Floriana/E+ through Getty Photographs

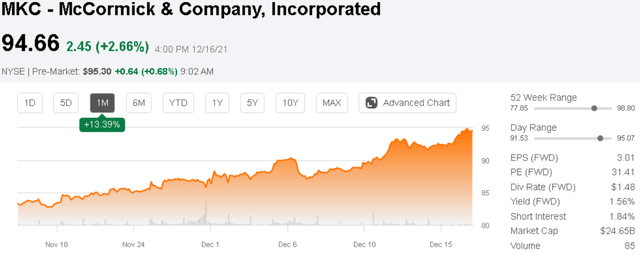

McCormick & Firm (NYSE:MKC) is a client staples chief with a various model portfolio throughout meals flavoring, seasoning, spices, and condiments. McCormick checks off all of the packing containers making it a real “blue-chip” between a protracted historical past of regular progress, constant profitability, and robust model momentum. The corporate is additionally a dividend aristocrat with a 36-year report of mountaineering its quarterly payout. Certainly, these measures of elementary high quality help a optimistic long-term outlook. That stated, we’re taking a extra cautious outlook on shares heading into 2022. In our view, the inventory seems costly following an enormous rally over the previous month. An expectation for a slowdown in progress and uncertainties associated to industry-wide value pressures could restrict additional upside within the inventory.

(Looking for Alpha)

MKC Earnings Recap

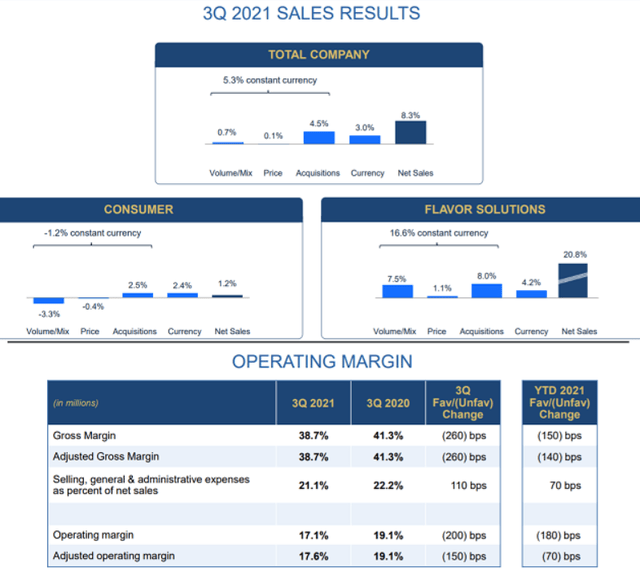

McCormick final reported its Q3 outcomes on the finish of September with GAAP EPS of $0.79, which was $0.08 forward of estimates. Income at $1.55 billion climbed 8.3% over the interval final yr though this included the mixture of acquisitions including 4.5% together with a 3% achieve in FX supporting a lot of the end result. Complete volumes had been up simply 0.7% y/y which is within the context of a troublesome comparability interval in Q3 2020. Equally, the working revenue was flat yr over yr whereas the adjusted working margin at 17.6% narrowed from 19.3% within the interval final yr with administration noting more moderen value pressures and a shift within the gross sales combine.

(Supply: Firm IR)

Wanting again, McCormick benefited from some pandemic-related dynamics in 2020 contemplating the pattern of customers stocking up on pantry necessities and consuming extra at house leading to a lift to gross sales final yr. On this regard, the newest Q3 figures had been total strong and replicate an underlying resiliency of the enterprise. By the primary 9 months of 2021, web revenue has climbed 8.6% highlighting the extra favorable normalized traits. Gross sales are additionally up double digits on a 2-year foundation in comparison with 2019 pre-pandemic ranges.

By working section, the robust level has been the “taste options” which generated a 7.5% improve in quantity progress on prime of an 8% increase from acquisitions. In 2020, McCormick acquired the “Cholula” scorching sauce model together with “FONA”, a specialty meals flavoring manufacture. For reference, the flavour options section refers back to the enterprise generated within the foodservice {industry} and different packaged meals producers. In distinction to the patron section capturing retail gross sales that acquired a lift in the course of the pandemic, the foodservice {industry} is on the rebound in comparison with weak point final yr with many eating places closed amid Covid restrictions.

