Get inside Wall Avenue with StreetInsider Premium. Declare your 1-week free trial right here.

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Assertion Pursuant to Part 14(a)

of the Securities Change Act of 1934 (Modification

No.)

Filed

by the Registrant ☒

Filed

by a Get together apart from the Registrant ☐

Verify the suitable field:

☐

Preliminary Proxy Assertion

☐

Confidential, for Use of the Fee Solely (as permitted by Rule 14a-6(e)(2))

☒

Definitive Proxy Assertion

☐

Definitive Extra Supplies

☐

Soliciting Materials Pursuant to Part 240.14a-12

| TAYLOR DEVICES INC | ||

| (Title of Registrant as Laid out in Its Constitution) | ||

| (Title of Particular person(s) Submitting Proxy Assertion, if apart from the Registrant) | ||

Fee of Submitting Price (Verify the suitable field):

☒

No payment required

☐

Price computed on desk beneath per Change Act Guidelines 14a-6(i)(1) and 0-11.

| 1) | Title of every class of securities to which transaction applies: |

| 2) | Mixture variety of securities to which transaction applies: |

| 3) | Per unit worth or different underlying worth of transaction computed pursuant to Change Act Rule 0-11 (Set forth the quantity on which the submitting payment is calculated and state the way it was decided): |

| 4) | Proposed most mixture worth of transaction: |

| 5) | Whole payment paid: |

☐

Price paid beforehand with preliminary supplies.

☐

Verify field if any a part of the payment is offset as offered by Change Act Rule 0-11(a)(2)

and determine the submitting for which the offsetting payment was paid beforehand. Establish the earlier submitting by registration assertion quantity,

or the Kind or Schedule and the date of its submitting.

| 1) | Quantity Beforehand Paid: |

| 2) | Kind, Schedule, or Registration Assertion No.: |

| 3) | Submitting Get together: |

| 4) | Date Filed: |

TAYLOR DEVICES, INC.

90 TAYLOR DRIVE

NORTH TONAWANDA, NEW YORK 14120

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO THE SHAREHOLDERS OF TAYLOR DEVICES, INC.

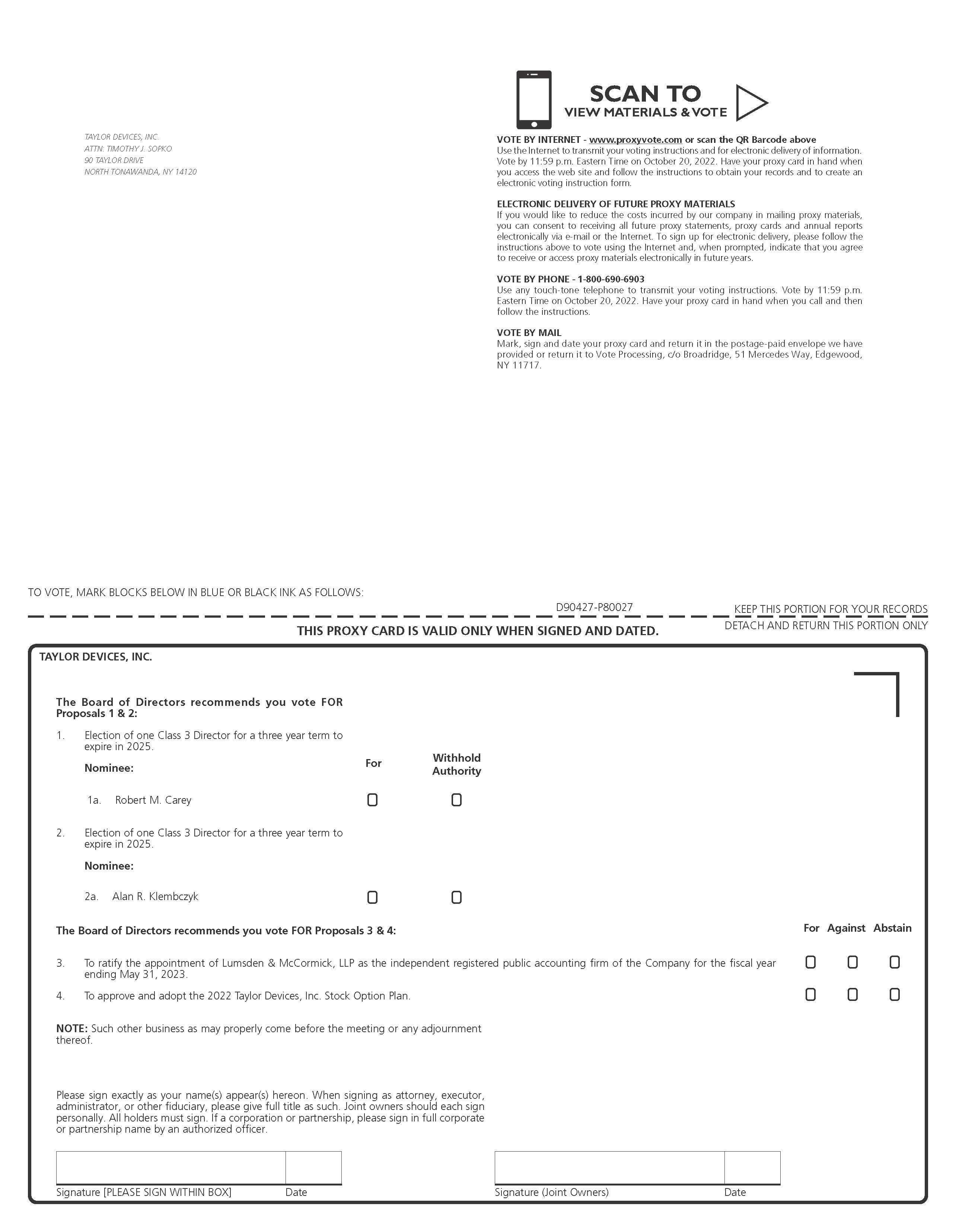

NOTICE IS HEREBY GIVEN that the Annual Assembly

of Shareholders of TAYLOR DEVICES, INC. (the “Firm”) shall be held just about on October 21, 2022, at 11:00 a.m. EDT.

