Brandon Bell/Getty Pictures Information

Amazon.com, Inc. (AMZN) just lately introduced its settlement to accumulate a stake (2%) in Grubhub however with a warrant to additional enhance it by one other 13% for a complete stake of over 15%. Moreover, Amazon is offering its U.S. Prime members with 1-year of free Grubhub+ subscription providing free supply for a minimal order worth of $12. Thus, we analyzed the potential alternative for Grubhub with this partnership with Amazon when it comes to customers, transaction quantity, and market share progress. Grubhub was acquired by Simply Eat Takeaway.com N.V. (OTCPK:JTKWY) in 2021 for $7.3 bln and accounted for 18% of income in 2021.

Partnership with Amazon Present Person Progress of 62 Mln Customers

Amazon partnered with Grubhub the place Amazon Prime members can take pleasure in a free one-year Grubhub+ membership (usually $9.99/month) with their Prime membership. As talked about by the corporate, “the settlement is anticipated to increase membership to Grubhub+.”

|

Grubhub |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Customers (‘mln’) |

38.94 |

44.08 |

49.22 |

54.36 |

59.50 |

|

Progress % |

15.21% |

13.20% |

11.66% |

10.44% |

9.46% |

|

Further Customers from Amazon Partnership (‘mln’) |

6.19 |

12.39 |

12.39 |

12.39 |

12.39 |

|

Whole Customers |

45.13 |

56.47 |

61.61 |

66.75 |

71.89 |

|

Whole Progress % |

33.53% |

25.11% |

9.10% |

8.34% |

7.70% |

Supply: Enterprise of Apps, Khaveen Investments

Within the desk above, we projected Grubhub’s person progress primarily based on its previous 5-year common buyer base enhance of 5.14 mln customers per 12 months. On high of that, we anticipate the Amazon partnership to supply a lift to its person progress. With the belief that Grubhub subsidizes the membership price, we analyzed Amazon U.S. Prime customers of 159.8 mln in 2021 compared to Grubhub customers to find out the potential person progress alternative for Grubhub.

|

Amazon Prime Members within the US (‘mln’) (‘a’) |

159.80 |

|

Penetration Charge of Meals Supply Companies within the US (‘b’) |

48.10% |

|

Estimated Variety of Prime Members Utilizing Meals Supply (‘mln’) (‘c’) |

76.86 |

|

Grubhub Share of Whole Meals Supply Customers (‘d’) |

19.41% |

|

Estimated Variety of Prime Members Utilizing Grubhub (‘mln’) (‘e’) |

14.92 |

|

Whole Further Person Alternative from Prime Members for Grubhub (‘mln’) (‘f’) |

61.94 |

*c = a x b

e = c x d

f = c – e

Supply: eMarketer, Statista, Khaveen Investments

To estimate the variety of Amazon Prime U.S. customers utilizing meals supply apps (76.86 mln), we used the penetration charge of meals supply customers (48.1%) and multiplied it by the variety of Amazon Prime customers (159.8 mln). From these 76.86 mln customers, we estimated the variety of Prime Members utilizing Grubhub (14.92 mln) primarily based on the corporate’s share of customers within the meals supply market (19.4%) which we derived by dividing Grubhub’s customers over the overall customers of meals supply platforms together with UberEats (UBER), Postmates, Grubhub, DoorDash (DASH), Deliveroo (OTCPK:DROOF) and Supply Hero (DHERO).

Moreover, we subtracted our estimated Amazon Prime customers already Grubhub customers (14.92 mln) from our estimated variety of Amazon Prime customers utilizing meals supply providers (76.86 mln) and prorate it throughout 5 years as a conservative assumption. Therefore, we obtained the estimated yearly further customers from the Amazon Partnership of 61.94 mln over 5 years, which interprets to 12.39 mln customers per 12 months. In 2022, we prorated this by 0.5 because the partnership was solely introduced in H2 2022. Total, with the anticipated further customers, we consider that the partnership might present Grubhub with person progress alternatives leveraging Amazon’s large Prime person base.