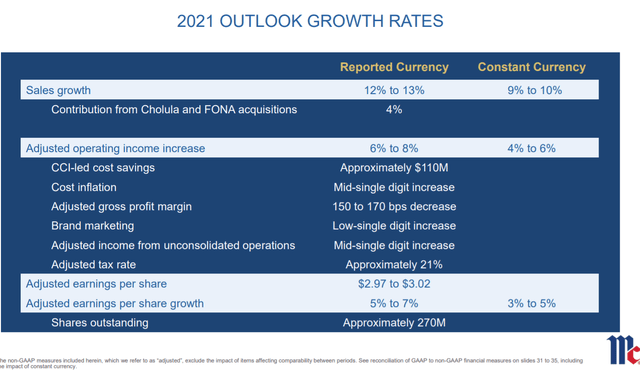

When it comes to steerage, administration is focusing on full-year gross sales progress between 12% and 13% on a reported foundation, or 9% to 10% at fixed foreign money. Amid some cost-related margin pressures balanced partially by a cost-savings plan, the expectation is to succeed in adjusted EPS proper round $3.00, up between 5% and seven% over 2020. Administration famous an effort to boost costs though the impact will seemingly take a number of quarters based mostly on a timing lag via totally different channels.

(Supply: Firm IR)

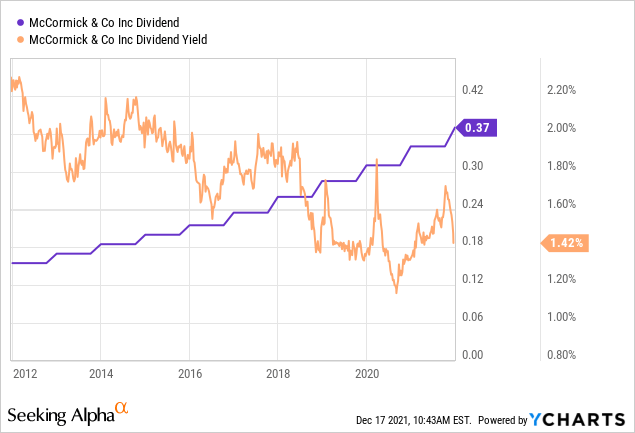

The corporate ended the quarter with $313 million in money in opposition to $4 billion in long-term debt, elevated given the current acquisitions that totaled over $700 million. Nonetheless, contemplating EBITDA of $1.2 billion over the previous yr, the web debt to EBITDA leverage ratio of round 3x is secure in our opinion recognizing the corporate generates important working money flows. Administration intends to pay down debt going ahead. Nonetheless, McCormick was in a position to ship its newest dividend hike of 8.8% in November to a brand new quarterly fee of $0.37 per share.

MKC Inventory Forecast

The attraction in MKC actually comes right down to its model portfolio. All the pieces from “Franks RedHot” sauce, “French’s” mustard, “Previous Bay Seasoning”, to the namesake “McCormick” herbs and spices largely outline its class. From a excessive degree, the corporate advantages from continued macro momentum and robust client spending, in addition to an ongoing growth into new markets together with the Asia Pacific and EMEA areas.

