JHVEPhoto

Alphabet (NASDAQ:NASDAQ:GOOG) is eyeing productiveness beneficial properties and doubtlessly extra job cuts within the quick time period in an try and drive income and counter rising headwinds within the digital promoting enterprise. Whereas Google has its Cloud enterprise to fall again on to offset a minimum of some progress declines within the promoting section, I imagine the corporate may announce an up-sized inventory buyback of $100B subsequent 12 months. Google has greater than sufficient money accessible on its stability sheet to exhaust its $70B buyback authorization and Google inventory continues to commerce at a really compelling P-E ratio!

20% effectivity beneficial properties

Google CEO Sundar Pichai has not too long ago stated that he plans to steer the corporate towards 20% productiveness beneficial properties in a bid to compensate for declines in its promoting enterprise which the corporate has blamed within the second-quarter for slowing high line progress. Though Google remains to be seeing robust income progress within the Cloud enterprise — 36% 12 months over 12 months progress in Q2’22 — Google is seemingly making ready for harder instances forward. With income progress slowing from 62% final 12 months to simply 13% in Q2’22, Google has to seek out new methods to get buyers within the inventory once more. One key approach for unlocking worth, along with in search of productiveness beneficial properties, might be a big up-size within the firm’s inventory buyback.

Google may simply pay for a $100B inventory buyback

In April of this 12 months, Google stated its board licensed a $70B inventory buyback. The $70B inventory buyback introduced a number of months in the past adopted a $50B inventory buyback within the year-earlier interval, exhibiting a 40% improve in inventory buyback authorization. Inventory buybacks are a great tool for expertise corporations like Google that are combating progress however are sitting on an infinite pile of money.

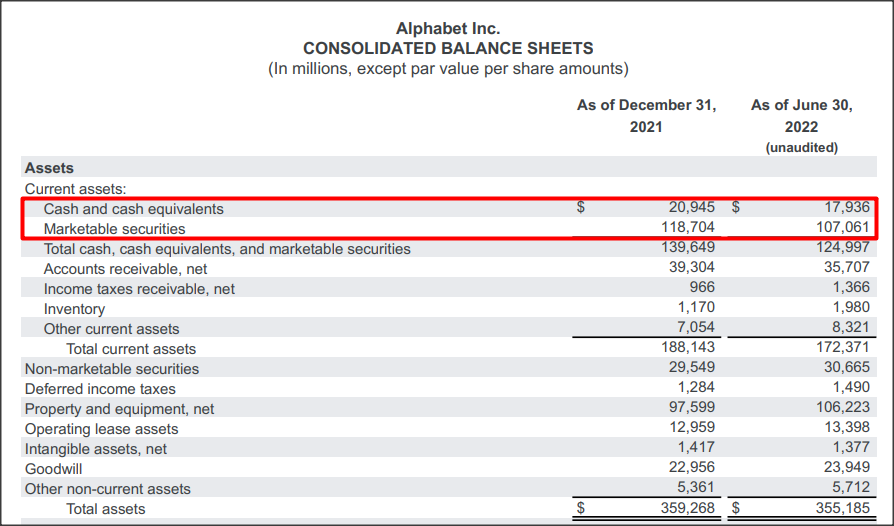

On the finish of the second-quarter, Google had $125B in money parked on its stability sheet, $107B (86%) of which was invested in marketable securities. Based mostly off of the amount of money that’s instantly accessible to Google, the agency may pay for its present $70B inventory buyback 1.8 instances over with out even having to make use of any of its free money circulate.

Alphabet Steadiness Sheet Q2’22

One other approach to take a look at Google’s buyback potentialities is asking how a lot of Google’s free money circulate can be required to execute the $70B inventory buyback. So, let’s have a look.

Google generated $65.2B in free money circulate within the final 4 quarters. The common free money circulate generated per quarter was $16.3B, or $5.4B per 30 days. To exhaust Google’s $70B inventory buyback would require a bit greater than 1 12 months of the agency’s present free money circulate (13 months to be actual).

|

$thousands and thousands |

Q2’21 |

Q3’21 |

This fall’21 |

Q1’22 |

Q2’22 |

|

Revenues |

$61,880 |

$65,118 |

$75,325 |

$68,011 |

$69,685 |

|

Internet money offered by working actions |

$21,890 |

$25,539 |

$24,934 |

$25,106 |

$19,422 |

|

Much less: purchases of property and tools |

($5,496) |

($6,819) |

($6,383) |

($9,786) |

($6,828) |

|

Free money circulate |

$16,394 |

$18,720 |

$18,551 |

$15,320 |

$12,594 |

|

Free money circulate margin |

26.5% |

28.7% |

24.6% |

22.5% |

18.1% |

(Supply: Writer)

The calculation referring to the financing of a possible $100B inventory buyback assumes that Google’s free money circulate isn’t rising… which isn’t a really lifelike assumption. Google generated a free money circulate margin of 23% within the final twelve months and the expertise firm is anticipated to develop its revenues 12% subsequent 12 months to $325.6B.

Assuming no change in free money circulate margin, Google may generate roughly $75B in free money circulate subsequent 12 months… which is about $10B greater than Google’s LTM free money circulate. The calculation particularly doesn’t embody a probably increased free money circulate margin attributable to enlargement within the firm’s Cloud enterprise or a rebound within the digital promoting trade. For these causes, I imagine a $75B free money circulate estimate for FY 2023 is a really affordable assumption.