Partnership Increase Whole Platform Order Quantity by $3.4 Bln

|

Grubhub |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Customers (‘mln’) |

38.94 |

44.08 |

49.22 |

54.36 |

59.50 |

|

Progress % |

15.21% |

13.20% |

11.66% |

10.44% |

9.46% |

|

Further Customers from Amazon Partnership (‘mln’) |

6.19 |

12.39 |

12.39 |

12.39 |

12.39 |

|

Whole Customers (‘mln’) |

45.13 |

56.47 |

61.61 |

66.75 |

71.89 |

|

Gross Transaction Quantity ($ bln) (‘a’) |

10.71 |

12.12 |

13.54 |

14.95 |

16.37 |

|

Progress % |

10.42% |

13.20% |

11.66% |

10.44% |

9.46% |

|

Incremental Quantity from Amazon partnership ($ bln) (‘b’) |

1.70 |

3.41 |

3.41 |

3.41 |

3.41 |

|

Whole Transaction Quantity with Amazon Partnership ($ bln) (‘c’) |

12.41 |

15.53 |

16.95 |

18.36 |

19.77 |

|

Progress % |

27.99% |

25.11% |

9.10% |

8.34% |

7.70% |

* c = a + b

Supply: Enterprise of Apps, Khaveen Investments

By way of the affect on Grubhub’s gross transaction quantity, we first projected Grubhub’s complete transaction quantity excluding the partnership primarily based on our person base forecast within the earlier level and the 5-year common Grubhub transaction quantity per person of $275.06 by dividing its gross transaction quantity by the variety of customers. Then, with the 5-year common transaction quantity per person of $275.06 multiplied by our estimated further customers per 12 months from the partnership (12.39 mln), we arrived on the estimated incremental quantity from the Amazon partnership of $3.41 bln yearly till 2026. In 2022, our estimated incremental quantity to Grubhub from the Amazon partnership is $1.7 bln primarily based on the prorated further customers of 6.19 mln.

Then, we calculated the overall estimated transaction quantity because the sum of our estimated Grubhub’s gross transaction quantity and incremental quantity from the Amazon partnership. Therefore, we consider that the partnership would enhance the platform order quantity with the contribution of an estimated incremental quantity of $3.41 bln yearly.

Alternative for Market Share to Enhance to eight.74% with Partnership

|

Comparability |

Uber Eats |

Postmates |

Grubhub |

DoorDash |

Deliveroo |

Supply Hero |

|

Customers ($ mln) |

81.00 |

9.30 |

33.80 |

25.00 |

8.00 |

17.00 |

|

Common Order Worth ($) |

40.00 |

40.00 |

31.27 |

37.28 |

26.42 |

12.69 |

|

Variety of eating places |

900,000 |

600,000 |

324,000 |

390,000 |

160,000 |

271,000 |

|

Critiques |

2.90 |

2.30 |

2.80 |

1.20 |

1.30 |

3.00 |

|

Common Supply Time (minutes) |

30.00 |

50.00 |

70.00 |

36.00 |

32.00 |

28.00 |

|

Common Supply Price ($) |

5.00 |

4.00 |

6.00 |

3.00 |

4.86 |

– |

|

Gross Reserving ($ bln) |

51.60 |

2.57 |

9.70 |

10.40 |

6.60 |

2.86 |

|

2021 Income ($ mln) |

8,300.00 |

730.00 |

2,123.00 |

4,880.00 |

1,824.00 |

6,664.70 |

Supply: Enterprise of Apps, Khaveen Investments

We in contrast Grubhub with Uber Eats, Postmates, DoorDash, Deliveroo, and Supply Hero primarily based on totally different metrics to find out Grubhub’s competitiveness. Primarily based on the desk, we consider that Uber Eats is the chief within the meals supply market on the high in all metrics apart from common supply time and supply payment. Furthermore, we consider Postmates is on par with Uber Eats when it comes to common order worth. Whereas Grubhub has the best common supply payment of $6 adopted by Uber Eats and Deliveroo. Moreover, DoorDash is the second when it comes to gross reserving whereas Supply Hero is the chief with the bottom common supply time and has the second highest income.

