Armastas/iStock Editorial by way of Getty Photos

Funding Thesis

- I charge each Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Apple (NASDAQ:AAPL) as a purchase: Each have sturdy aggressive benefits, sturdy financials and are extremely worthwhile. Nonetheless, the outcomes of the In search of Alpha Issue Grades and the HQC Scorecard, each present Alphabet to be extra enticing by way of Valuation and Progress.

- In keeping with the In search of Alpha Quant Rating, Alphabet is in a greater place than Apple: Whereas Alphabet is ranked third out of 63 within the Interactive Media and Companies Business, Apple is rated seventh out of 31 within the Expertise {Hardware}, Storage and Peripherals Business. Throughout the Communication Companies Sector, Alphabet is ranked eighth out of 251, whereas Apple is ranked 134th out of 631 inside the Data Expertise Sector.

- Alphabet scores 91/100 factors on the HQC Scorecard. This can be a very enticing total score by way of threat and reward. The corporate produces very enticing leads to all classes of the Scorecard and achieves higher outcomes than Apple within the classes of Monetary Energy, Valuation, Progress and Anticipated Return.

- Apple at present scores 81/100 factors as in accordance with the HQC Scorecard. The corporate is rated as very enticing within the classes of Financial Moat (100/100), Profitability (100/100), Innovation (100/100) and Anticipated Return (80/100). Within the classes of Monetary Energy (65/100), Valuation (68/100) and Progress (60/100) Apple is rated as enticing.

The general rankings of the HQC Scorecard demonstrates that each are top quality firms, however that Alphabet is at present barely extra enticing in the case of threat and reward.

Apple’s and Alphabet’s Aggressive Positions

Each Apple and Alphabet have sturdy aggressive benefits over their rivals. They’ve sturdy model pictures, which is underlined by the truth that the businesses are ranked 1st and third among the many most respected firms on the planet as in accordance with Model Finance.

With regard to Alphabet, I see the corporate’s huge quantity of information and the flexibility to analyse and use this knowledge as a powerful aggressive benefit. In my detailed evaluation on Alphabet from a month in the past, I additionally mentioned the corporate’s sturdy development potential:

“For my part, when investing in Alphabet, you not solely put money into a financially sturdy firm with a sturdy and effectively confirmed enterprise mannequin, however on the identical time its acquisition and integration of startups allow it to keep up comparatively sturdy development potential. Alphabet’s Common Income Progress Fee of twenty-two.88% over the past 5 yr is an extra indicator of the corporate’s glorious development views.”

In my earlier evaluation on Apple, I mentioned how the corporate’s ecosystem is certainly one of its sturdy aggressive benefits:

“Apple has succeeded in constructing an entire ecosystem. This implies the system-wide integration of Apple merchandise, which ensures a good higher consumer expertise when you personal a number of Apple merchandise. An instance of this could be to unlock your Mac along with your Apple Watch or to obtain messages on your entire Apple units.”

The Valuation of Apple and Alphabet

Discounted Money Circulation [DCF]-Mannequin

When it comes to valuation, I’ve used the DCF Mannequin to find out the intrinsic worth of Apple and Alphabet. The tactic calculates a good worth of $187.78 for Apple and $157.23 for Alphabet. On the present inventory costs, this provides Apple an upside of 21.50% and Alphabet an upside of 46.30%.