Shareholders who want to attend the passcode protected digital Shareholders Assembly might achieve this by visiting

www.taylordevices.com/annual-shareholders-meeting/. To register for the assembly and to acquire the assembly’s passcode, please

electronic mail [email protected] forward of the October 21, 2022, Assembly Date.

|

1.

|

To elect one Class 3 director of the Firm to serve

|

|

2.

|

To elect one Class 3 director of the Firm to serve a three-year time period to run out in 2025, or till the election and qualification of his successor. [Alan R. Klembczyk] |

| 3. | To ratify the appointment of Lumsden & McCormick, LLP because the unbiased registered public accounting agency of the Firm for the fiscal yr ending Could 31, 2023. |

| 4. | To approve and undertake the 2022 Taylor Gadgets, Inc. Inventory Choice Plan. |

| 5. |

To transact such different enterprise as might correctly come

|

The Board of Administrators has fastened the shut of enterprise

on August 22, 2022, because the document date for figuring out which shareholders shall be entitled to note of and to vote on the Annual Assembly.

SHAREHOLDERS MAY ATTEND THE MEETING BY PROXY. SHAREHOLDERS ARE REQUESTED TO PROMPTLY SUBMIT THEIR VOTE BY INTERNET, BY TELEPHONE OR BY

SIGNING, DATING AND RETURNING THE ENCLOSED PROXY CARD. THE PROXY MAY BE REVOKED AT ANY TIME BEFORE IT IS VOTED.

| BY ORDER OF THE BOARD OF DIRECTORS | ||

| /s/Mark V. McDonough | ||

| DATED: | September 6, 2022 | Mark V. McDonough |

| North Tonawanda, New York | Company Secretary | |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

The

Proxy Assertion and the 2022 Annual Report back to shareholders can be found at www.taylordevices.com/traders.html

[THIS PAGE INTENTIONALLY LEFT BLANK]

PROXY STATEMENT

FOR THE

ANNUAL MEETING OF SHAREHOLDERS

OF

TAYLOR DEVICES, INC.

90 TAYLOR DRIVE

NORTH TONAWANDA, NEW YORK 14120

_________________________

OCTOBER 21, 2022

This Proxy Assertion is furnished to

shareholders by the Board of Administrators of Taylor Gadgets, Inc. in reference to the solicitation of proxies to be used on the Annual

Assembly of Shareholders to be held on October 21, 2022, at 11:00 a.m. EDT, and at any adjournments of the assembly, for the needs set

forth within the accompanying Discover of Annual Assembly of Shareholders. This Proxy Assertion and the accompanying type of proxy are

being mailed to shareholders commencing on or about September 9, 2022.

If the enclosed type of proxy is correctly executed

and returned, the shares represented by the proxy shall be voted in accordance with the proxy’s directions. Any proxy given pursuant

to this solicitation could also be revoked by the shareholder at any time previous to its use by written discover to the Company Secretary of the

Firm.

The Board of Administrators has fastened the shut of enterprise

on August 22, 2022, because the document date for figuring out the holders of widespread inventory entitled to note of and to vote on the assembly. On

August 22, 2022, the Firm had excellent and entitled to vote a complete of three,502,292 shares of widespread inventory. Every excellent share

of widespread inventory is entitled to at least one vote on all issues to be introduced earlier than the assembly.

For shares held within the title of a dealer or different nominee,

the proprietor might vote such shares on the assembly if the proprietor brings with her or him a letter from the dealer or nominee confirming his or

her possession as of the document date, and a authorized proxy.

PROPOSAL 1

ELECTION OF DIRECTOR

Normal

Annually administrators comprising one of many three Lessons

of the Board of Administrators of the Firm are proposed for election by the shareholders, every to serve for a three-year time period, or till

the election and qualification of his successor. The Board of Administrators, appearing upon the advice of the Nominating Committee, named

Mr. Alan Klembczyk and Mr. Robert Carey as administration’s nominees to be elected at this Annual Assembly.

The

individuals named on the enclosed type of proxy will vote all shares current on the Annual Assembly for the election of the nominees,

until a shareholder, by his or her proxy, directs in any other case. Ought to both of Messrs. Klembczyk and Carey be unable to serve, proxies

shall be voted in accordance with the perfect judgment of the individual or individuals appearing underneath such authority. Administration expects that the nominees

will be capable to serve.

