The Nasdaq-100 know-how index has spent a lot of 2022 in bear market territory. Excessive inflation and rising rates of interest have thrown chilly water over buyers’ progress expectations for a few of the best-performing tech corporations, that means they’re keen to pay a lot much less for these shares now in comparison with a yr in the past.

Nonetheless, the broader market has staged a convincing bounce over the previous two months. However after the Federal Reserve got here out final week and warned buyers that it wasn’t accomplished with aggressively mountain climbing rates of interest, the decline seems to have resumed.

Historical past suggests {that a} down market is one of the best time to place cash to work as a result of, given sufficient time, costs finally are likely to get better to new highs. However not all shares are created equal and in an setting like this, it is essential to be selective. This is one inventory to purchase now and one to promote.

The inventory to purchase: Sea Restricted

Sea Restricted (SE -2.27%) inventory has been hammered during the last 12 months, shedding 82% of its worth since reaching its all-time excessive value of $372.70. The corporate’s challenges are more likely to persist within the quick time period, however this is perhaps a golden alternative for buyers with a five-to-10-year time horizon.

Sea Restricted operates in three key areas of the digital economic system: e-commerce, digital leisure (gaming), and funds. The digital leisure section accounts for a few third of the corporate’s complete income, and it generated hovering progress throughout 2020 and 2021 because of pandemic lockdowns, which led to folks spending extra time in entrance of their screens.

However society has steadily reopened, and Sea Restricted’s gaming section is now shrinking — to the tune of 10% (yr over yr) within the current second quarter of 2022. The corporate’s sport studio nonetheless holds one of many highest-grossing cellular titles, known as Free Fireplace, which was additionally essentially the most downloaded sport globally within the second quarter. However the trade as a complete is more likely to proceed experiencing a lower in engagement in comparison with the final two years.

There’s some excellent news for Sea Restricted, although. The power within the e-commerce trade has continued past the worst of the pandemic, which is an enormous win for the corporate because it accounts for over half of its income. Sea Restricted noticed e-commerce progress of 51% yr over yr in Q2 to $1.7 billion in income. Within the procuring class, its Shopee app stays No. 1 in Southeast Asia — the corporate’s focus market — in each energetic customers and time spent on the platform.

Sea Restricted faces the problem of turning worthwhile now after years of investing in progress. It has misplaced $2.7 billion during the last 4 quarters on $11.7 billion in complete income, but it surely does have $7.7 billion in money, equivalents, and short-term investments on its stability sheet, so it has loads of room to make the required changes. Buyers ought to stay centered on the long term as a result of between now and 2027, the worldwide e-commerce alternative is ready to just about double to $27.1 trillion yearly, in accordance with Grand View Analysis.

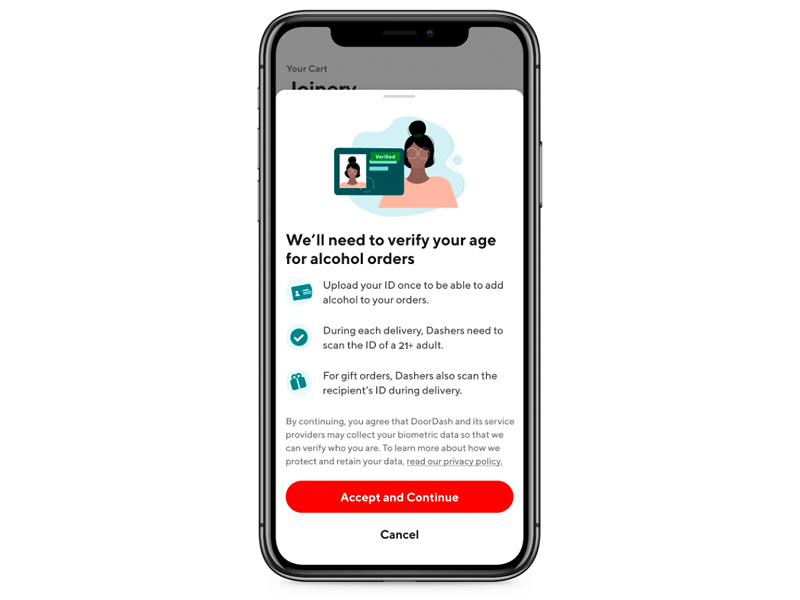

The inventory to promote: DoorDash

Who would not love meals supply? It has turn into part of life for many individuals, very similar to ride-sharing and social media, and DoorDash (DASH -1.10%) holds a 59% market share within the trade within the U.S. However this is without doubt one of the uncommon instances the place being the most important hasn’t yielded an excessive amount of fruit for buyers, as a result of DoorDash inventory is buying and selling close to its 52-week low and the value has declined 75% from its all-time excessive.

Primarily based on DoorDash’s previous few quarters of economic knowledge, it is turning into evident that peak progress occurred throughout 2021 for the corporate. Since then, its income has quickly decelerated and, in contrast to Sea Restricted which operates in a number of fast-growing segments, DoorDash’s market alternative is perhaps restricted from right here.

Why? Latest surveys of American customers recommend 45% of households are depending on meals supply already, however whereas it is really easy and handy, value is probably going a prohibitive consider rising that base a lot additional. In accordance with analysis by Loup Funds, it is 58% costlier to make use of DoorDash than to choose up (or dine-in) the identical meal immediately from the restaurant. To not point out, there’s little or no buyer loyalty throughout supply platforms, with as much as 62% of Individuals utilizing a number of suppliers — and 20% utilizing 4 or extra.

Within the second quarter of 2022 (ended June 30), DoorDash grew its income by 30% to $1.6 billion. That is not a horrible progress charge by any means, but it surely’s down considerably from the 83% progress it delivered in the identical interval final yr. Plus, its second-quarter lack of $263 million was the steepest for the reason that fourth quarter of 2020, and it is a results of a whopping 41% year-over-year soar in prices.

DoorDash now finds itself barely trimming again on bills like advertising and marketing, but it surely operates in a extremely aggressive trade and its service is not very totally different than different suppliers, so this might lead to its market share (and its gross sales) slipping over time.

Put merely, DoorDash is a slowing enterprise with a probably restricted market alternative, and its path to profitability is slightly murky. That is in all probability not one of the best place for buyers’ cash proper now.