David Iben put it properly when he mentioned, ‘Volatility just isn’t a danger we care about. What we care about is avoiding the everlasting lack of capital.’ So it appears the good cash is aware of that debt – which is normally concerned in bankruptcies – is an important issue, while you assess how dangerous an organization is. We will see that HubSpot, Inc. (NYSE:HUBS) does use debt in its enterprise. However ought to shareholders be frightened about its use of debt?

When Is Debt A Drawback?

Debt assists a enterprise till the enterprise has bother paying it off, both with new capital or with free money movement. Within the worst case situation, an organization can go bankrupt if it can not pay its collectors. Nevertheless, a extra normal (however nonetheless costly) state of affairs is the place an organization should dilute shareholders at an affordable share worth merely to get debt beneath management. After all, debt will be an necessary instrument in companies, notably capital heavy companies. After we take into consideration an organization’s use of debt, we first have a look at money and debt collectively.

See our newest evaluation for HubSpot

How A lot Debt Does HubSpot Carry?

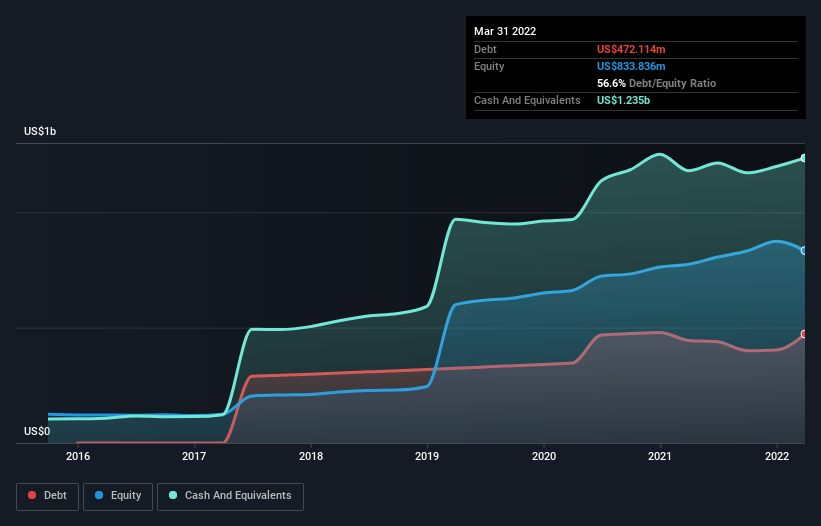

The picture beneath, which you’ll be able to click on on for larger element, reveals that at March 2022 HubSpot had debt of US$472.1m, up from US$444.4m in a single yr. Nevertheless, it does have US$1.23b in money offsetting this, resulting in internet money of US$762.8m.

How Wholesome Is HubSpot’s Steadiness Sheet?

The most recent steadiness sheet knowledge reveals that HubSpot had liabilities of US$662.0m due inside a yr, and liabilities of US$757.5m falling due after that. Then again, it had money of US$1.23b and US$152.7m value of receivables due inside a yr. So it has liabilities totalling US$31.9m greater than its money and near-term receivables, mixed.

This state of affairs signifies that HubSpot’s steadiness sheet appears fairly stable, as its whole liabilities are nearly equal to its liquid belongings. So whereas it is onerous to think about that the US$14.4b firm is struggling for money, we nonetheless suppose it is value monitoring its steadiness sheet. Regardless of its noteworthy liabilities, HubSpot boasts internet money, so it is truthful to say it doesn’t have a heavy debt load! When analysing debt ranges, the steadiness sheet is the apparent place to start out. However finally the long run profitability of the enterprise will resolve if HubSpot can strengthen its steadiness sheet over time. So if you wish to see what the professionals suppose, you would possibly discover this free report on analyst revenue forecasts to be fascinating.

Over 12 months, HubSpot reported income of US$1.4b, which is a acquire of 47%, though it didn’t report any earnings earlier than curiosity and tax. Shareholders in all probability have their fingers crossed that it will probably develop its option to earnings.

So How Dangerous Is HubSpot?

Though HubSpot had an earnings earlier than curiosity and tax (EBIT) loss during the last twelve months, it generated constructive free money movement of US$188m. So though it’s loss-making, it does not appear to have an excessive amount of near-term steadiness sheet danger, preserving in thoughts the web money. One constructive is that HubSpot is rising income apace, which makes it simpler to promote a progress story and lift capital if want be. However we nonetheless suppose it is considerably dangerous. The steadiness sheet is clearly the world to deal with if you end up analysing debt. Nevertheless, not all funding danger resides inside the steadiness sheet – removed from it. To that finish, try to be conscious of the 2 warning indicators we have noticed with HubSpot .

If, in any case that, you are extra curious about a quick rising firm with a rock-solid steadiness sheet, then try our record of internet money progress shares immediately.

Have suggestions on this text? Involved concerning the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is common in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles will not be supposed to be monetary recommendation. It doesn’t represent a advice to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to convey you long-term targeted evaluation pushed by elementary knowledge. Notice that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not HubSpot is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Supply hyperlink