The Firm believes that the nominees have skilled

expertise in areas related to its technique and operations. The Firm additionally believes that the nominees produce other attributes mandatory

to information the Firm and assist the Board operate successfully, together with excessive private {and professional} ethics, the willingness to interact

administration and one another in a constructive and collaborative vogue, the flexibility to dedicate important time to serve on the Board and

its committees and a dedication to representing the long-term pursuits of the shareholders. Along with these attributes, in every

particular person’s biography set forth beneath, the Firm has highlighted particular expertise, {qualifications} and expertise that led the Nominating

Committee and the Board to conclude that every particular person ought to proceed to function a director.

Class 3 Director Whose Time period Will Expire in

2025

Robert M. Carey, 77, has served as a

director since 2020.

Mr. Carey brings over forty-five years of expertise

starting from Normal Administration to consultative work to the Firm. He was the Normal Supervisor of the Reichert Analytical Devices

group from 2001 to 2009. The corporate manufactures and internationally sells a wide range of analytical measurement devices to be used in

drugs, meals processing, and biotechnology analysis.

Mr. Carey was the Principal at CMA, Ltd from

1990 to 2001. CMA, Ltd gives consulting companies to the manufacturing sector within the space of group, operational change, and strategic

planning. Mr. Carey was additionally a Accomplice in Resolution Processes Worldwide (DPI) from 1999 to 2001. DPI is a global strategic

planning consultancy working with firms of all sizes.

In 1979 Mr. Carey joined Wilson Greatbatch Ltd.

(now Integer Holdings) as North American Gross sales Supervisor. Mr. Greatbatch held the patents for the implantable pacemaker. The eponymously

named firm is the world’s chief in implantable energy sources. In 1981 Mr. Carey was named Vice President of Wilson Greatbatch

and Normal Supervisor of the Electrochem Division. Electrochem manufactures and internationally sells excessive power batteries utilized in rugged

or distant environments similar to area, oil and fuel drilling, the navy and the ocean.

He earned a Bachelor of Science in Microbiology

from the State College of California, Lengthy Seashore, and a Grasp of Enterprise Administration from the State College of New York at

Buffalo. Mr. Carey served within the U.S. Military reaching the rank of Captain.

The Firm believes that Mr. Carey’s

expertise in strategic planning for technical manufacturing firms and his information of lean manufacturing, associated statistical methods,

and team-based group buildings qualify him to function a member of the Board of Administrators.

MANAGEMENT RECOMMENDS THAT YOU VOTE “FOR”

THE NOMINEE.

PROPOSAL 2

ELECTION OF DIRECTOR

Class 3 Director Whose Time period Will Expire in

2025

Alan

R. Klembczyk, 56, has served the Firm as President and as a member of the Board of Administrators since June 1, 2018.

Since graduating from the College of Buffalo in

1987 with a level in Mechanical Engineering, Mr. Klembczyk has held key positions in Gross sales, Engineering and Government Administration at Taylor

Gadgets. Over the past 34 years, he has held titles similar to Design Engineer, Assistant Chief Engineer, Chief Engineer, Vice President

of Gross sales & Engineering and was appointed President of the Firm and Member of the Board of Administrators in 2018.

Mr. Klembczyk has been liable for establishing

new Gross sales & Advertising and marketing insurance policies and has been straight concerned with defining inner Firm coverage and strategic course in cooperation

with all ranges of Taylor Gadgets’ Administration. He has been an integral a part of the workforce that managed upgrades to the High quality System

and acquiring third social gathering certification to Worldwide Requirements ISO 9001, ISO 14000 and Aerospace Customary AS9100.

Mr. Klembczyk has served for a few years on the Technical

Advisory Group for the US Shock and Vibration Data & Evaluation Middle (SAVIAC) and the Shock and Vibration Change (SAVE).

In 2019, he acquired the Distinguished Service Award from SAVE. Moreover, he has been a tutorial and course teacher for varied

organizations internationally and has participated in technical conferences and symposia. He’s a founding member and first co-chair of

the Trade Accomplice Committee of the US Resiliency Council.

Mr. Klembczyk has participated in lots of analysis initiatives

for merchandise for navy & aerospace, industrial, and structural purposes. He has served as Program Supervisor for a lot of of those

initiatives and has labored with academia together with the College at Buffalo’s MCEER: Earthquake Engineering to Excessive Occasions, amongst

others.

He has printed a number of papers describing distinctive

purposes for structural dampers, tuned mass dampers, vibration isolators, shock absorbers, and shock isolators and holds US Patents

for a few of these parts. These papers have been printed by SAVE, SAVIAC, the Society for Experimental Mechanics (SEM) and the Utilized

Know-how Council (ATC).

The Firm believes that his wide-ranging roles all through

his profession on the Firm present him with important management, trade, advertising and marketing, and worldwide expertise, which qualify him

to function a member of the Board of Administrators.

MANAGEMENT RECOMMENDS THAT YOU VOTE “FOR”

THE NOMINEE.

Class 1 Director Whose Time period Will Expire in 2024

John

Burgess, 77, has served as a director since 2007 and is at present the Chairman of the Board of Administrators.

Mr. Burgess gained his worldwide technique, manufacturing

operations and organizational growth experience from his greater than 40 years of expertise with center market public and privately-owned

firms. Mr. Burgess served as President and CEO of Reichert, Inc. a number one supplier of ophthalmic devices, and spearheaded the

acquisition of the corporate from Leica Microsystems in 2002, main the corporate till its sale in January 2007. Previous to the acquisition,

Mr. Burgess served as President of Leica’s Ophthalmic and Instructional Divisions earlier than main the buyout of the Ophthalmic Division

and formation of Reichert, Inc.