My calculations are based mostly on the next assumptions as offered beneath (in $ tens of millions besides per share gadgets):

|

Apple |

Alphabet |

|

|

Firm Ticker |

AAPL |

GOOG |

|

Income Progress Fee for the subsequent 5 years |

8% |

10% |

|

EBIT Progress Fee for the subsequent 5 years |

8% |

10% |

|

Tax Fee |

13.3% |

16.2% |

|

Low cost Fee [WACC] |

7.75% |

8.00% |

|

Perpetual Progress Fee |

4% |

4% |

|

EV/EBITDA A number of |

18.7x |

13.1x |

|

Present Worth/Share |

$154.53 |

$107.48 |

|

Shares Excellent |

16,070 |

13,044 |

|

Debt |

$119,691 |

$28,810 |

|

Money |

$27,502 |

$17,936 |

|

Capex |

$10,642 |

$29,816 |

Supply: The Writer

Based mostly on the above, I calculated the next outcomes:

Market Worth vs. Intrinsic Worth

|

Apple |

Alphabet |

|

|

Market Worth |

$154.53 |

$107.48 |

|

Upside |

21.50% |

46.30% |

|

Intrinsic Worth |

$187.78 |

$157.23 |

Supply: The Writer

Relative Valuation Fashions

Apple’s and Alphabet’s P/E [FWD] Ratio

Apple’s P/E Ratio is at present 25.54, which is 13.72% above its 5 Yr Common (22.46), this supplies us with an indicator that the corporate is at present overvalued.

Alphabet’s present P/E Ratio is 20.83, which is 25.48% beneath its 5 Yr Common of 27.95. This serves as an indicator that Alphabet is undervalued and as soon as once more confirms the speculation that it is at present the extra enticing choice when in comparison with Apple.

Monetary Overview: Apple vs. Alphabet

|

Apple |

Alphabet |

|

|

Ticker |

AAPL |

GOOG |

|

Sector |

Data Expertise |

Communication Companies |

|

Business |

Expertise {Hardware}, Storage and Peripherals |

Interactive Media and Companies |

|

Market Cap |

2.50T |

1.41T |

|

Income |

387.54B |

278.14B |

|

Income 3 Yr [CAGR] |

14.37% |

23.32% |

|

Income Progress 5 Yr [CAGR] |

11.64% |

22.88% |

|

EBITDA |

129.56B |

96.89B |

|

EBIT Margin |

30.53% |

29.65% |

|

ROE |

162.82% |

29.22% |

|

P/E GAAP [FWD] |

25.54 |

20.83 |

|

Dividend Yield [FWD] |

0.59% |

– |

|

Dividend Progress 3 Yr [CAGR] |

6.27% |

– |

|

Dividend Progress 5 Yr [CAGR] |

8.45% |

– |

|

Consecutive Years of Dividend Progress |

8 Years |

– |

|

Dividend Frequency |

Quarterly |

– |

Supply: In search of Alpha

The Excessive-High quality Firm [HQC] Scorecard

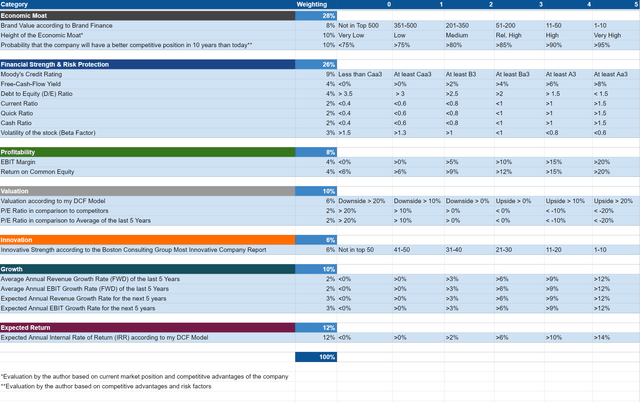

“The goal of the HQC Scorecard that I’ve developed is to assist buyers establish firms that are enticing long-term investments by way of threat and reward.” Right here yow will discover a detailed description of how the HQC Scorecard works.

Overview of the Gadgets on the HQC Scorecard

“Within the graphic beneath, yow will discover the person gadgets and weighting for every class of the HQC Scorecard. A rating between 0 and 5 is given (with 0 being the bottom score and 5 the best) for every merchandise on the Scorecard. Moreover, you’ll be able to see the circumstances that should be met for every level of each rated merchandise.”