If Google had been to up-size its inventory buyback once more by 40% in FY 2023, then the expertise agency might be near saying a $100B inventory buyback within the first half of 2023. This $100B inventory buyback would even be simply coated, both by Google’s accessible money sources, its estimated FY 2023 free money circulate or a mix of each.

Low cost valuation

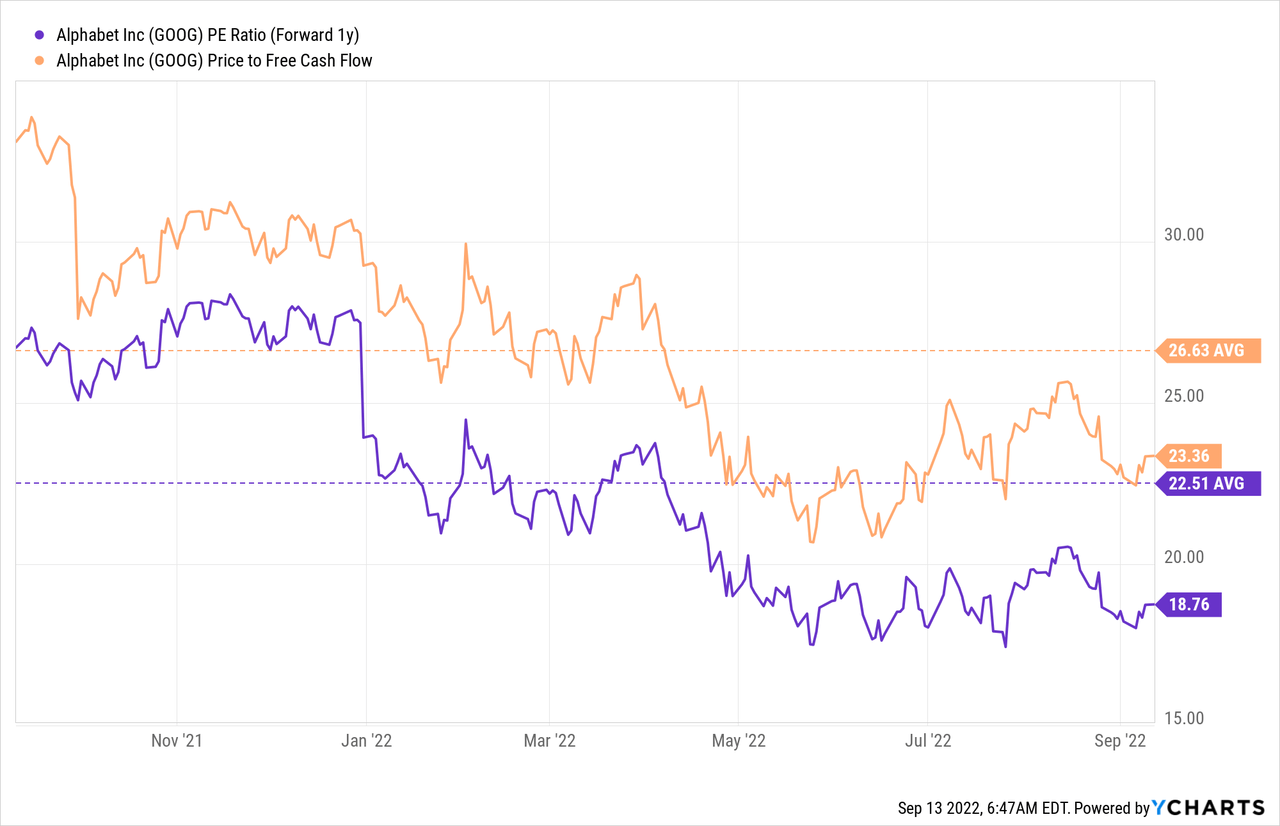

The expectation is for Google to have $5.96 in EPS in FY 2023 which interprets to a P-E ratio of 18.8 X. Based mostly each off of earnings and free money circulate, shares of Google are very attractively priced… and each ratios are beneath the 1-year common (as indicated by the dotted line within the chart beneath). The low valuation of Google’s inventory may very well drive the choice to extend Google’s inventory buyback authorization.

Dangers with Google

Google’s largest business danger is that the digital promoting market will proceed to chill down whereas on the identical time Cloud income progress moderates. For Google this might imply a fair stronger have to give attention to productiveness beneficial properties and inventory buybacks as a solution to unlock worth and drive shares of Google again into a brand new up-leg. What would change my thoughts about Google is that if the corporate noticed a fabric drop-off in its free money circulate or its margins.

Last ideas

Google up-sized its inventory buyback by 40% to $70B this 12 months and, given the challenges in Google’s enterprise, I see the agency up-sizing its buyback to shut to $100B subsequent 12 months. The expertise firm clearly has each the free money circulate and the accessible money sources to drag this off… and with high line progress moderating, buybacks may develop into a key technique for Google to make the inventory attention-grabbing once more for buyers.

With an estimated $75B in free money circulate in FY 2023, Google may afford to announce an enormous improve in its inventory buyback. Contemplating that the inventory remains to be buying and selling at a depressed valuation, it could be an important use of firm sources as nicely!

Supply hyperlink