From 1996 to 1999, Mr. Burgess was COO of Worldwide Movement Controls, a $200 million diversified manufacturing agency. Throughout his tenure

there, he led a big acquisition technique that resulted in seven accomplished acquisitions and sixteen worldwide companies within the

movement management market. Beforehand, Mr. Burgess operated numerous firms for Moog, Inc., and Carleton Applied sciences, together with six

years as President of Moog’s Japanese subsidiary, Nihon Moog Ok.Ok. positioned in Hiratsuka, Japan. Moog, Inc. is the worldwide chief in

electro-hydraulic servo management know-how with give attention to the aerospace and protection sectors. It was acknowledged as one in all The 100 Greatest Corporations

to Work for in America by Fortune Journal.

Mr.

Burgess earned a Bachelor of Science in Engineering from Tub College in England, and a Grasp of Enterprise Administration from Canisius

Faculty. At the moment Mr. Burgess is a Director of Fowl Applied sciences Company of Solon, Ohio.

On account of the positions and expertise described

above, Mr. Burgess demonstrates management expertise together with his sturdy background in monetary and accounting issues. He serves as Chairman

of the Audit Committee in addition to the Audit Committee monetary skilled. The Firm believes that Mr. Burgess’ tutorial background, and

his expertise in govt positions at a spread of firms in industries associated to that of the Firm, qualify him to function a

member of the Board of Administrators.

F.

Eric Armenat, 63, has served as a director since 2018.

Mr. Armenat has 40 years of enterprise expertise throughout

a myriad of industries each non-public and public. He most not too long ago served because the President and Chief Government Officer of Multisorb Filtration

Group which he efficiently spearheaded the sale of in early 2018 from a non-public fairness proprietor. Multisorb is the world chief within the lively

packaging trade fixing advanced technical challenges within the pharmaceutical, meals, and industrial markets.

From 2012 to 2016, Mr. Armenat served and President

and Chief Government Officer for a number of firms owned by non-public fairness. These firms included healthcare supply, medical waste

assortment and disposal in addition to lively packaging. He was liable for the profitable enterprise enchancment and eventual divestiture

of the businesses.

From 2009 to 2012, Mr. Armenat served as Chief Working

Officer of Avox Methods (Zodiac Aerospace), a number one provider of plane oxygen methods. From 1994 to 2009, he served as Vice President

of Operations after which President and Normal Supervisor of Carleton Applied sciences (Cobham Mission Methods), a worldwide chief of know-how

for the navy and business aviation markets. Mr. Armenat additionally labored as an Operations Administration Guide with Ernst and Younger

starting in 1984.

Mr. Armenat earned his Bachelor of Science Diploma

in Industrial Engineering from Southern Illinois College and his MBA in Finance and Accounting from St. Bonaventure College. He

additionally proudly served in the USA Air Power.

Mr. Armenat’s administration and trade expertise

allow him to offer the Board with a perspective on the Firm’s enterprise, operations, and strategic points. The Firm believes

that Mr. Armenat’s training, positions and expertise described above qualify him to function a member of the Board of Administrators.

Class 2 Director Whose Time period Will Expire in 2023

Timothy

J. Sopko, 56, has served as a director since 2020.

Mr. Sopko’s enterprise expertise spans greater than

thirty years in Aerospace (Army and Civil), Industrial in addition to Business markets with a main focus within the areas of Engineering,

Product Improvement, Program Administration, Operations, and Enterprise Administration.

Previous to becoming a member of Taylor Gadgets as CEO in April 2019,

Mr. Sopko was Vice President and Normal Supervisor of Carleton Applied sciences Inc. (d.b.a. Cobham Mission Methods) in Orchard Park, New York,

a Division of Protection Contractor. Whereas there, he additionally held the positions of Normal Supervisor, Director of Engineering and Applications,

Director of Engineering and Director of Enterprise Improvement. Beneath Mr. Sopko’s management as VP and GM, Carleton efficiently grew

annual gross sales from $110m to over $200m.

After 9 years of Design Engineering and Program

Administration in trade (1988-1997), Mr. Sopko co-founded Complete Technical Options Inc., a New York State S-corporation that gives

product design engineering companies to firms throughout the USA in addition to produces and helps a portfolio of internally funded

merchandise.

Mr. Sopko is a Mechanical Engineering graduate of

The State College of New York at Buffalo the place he was additionally a member of the College’s Mechanical and Aerospace Dean’s

Advisory Board for over ten years. Mr. Sopko can be an creator and/or co-author on a number of US Patents. The mixture of Mr. Sopko’s

information and expertise in varied administration positions inside the trade is the premise for the Nominating Committee’s appointment

of Mr. Sopko to function a member of the Board of Administrators.

CORPORATE GOVERNANCE

Board Committees and Conferences

Throughout the fiscal yr ended Could 31, 2022, the Board

of Administrators met 3 times with all the administrators in attendance. All Board members historically attend the annual assembly, however

that the Firm doesn’t have a coverage with regard to attendance. All 5 Board members attended the Firm’s Annual Assembly of Shareholders

held on October 22, 2021.

The

Government Committee, between conferences of the Board of Administrators and to the extent permitted by legislation, workouts all of the powers

and authority of the Board within the administration of the enterprise of the Firm. The Government Committee is comprised of Messrs. Carey, Burgess

and Armenat and chaired by Mr. Burgess.