Supply: The Writer

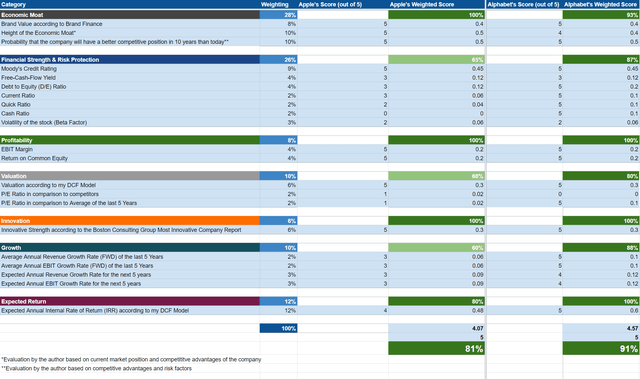

Apple and Alphabet In keeping with the HQC Scorecard

Supply: The Writer

As in accordance with the HQC Scorecard, each Apple and Alphabet can at present be categorized as very enticing by way of threat and reward. Whereas Apple scores 81/100 factors, Alphabet scores 91/100.

Alphabet is classed as very enticing in all classes of the HQC Scorecard. The corporate is rated forward of Apple within the classes of Monetary Energy, Valuation, Progress and Anticipated Return.

Within the classes of Monetary Energy, Alphabet is rated as very enticing (87/100) whereas Apple will get a beautiful score (65/100). This is because of Alphabet’s increased Present Ratio (2.81 in comparison with Apple’s 0.86), increased Fast Ratio (2.64 vs. Apple’s 0.70) and its increased Money Ratio (2.04 compared to 0.37).

When it comes to Valuation, Alphabet can be rated increased than Apple. That is notably on account of Alphabet’s at present decrease P/E Ratio as in comparison with its Common of the final 5 years.

When it comes to Progress, Alphabet (88/100) can be rated increased than Apple (60/100). This can be a results of the truth that I count on the corporate to develop with the next Progress Fee than Apple within the coming years.

The HQC Scorecard demonstrates that each Alphabet and Apple are very enticing firms by way of threat and reward. Nonetheless, Alphabet’s increased score strengthens my perception that it is at present the marginally higher choice when selecting between the 2 rivals.

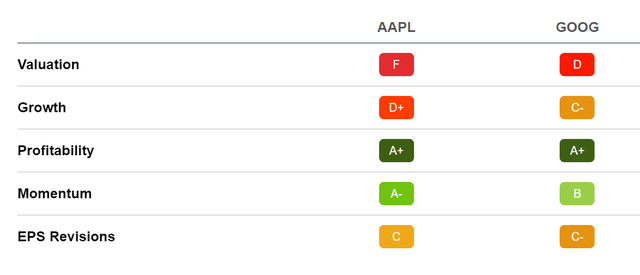

Apple and Alphabet In keeping with the In search of Alpha Quant Issue Grades

When trying on the In search of Alpha Quant Issue Grades, we get additional affirmation that Alphabet is at present barely extra enticing than Apple. Whereas Alphabet receives a D score by way of Valuation, Apple receives an F. When it comes to Progress, Alphabet receives a C- whereas Apple solely will get a D+. These outcomes as soon as once more strengthen my opinion that Alphabet is extra enticing than Apple at this second in time. That is notably on account of its increased rankings by way of Valuation and Progress, thus being in keeping with the outcomes of the HQC Scorecard.