Therefore, we consider that Grubhub is much less aggressive general as in comparison with Uber Eats, Postmates, DoorDash and Deliveroo.

|

Income Comparability ($ mln) |

2022F |

2023F |

2024F |

|

Grubhub (with out Amazon Partnership) |

2,511 |

2,868 |

3,176 |

|

Progress % |

18.29% |

14.19% |

10.75% |

|

Grubhub (with Amazon Partnership) |

2,691 |

3,367 |

3,709 |

|

Progress % |

26.76% |

25.11% |

10.16% |

Supply: Khaveen Investments

We projected Grubhub’s ahead 3-year income with out the Amazon partnership primarily based on analyst income progress consensus. Moreover, we then in contrast this with our forecasted Grubhub income progress with the Amazon partnership which is larger because of the integration with a forecasted 3-year common progress of 23.45% as in comparison with 14.41% excluding synergies from the partnership. Total, we consider that the partnership would offer a better income progress to Grubhub.

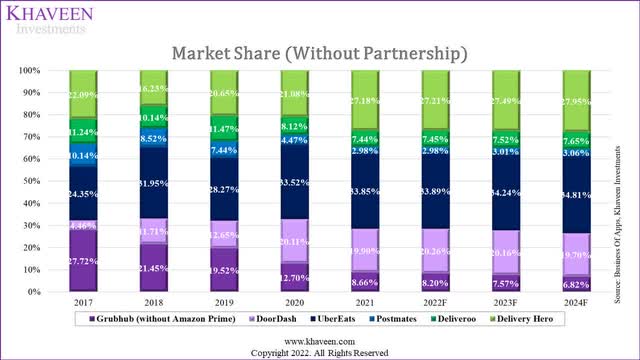

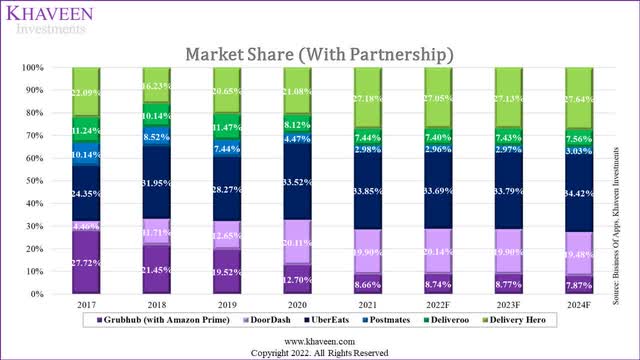

Whereas for Postmates, UberEats, Deliveroo, and Supply, we forecasted their income primarily based on Allied Market Analysis meals supply cellular software market CAGR of 25% by 2030. We then obtained the market share of every firm by dividing their income by the overall income of the 6 firms.

Enterprise of Apps, Khaveen Investments Enterprise of Apps, Khaveen Investments

As seen within the charts, we anticipate the partnership to lead to a better market share for Grubhub at a forecast of 8.74%, as in comparison with 8.2% with out the partnership, in 2022. Grubhub’s market share had declined yearly since 2017 when it had the most important market share of 27.72%. Nevertheless, in 2018 it was overtaken by UberEats with a 31.95% market share, inserting it within the 2nd place in 2018 and 2019. Then in 2020 and 2021, Grubhub additional dropped to the third place whereas Supply Hero overtook it to the 2nd place. All in all, we nonetheless anticipate Uber Eats’ market share to stay the most important adopted by DoorDash whereas we forecasted Grubhub to have the 4th largest market share with or with out the partnership. Nonetheless, we consider that the partnership might enhance Grubhub’s market share however stay smaller in comparison with Uber Eats, Door Sprint, and Supply Hero.

Danger: Sale of Grubhub

In April 2022, Simply Eat Takeaway talked about that they’re contemplating a full or partial sale of Grubhub “after going through stress from traders to discover strategic offers” and to “refocus its enterprise on Europe.” In Might, the corporate confirmed that it was exploring divestment choices. Due to this fact, we consider that Simply Eat Takeaway won’t profit from the Amazon partnership if it decides to promote its remaining stake in Grubhub.

Verdict

To conclude, we consider that Amazon’s partnership with Grubhub might present an incremental person progress alternative for the corporate which we estimated to be 12.39 mln per 12 months from 2023 by 2026 and forecasted its complete order quantity to extend by $3.41 bln per 12 months till 2026. Primarily based on our forecasted income for all firms, we anticipate Grubhub’s market share to extend to eight.74% in comparison with 8.2% market share with out partnership in 2022.