The Audit Committee

represents and assists the Board of Administrators with its oversight of the integrity of the Firm’s monetary statements and

inner controls, the Firm’s compliance with authorized and regulatory necessities, the unbiased auditor’s {qualifications} and independence

and the efficiency of the Firm’s inner audit operate and unbiased auditor. Besides as in any other case required by relevant legal guidelines,

rules or itemizing requirements, all main selections are thought-about by the Board of Administrators as an entire.

The Audit Committee, comprised of Messrs. Carey, Burgess

and Armenat and chaired by Mr. Burgess, is ruled by an Audit Committee Constitution which was revised and adopted by the Board of Administrators.

Mr. Burgess additionally serves because the Audit Committee monetary skilled. The Audit Committee met 5 instances in fiscal 2022, with all members in

attendance.

The

Compensation Committee, comprised of Messrs. Carey, Burgess and Armenat and chaired by Mr. Armenat, opinions the compensation

of the Firm’s govt officers, and makes suggestions in that regard to the Board as an entire. The Committee additionally administers

the Firm’s inventory possibility plans. The Compensation Committee met 3 times in fiscal 2022, with all members in attendance.

The

Nominating Committee, comprised of Messrs. Carey, Burgess and Armenat and chaired by Mr. Carey, is liable for figuring out

and evaluating people certified to turn into Board members and recommending to the Board candidates to face for election or re-election

as administrators. The Nominating Committee met twice in fiscal 2022, with all members in attendance.

The Charters for the Firm’s Audit, Compensation

and Nominating Committees can be found on-line at www.taylordevices.com/traders. Shareholders may additionally request a printed copy upon written

request to: Mark V. McDonough, Company Secretary, Taylor Gadgets, Inc., 90 Taylor Drive, North Tonawanda, New York 14120.

Independence.

Messrs. Carey, Burgess and Armenat are unbiased administrators inside the which means of Rule 5605 of the relevant NASDAQ Capital

Market itemizing requirements.

Nominating Committee

The Nominating Committee is ruled by the phrases

of its Constitution with respect to the consideration and number of nominees proposed for election to the Board of Administrators, together with

these beneficial by shareholders.

The Standards and Procedures.

The Firm strives to have a Board of Administrators which

will work diligently to advertise the long-term pursuits of the Firm and its shareholders. To that finish, the Nominating Committee Constitution

units forth sure director qualification standards (the “Standards”) which the Nominating Committee and the Board believes are

mandatory for a director of the Firm to own and gives an outline of the procedures to be adopted when making a advice

as to any nominee. As long as any particular person proposed by shareholders meets the Standards, the Nominating Committee will think about such

suggestions on the identical foundation as different candidates. The Standards embrace integrity, repute, judgment, information, independence,

expertise and accomplishments, board interplay, expertise, and long-term dedication. The Committee is required to use the Standards to

candidates beneficial by a Nominating Committee member, different administrators, and administration, in addition to to any candidate assembly the Standards

beneficial by shareholders.

Throughout the choice course of, the Nominating Committee

seeks inclusion and variety inside the Board and adheres to the Firm’s coverage of sustaining an setting free from discrimination

primarily based upon race, colour, faith, nationwide origin, intercourse, age, incapacity, sexual choice or orientation, marital standing, or every other

illegal issue. The Board strives to appoint administrators with a wide range of complementary expertise in order that, as a gaggle, the Board will possess

the suitable expertise, expertise, and experience to supervise the Firm’s enterprise.

The Nominating Committee yearly opinions the necessities

referring to variety and recommends to the Board any modifications it believes acceptable to mirror greatest practices. As well as, the Board

assesses yearly its general effectiveness by way of a self-evaluation course of. This analysis consists of, amongst different issues, an evaluation

of the general composition of the Board, together with a dialogue as as to if the Board has adequately thought-about variety, amongst different

components, in figuring out and discussing director candidates.

The Analysis Course of.

The Nominating Committee Constitution additionally describes the

course of for figuring out and evaluating nominees for director, together with these nominated by shareholders. In every occasion, the Nominating

Committee should assess the Board’s current and anticipated strengths and wishes, primarily based upon the Firm’s present and future wants. The

number of candidates is meant to offer the Board with an acceptable steadiness of experience or expertise in accounting and finance,

know-how, administration, worldwide enterprise, compensation, company governance, technique, trade information and common enterprise

issues.

Administration’s Nominees.

The Board of Administrators beneficial Mr. Alan Klembczyk

as administration’s proposed Class 3 Director nominee and Mr. Robert Carey as administration’s proposed Class 3 Director nominees

to face for election by shareholders at this Annual Assembly. Along with different standards, any nominee beneficial should meet independence

requirements set forth in of Rule 5605 of the NASDAQ Capital Market itemizing requirements.

Nominees by

Shareholders.

Shareholders of the Firm might make their solutions

for a director nominee to your entire Board of Administrators or to any particular person director, by a submission directed to the Firm’s Company

Secretary’s Workplace. The Company Secretary’s Workplace will then ahead the advice, along with all supporting documentation,

to Mr. Carey, as Chairman of the Nominating Committee. Supporting documentation should embrace an in depth background of the proposed candidate

and reveal how the candidate meets the Standards.

Suggestions must be despatched c/o Company Secretary’s

Workplace, Taylor Gadgets, Inc., 90 Taylor Drive, North Tonawanda, NY 14120.

