX) – 6.4% allocation and Very Unattractive score

- T Rowe Worth International Expertise Fund (PGTIX, PRGTX) – 6.3% allocation and Unattractive score

- Artisan Mid Cap Fund (ARTMX, APDMX, APHMX) – 4.4% allocation and Unattractive score

- Berkshire Focus Fund (BFOCX) – 3.6% allocation and Very Unattractive score

- American Beacon Bridgeway Massive Cap Development Fund (BLYAX) – 3.1% allocation and Unattractive score

This text initially printed on March 28, 2022.

Disclosure: David Coach, Kyle Guske II, and Matt Shuler obtain no compensation to jot down about any particular inventory, fashion, or theme.

[1] We check with Salesforce’s fiscal 12 months ended January 31, 2022 as 2021.

[2] Grand View Analysis estimates small and medium enterprises (SME) make up 40% of the worldwide CRM market in 2021. To calculate the implied international SME CRM market measurement in 2030, we take 40% of the Grand View Analysis’s projected 2030 international CRM market.

[3] This determine refers to HubSpot’s estimated share of the worldwide SME CRM market, whereas the decrease percentages referenced earlier within the report check with share of the whole (SME and huge enterprises) CRM market.

Supply hyperlink