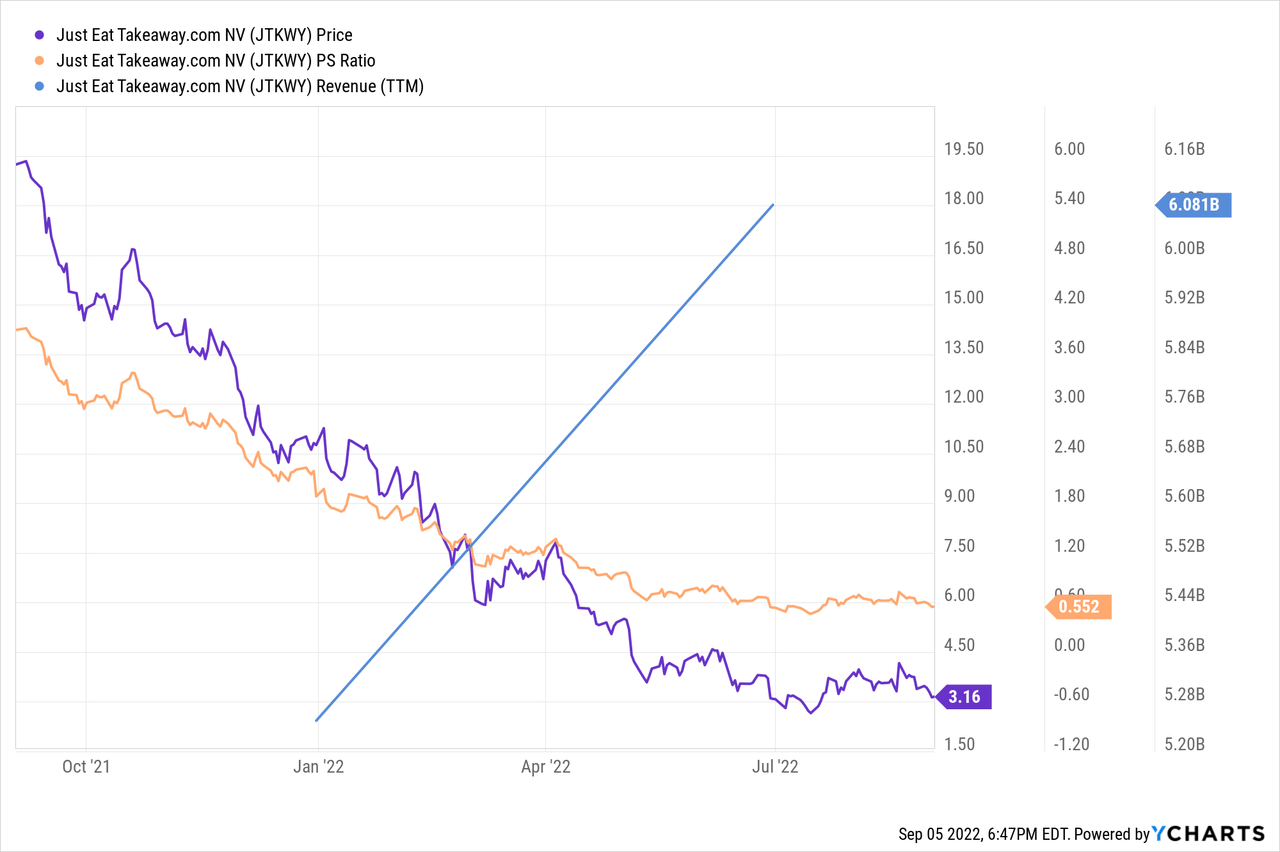

The corporate’s inventory value had declined by 78% over the previous 1 12 months, whereas its income had continued to extend. This translated to the corporate changing into extra undervalued when it comes to its P/S ratio declining.

Primarily based on analyst consensus, Simply Eat Takeaway has a mean analyst consensus upside of 99.9% translating to a value goal of $7.16 with a Robust Purchase score for Simply Eat Takeaway.com.