Speaking with the Board of Administrators

Though the Board of Administrators doesn’t have a proper

process for shareholders to ship communications to the Board of Administrators, a shareholder might talk with the Firm at its web site

at www.taylordevices.com/about-us/traders. The Firm will relay communications to specified particular person administrators if an specific request

to take action is included within the shareholder communication.

Code of Ethics

On August 23, 2003, the Firm adopted a Code of

Ethics (the “Code”) which is a compilation of written requirements fairly designed to discourage wrongdoing and promote sincere and

moral conduct. Code necessities embrace, amongst others, the preparation of full, truthful, well timed and comprehensible disclosure in paperwork

that the Firm information with and submits to the SEC; compliance with governmental legal guidelines, guidelines and rules; immediate inner reporting

of violations to the Code; and accountability for adherence to the Code. There have been no amendments to the Code since its adoption

and it was re-adopted by the Board of Administrators on March 12, 2020.

Board Management Construction

Subsequent to the retirement of Douglas P. Taylor

on Could 31, 2018, the Board of Administrators appointed long-time unbiased director John Burgess as Chairman of the Board. The Board additionally

appointed Timothy J. Sopko as Chief Government Officer in April 2019. In doing so, the Board believes that that is the best management

construction for the Firm and is in the perfect pursuits of its shareholders. The Board believes that Messrs. Burgess and Sopko are greatest

suited to serve of their respective roles as a result of their collective information and expertise inside the trade will enable them to determine

strategic priorities and alternatives, and thus, extra successfully execute the Firm’s technique and obtain long-term success.

Board Threat Oversight

Threat administration is primarily the duty of

the Firm’s administration; nonetheless, the Board has duty for overseeing administration’s identification and administration of these dangers.

The Board considers dangers in making important enterprise selections and as a part of the Firm’s general enterprise technique. The Board and

its committees, as acceptable, talk about and obtain periodic updates from senior administration relating to important dangers, if any, to the

Firm in reference to the annual overview of the Firm’s marketing strategy and its overview of budgets, technique, and main transactions.

Every Board committee assists the Board in overseeing

administration of the Firm’s dangers inside the areas delegated to that committee, and is tasked with reporting to the complete Board, as acceptable.

The Audit Committee is liable for dangers referring to its overview of the Firm’s monetary statements and monetary reporting processes,

the analysis of the effectiveness of inner management over monetary reporting, and compliance with authorized and regulatory necessities.

The Compensation Committee is liable for monitoring dangers related to the design and administration of the Firm’s compensation

applications. The Nominating Committee oversees danger because it pertains to the Firm’s company governance processes. Every committee has full

entry to administration. As well as, the Audit Committee meets commonly with the Firm’s unbiased auditors.

Report of the Audit Committee for the Fiscal Yr

Ended Could 31, 2022

The knowledge contained on this Audit Committee

Report shall not be deemed to be soliciting materials or deemed to be filed with or included by reference in filings with the U.S.

Securities and Change Fee (“SEC”), or topic to the liabilities of Part 18 of the Securities Change Act of 1934.

As required by the phrases of the Audit Committee Constitution, the undersigned

members of the Audit Committee have:

| 1. |

Reviewed and mentioned the Firm’s audited monetary

|

| 2. |

Reviewed

|

| 3. |

Obtained the written disclosures and the letter from

|

| 4. | Primarily based on the foregoing, the Audit Committee has beneficial to the Firm’s Board of Administrators that the Firm’s audited monetary statements be included in its Annual Report on Kind 10-Ok for fiscal 2022 for submitting with the SEC. |

|

Respectfully submitted, John Burgess F. Eric Armenat Robert M. Carey |

[THIS PAGE INTENTIONALLY LEFT BLANK]

Director Compensation – Fiscal 2022

Every non-employee member of the Board of Administrators

receives a $3,500 quarterly retainer payment. Efficient in fiscal 2023, the Chairman of the Board of Administrators receives a $11,000 quarterly

retainer payment and the opposite two non-employee members of the Board of Administrators receives a $7,000 quarterly retainer payment.

The Audit Committee meets independently of the Board

of Administrators not lower than 5 instances every year. Every committee member receives a payment of $1,000 per committee assembly. Efficient in fiscal

2023, every committee member receives a payment of $2,000 per committee assembly.

The Nominating Committee meets independently of the

Board of Administrators not lower than twice a yr. Every committee member receives a payment of $500 per committee assembly. Efficient in fiscal

2023, every committee member receives a payment of $1,000 per committee assembly.

The Compensation Committee meets independently of

the Board of Administrators not lower than twice a yr. Every committee member receives a payment of $500 per committee assembly. Efficient in fiscal

2023, every committee member receives a payment of $1,000 per committee assembly.

Pursuant to the components set forth within the 2018 Taylor

Gadgets, Inc. Inventory Choice Plans on April 18, 2022, the fastened date of the grant, every director and the Firm’s Chief Monetary Officer

had been granted choices to buy 5,000 shares of the Firm’s inventory. The train worth on April 18, 2022 was $9.53, which was the truthful

market worth for a share of widespread inventory in keeping with the phrases of the 2018 Plan. The truthful market worth is the imply between the excessive and

low costs for a share of widespread inventory as quoted by NASDAQ on the date of the grant. If there is just one worth quoted for the day of

the grant, the truthful market worth shall be such worth; and if no such worth is quoted for the day of the grant, the truthful market worth shall

be the earlier closing worth. Within the occasion that no earlier closing worth is obtainable, then the truthful market worth of 1 share of Widespread

Inventory on the day the choice is granted shall be decided by the Committee or by the Board.