Supply: In search of Alpha

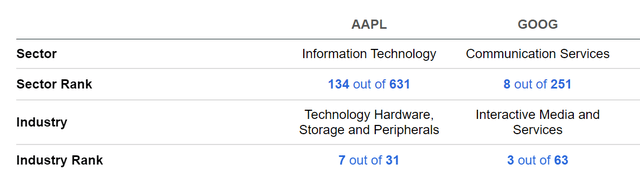

Apple and Alphabet In keeping with the In search of Alpha Quant Rating

As in accordance with the In search of Alpha Quant Rating, Alphabet can be in a greater place than Apple. Whereas Alphabet is ranked third out of 63 in its trade, Apple is barely seventh out of 31 in its personal trade. Throughout the Communication Companies Sector, Alphabet is ranked eighth out of 251, whereas Apple is ranked 134th out of 631 inside the Data Expertise Sector. The In search of Alpha Quant Rating reinforces the speculation that an funding in Alphabet is at present extra enticing than investing in Apple.

Supply: In search of Alpha

Apple and Alphabet In keeping with the In search of Alpha Authors Score and Wall Road Analysts Score

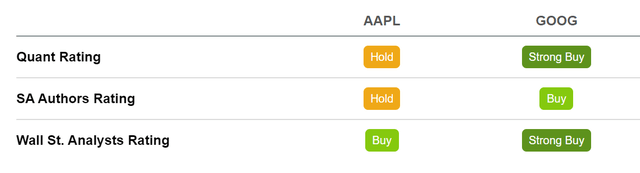

As in accordance with the In search of Alpha Quant Score, Alphabet is at present a powerful purchase, whereas Apple is a maintain. When contemplating the In search of Alpha Authors Score, Alphabet is a purchase and Apple a maintain. In the meantime, the Wall Road Analysts Score has Alphabet as a powerful purchase and Apple a purchase. The rankings affirm yet one more time that Alphabet is at present the extra enticing firm.

Supply: In search of Alpha

Dangers

In my earlier evaluation on Alphabet, I discussed that one of many most important threat components concerning an funding within the firm is the truth that the biggest a part of its income is generated by its enterprise unit Google Promoting:

“One potential threat issue I see for Alphabet is the truth that the biggest a part of the corporate’s income (greater than 80%) is generated by its enterprise unit Google Promoting. Diminished spending in promoting by Alphabet’s purchasers may adversely have an effect on its enterprise and subsequently end in lowering revenue margins. Nonetheless, as proven on this evaluation, Alphabet’s different enterprise models have gotten increasingly essential: proof of this, for instance, is the truth that Google Cloud already accounted for 9% of the corporate’s complete income in 2Q22 whereas it accounted for under 7.5% in the identical quarter of the earlier yr.”

In my evaluation on Apple, I discussed that the most important threat issue for the corporate can be if its model picture received broken:

“This might imply that Apple’s prospects now not pay premium costs for its merchandise and thus revenue margins in addition to the corporate’s development charges may very well be affected negatively.”

The Backside Line

For my part, each Alphabet and Apple are glorious selections when aiming to put money into a top quality firm. Nonetheless, Alphabet is at present barely extra enticing than Apple in the case of threat and reward. That is underlined by the outcomes of the HQC Scorecard during which Alphabet receives 91/100 factors whereas Apple scores 81/100. Though each firms are rated as very enticing by way of threat and reward, Alphabet exhibits even higher outcomes than Apple within the classes of Monetary Energy, Valuation, Progress and Anticipated Return.

The In search of Alpha Quant Rating strengthens my opinion that Alphabet is at present the higher selection: Whereas Alphabet is ranked third out of 63 in its trade, Apple is barely rated seventh out of 31 in its personal. Throughout the Communication Companies Sector, Alphabet is ranked eighth out of 251, whereas Apple is ranked 134th out of 631 within the Data Expertise Sector.

My DCF Mannequin exhibits that each Alphabet and Apple are at present undervalued. Nonetheless, it additionally exhibits the next upside for Alphabet (46.30%) than for Apple (21.50%); as soon as once more reaffirming my perception that Alphabet is at present extra enticing than its rival.

I charge each firms as a purchase. But when I needed to decide only one at this second in time, I’d select Alphabet. Notably on account of its decrease valuation and better development prospects.

Supply hyperlink