Most readers would already remember that Alphabet’s (NASDAQ:GOOGL) inventory elevated considerably by 11% over the previous month. Because the market normally pay for a corporation’s long-term fundamentals, we determined to review the corporate’s key efficiency indicators to see in the event that they could possibly be influencing the market. Significantly, we will probably be taking note of Alphabet’s ROE in the present day.

Return on fairness or ROE is a key measure used to evaluate how effectively an organization’s administration is using the corporate’s capital. In easier phrases, it measures the profitability of an organization in relation to shareholder’s fairness.

Try our newest evaluation for Alphabet

How To Calculate Return On Fairness?

The formulation for ROE is:

Return on Fairness = Web Revenue (from persevering with operations) ÷ Shareholders’ Fairness

So, based mostly on the above formulation, the ROE for Alphabet is:

28% = US$72b ÷ US$255b (Primarily based on the trailing twelve months to June 2022).

The ‘return’ is the quantity earned after tax during the last twelve months. That implies that for each $1 value of shareholders’ fairness, the corporate generated $0.28 in revenue.

Why Is ROE Necessary For Earnings Progress?

Up to now, we have discovered that ROE is a measure of an organization’s profitability. Primarily based on how a lot of its income the corporate chooses to reinvest or “retain”, we’re then in a position to consider an organization’s future potential to generate income. Typically talking, different issues being equal, companies with a excessive return on fairness and revenue retention, have a better development price than companies that don’t share these attributes.

A Facet By Facet comparability of Alphabet’s Earnings Progress And 28% ROE

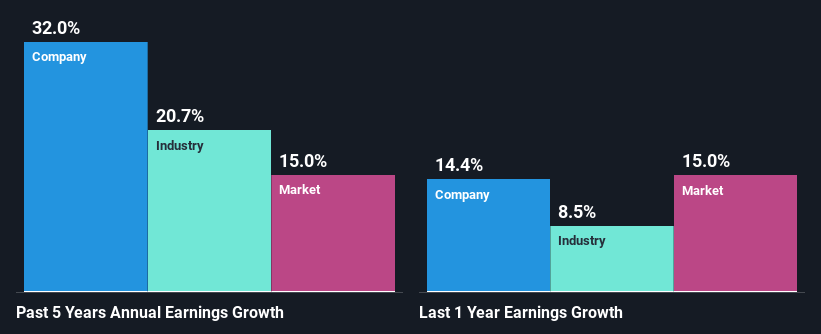

To start with, Alphabet has a reasonably excessive ROE which is attention-grabbing. Second, a comparability with the common ROE reported by the business of seven.6% additionally does not go unnoticed by us. Underneath the circumstances, Alphabet’s appreciable 5 12 months internet revenue development of 32% was to be anticipated.

As a subsequent step, we in contrast Alphabet’s internet revenue development with the business, and pleasingly, we discovered that the expansion seen by the corporate is larger than the common business development of 21%.

Earnings development is a vital metric to think about when valuing a inventory. What buyers want to find out subsequent is that if the anticipated earnings development, or the shortage of it, is already constructed into the share value. By doing so, they are going to have an concept if the inventory is headed into clear blue waters or if swampy waters await. One good indicator of anticipated earnings development is the P/E ratio which determines the value the market is prepared to pay for a inventory based mostly on its earnings prospects. So, you could wish to verify if Alphabet is buying and selling on a excessive P/E or a low P/E, relative to its business.

Is Alphabet Utilizing Its Retained Earnings Successfully?

On condition that Alphabet does not pay any dividend to its shareholders, we infer that the corporate has been reinvesting all of its income to develop its enterprise.

Abstract

Total, we’re fairly happy with Alphabet’s efficiency. Specifically, it is nice to see that the corporate is investing closely into its enterprise and together with a excessive price of return, that has resulted in a sizeable development in its earnings. Having stated that, the corporate’s earnings development is anticipated to decelerate, as forecasted within the present analyst estimates. Are these analysts expectations based mostly on the broad expectations for the business, or on the corporate’s fundamentals? Click on right here to be taken to our analyst’s forecasts web page for the corporate.

Have suggestions on this text? Involved in regards to the content material? Get in contact with us straight. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is basic in nature. We offer commentary based mostly on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. We purpose to convey you long-term centered evaluation pushed by elementary information. Word that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Valuation is complicated, however we’re serving to make it easy.

Discover out whether or not Alphabet is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

View the Free Evaluation

Supply hyperlink