Director Compensation Desk

|

Title |

Charges earned or paid in money ($) |

Inventory awards ($) |

Choice awards ($) |

Non-equity incentive plan compensation ($) |

Nonqualified deferred compensation earnings ($) |

All different compensation ($) |

Whole ($) |

|

John Burgess |

$21,500 |

– |

$12,586 |

– |

– |

$1,000 |

$35,086 |

|

F. Eric Armenat |

$21,500 |

– |

$12,586 |

– |

– |

$1,000 |

$35,086 |

|

Robert M. Carey |

$21,500 |

– |

$12,586 |

– |

– |

$1,000 |

$35,086 |

Assumptions made within the valuation of possibility awards

are described in Observe 14 to the Firm’s Consolidated Monetary Statements included within the Firm’s Annual Report back to Shareholders accompanying

this Proxy Assertion.

EXECUTIVE COMPENSATION

Overview of Compensation Program

The first goal of the Compensation Committee

is to yearly overview and approve the Firm’s general compensation philosophy and set up company objectives and aims in accordance

with such philosophy.

Duties and Duties

In step with its main goal, the committee

yearly evaluates the efficiency of the Firm’s govt officers; determines and approves the compensation of the CEO, together with

particular person components of wage, bonus, supplemental retirement, incentive and fairness compensation, and determines and approves govt

officer (non-CEO) compensation, incentive compensation plans and equity-based plans. In its deliberations, the committee considers firm

efficiency, compensation at comparable firms, previous years’ compensation to the corporate’s govt officers and different related components.

The next desk units forth sure info

regarding compensation of, and inventory choices held by the Firm’s Chief Government Officer, President and Chief Monetary Officer as

of Could 31, 2022.

Abstract Compensation Desk

|

Title and principal place |

Yr |

Wage ($) |

Bonus ($) |

Inventory awards ($) |

Choice awards ($) |

Nonequity incentive plan compensation ($) |

Change in pension worth and nonqualified deferred compensation earnings ($) |

All different compensation ($) |

Whole ($) |

|

Timothy J. Sopko Chief Government Officer |

2022 2021 |

$250,000 $250,000 |

$69,691 – |

None None |

$12,586 $17,438 |

– – |

None None |

$22,650 $23,668 |

$362,427 $291,106 |

|

Alan R. Klembczyk President |

2022 2021 |

$235,000 $235,000 |

$65,511 – |

None None |

$12,586 $17,438 |

– – |

None None |

– $11,361 |

$313,097 $263,799 |

|

Mark V. McDonough Chief Monetary Officer |

2022 2021 |

$220,000 $220,000 |

$61,329 – |

None None |

$12,586 $17,438 |

– – |

None None |

– $11,346 |

$293,915 $248,783 |

Pursuant to its Administration Bonus Coverage, for the fiscal

yr ended Could 31, 2022, the Firm paid bonuses to the chief officers named within the Abstract Compensation Desk above. Beneath the coverage,

the Compensation Committee might approve cost for efficiency primarily based on an quantity, calculated within the mixture for all individuals, and

of not more than 15% of internet earnings of the Firm for the fiscal yr then ended.

Choice awards embrace 5,000 choices awarded to Mr.

Sopko in 2022 and 2021; 5,000 choices awarded to Mr. Klembczyk in 2022 and 2021; and 5,000 choices awarded to Mr. McDonough in 2022 and

2021. See additionally Safety Possession of Sure Helpful House owners and Administration.

Assumptions made within the valuation of possibility awards

are described in Observe 14 to the Firm’s Consolidated Monetary Statements included within the Firm’s Annual Report back to Shareholders accompanying

this Proxy Assertion.

Excellent Fairness Awards at Fiscal 2022 Yr-Finish

| Choice Awards | Inventory Awards | ||||||||

|

Title |

Variety of securities underlying unexercised choices (#) exercisable |

Variety of securities underlying unexercised choices (#) unexercisable |

Fairness incentive plan awards: Variety of securities unearned choices (#) |

Choice train worth ($) |

Choice expiration date |

Variety of shares or items of inventory that haven’t (#) |

Market worth of shares or items of inventory which have ($) |

Fairness incentive plan awards: Variety of unearned (#) |

Fairness incentive plan awards: Market or payout worth ($) |

| Timothy J. Sopko |

5,000 5,000 5,000 |

None | None |

$ 9.8500 $11.9500 $9.5250 |

04/18/30 04/22/31 04/18/32 |

None | None | None | None |

|

Alan R. Klembczyk |

3,000 3,000 3,000 5,000 5,000 5,000 5,000 |

None |

None |

$12.8000 $19.2550 $12.2792 $11.9750 $ 9.8500 $11.9500 $9.5250 |

08/12/25 08/03/26 08/04/27 04/18/29 04/18/30 04/22/31 04/18/32 |

None |

None |

None |

None |

|

Mark V. McDonough |

4,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 |

None |

None |

$ 8.0550 $ 7.7400 $ 8.9851 $12.2000 $16.4000 $13.8000 $10.3000 $11.9750 $ 9.8500 $11.9500 $9.5250 |

08/07/22 04/18/23 04/18/24 04/18/25 04/18/26 04/18/27 04/18/28 04/18/29 04/18/30 04/22/31 04/18/32 |

None |

None |

None |

None |

Employment and Change in Management Agreements

As of August 9, 2021, Mr.