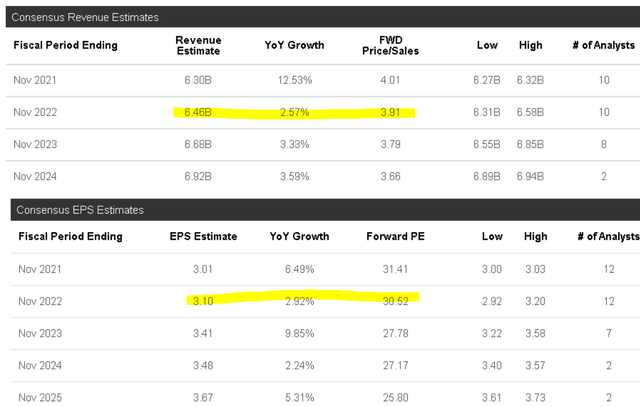

Because it pertains to the inventory, our concern relies extra on the ahead progress outlook in opposition to the present valuation. In response to consensus estimates, the setup for 2022 forecasting income progress of simply 2.6% and three% greater EPS leaves so much to be desired. Topline progress is simply anticipated to be within the low single-digits via fiscal 2024. Our sense is that the market is specializing in the steerage for 2021 and failing to acknowledge that a few of these tailwinds from the acquisitions and year-over-year base results from the flavors section restoration can be troublesome to match. Moreover, we see a draw back to the present earnings estimates even into This autumn outcomes based mostly on the upper value pressures.

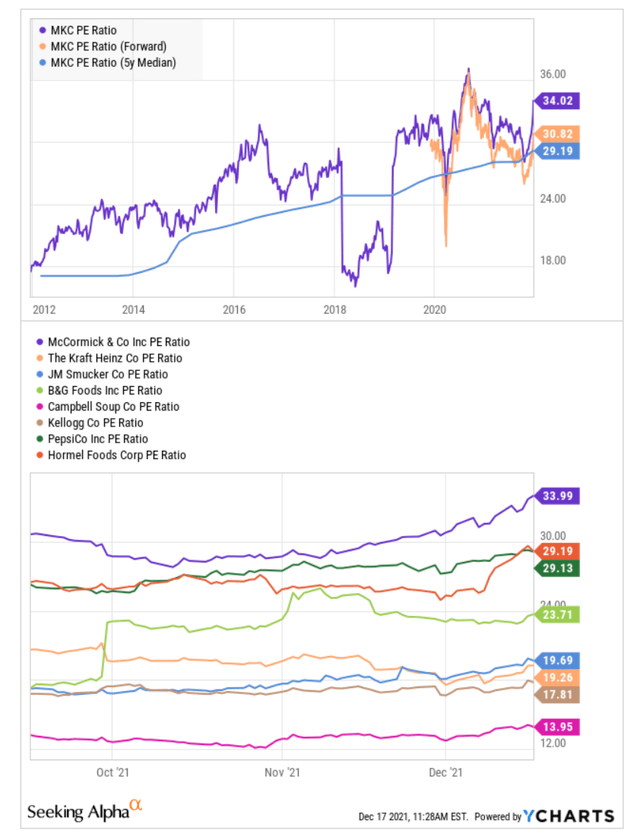

(Looking for Alpha, highlights from writer)

It merely turns into tougher to justify the next valuation from the present degree. The inventory is buying and selling at a ahead P/E of 31x which is effectively above the corporate’s 5-year common for the ratio nearer to 29x. Sometimes, we’d need to see a pattern of increasing valuation multiples and climbing margins into an surroundings the place progress is accelerating, which isn’t the case right here.

Individually, we additionally spotlight that MKC trades at a big premium to the packaged meals {industry} contemplating comparables like J. M. Smucker Co. (SJM), The Kraft Heinz Co. (KHC), B&G Meals, Inc. (BGS), Campbell Soup Co. (CPB), and even PepsiCo, Inc. (PEP) all with a mean P/E nearer to 25x. The reason for the MKC’s greater valuation seemingly displays, partially, its particular condiments class seen as much less variable together with its profile as a dividend aristocrat.

Is MKC a Purchase, Maintain, or Promote?

It is clear the market actually likes MKC and its status of high quality together with resilient working outlook will seemingly preserve shares supported. We fee the inventory as a Maintain with a worth goal of $100 for the yr forward based mostly on a view that shares are totally valued. On the upside, we might prefer to see the corporate ship a bit extra gross sales momentum and progress in paying down debt.

The principle threat to observe past the opportunity of a extra regarding financial slowdown can be the near-term inflationary pressures that may additional hit margins. Weaker than anticipated outcomes into the This autumn report anticipated to be launched in mid-January might drive shares decrease and power a reassessment of the long-term earnings outlook.