Sopko and, as of June 1, 2018, Messrs. Klembczyk and McDonough (every, an “Government”) entered into Employment Agreements with

the Firm (collectively, the “Agreements”). By their phrases, the Agreements will robotically renew every year after the date of

this settlement (the “Preliminary Time period”) offered nonetheless, that both social gathering might elect to not renew this Settlement for any Renewal

Interval by offering 90 days written discover of such election previous to the top of the Preliminary Time period or any Renewal Interval. The Firm might

terminate the employment of an Government in its absolute discretion, with out Trigger (as outlined within the relevant Settlement), and for any

cause. The Government might terminate the Settlement and his employment at any time and for Good Cause (as outlined within the relevant Settlement).

Every Settlement gives for

the cost of a Severance Bundle of (i) the continuation of the Government’s base wage for a interval of 12 months and (ii) if,

the Government makes a sound election pursuant to the Consolidated Omnibus Finances Reconciliation Act of 1985, as amended (COBRA) for continuation

of medical health insurance underneath the relevant Firm plan, reimbursement of premiums for such protection for a interval of as much as 12 months. If

the Settlement just isn’t renewed by the Government, no Severance Bundle shall be paid. If the Settlement just isn’t renewed by the Firm, the

Government shall be entitled to the Severance Bundle. Every Government has agreed to a non-competition clause for 12 months after termination

of employment with the Firm, in any location the place the Firm has made gross sales inside the 5 years previous termination.

The Firm agrees to pay

Messrs. Sopko, Klembczyk and McDonough base salaries of $257,500, $242,000 and $226,600 per yr, respectively, topic to extend at

the discretion of the Board. Executives shall be eligible for an Incentive Compensation Plan primarily based on Firm efficiency as permitted

by the Board of Administrators.

Safety Possession of Sure Helpful House owners

and Administration

The next desk units forth sure info

relating to the helpful possession of the Firm’s widespread inventory as of August 22, 2022, with respect to (i) every individual identified by the Firm

to be the helpful proprietor of greater than 5% of the Firm’s widespread inventory, (ii) every of the Firm’s administrators and nominees for director,

(iii) every named govt officer and (iv) all the administrators and govt officers as a gaggle. All info is predicated solely upon

possession filings made by such individuals with the Securities and Change Fee, or upon info offered by such individuals to the

Firm.

Title of Helpful Proprietor |

Variety of Shares |

Proportion of Widespread Inventory Owned |

|||||||||

|

Janney Montgomery Scott LLC 1717 Arch Avenue Philadelphia, PA 19103 |

339,196 | 9.7 | |||||||||

|

Ira Sochet 121 14th Avenue Belleair Seashore, FL 33786 |

459,015 |

13.12 |

|||||||||

| Administration | Variety of Shares | Proportion of Widespread Inventory Owned | |||||||||

| John Burgess | 75,000 | (1) | 2.04 | ||||||||

| Mark V. McDonough | 62,000 | (1) | 1.69 | ||||||||

| Alan R. Klembczyk | 31,123 | (1) | 0.85 | ||||||||

| Timothy J. Sopko | 21,000 | (1) | 0.57 | ||||||||

| F. Eric Armenat | 20,000 | (1) | 0.54 | ||||||||

| Robert M. Carey | 12,500 | (1) | 0.34 | ||||||||

| All the Administrators and Government Officers as a gaggle |

221,623

|

|

6.03

|

||||||||

| (1) | Consists of choices granted to administrators and officers which haven’t been exercised: 50,000 by Mr. Burgess, 50,000 by Mr. McDonough, 20,000 by Mr. Armenat, 29,000 by Mr. Klembczyk, 15,000 by Mr. Sopko and 10,000 by Mr. Carey. These choices had been granted pursuant to the 2012 Taylor Gadgets, Inc. Inventory Choice Plan (“2012 Plan”), the 2015 Taylor Gadgets, Inc. Inventory Choice Plan (“2015 Plan”) and the 2018 Taylor Gadgets, Inc. Inventory Choice Plan “2018 Plan). | ||||||||||

Indemnification Insurance coverage for Administrators and Officers

On August 23, 2022, the Firm bought a director

and officer indemnification insurance coverage coverage written by the Cincinnati Insurance coverage Firm. The renewal was for a one-year interval at an

annual premium of $46,450. The coverage gives indemnification advantages and the cost of bills in actions instituted in opposition to any

director or officer of the Firm for claimed legal responsibility arising out of his conduct in such capacities. No funds or claims for indemnification

or bills have been made underneath any administrators’ and officers’ insurance coverage insurance policies bought by the Firm.

The Firm has entered into Indemnity Agreements

with its administrators and sure officers. Though the Firm’s by-laws and the New York Enterprise Company Legislation (the “BCL”)

authorize the Firm to indemnify administrators and officers, neither require the administrators and officers to be indemnified through the pendency

of litigation or specify the instances at which the Firm is obligated to reimburse an indemnified individual for bills. The Indemnity Agreements

present that the Firm will advance litigation bills to the individual indemnified whereas the motion is pending, upon the indemnified

individual’s assurance (as required by the BCL) that the advance shall be returned if the indemnified individual is finally discovered to not be

entitled to it.

Fairness Compensation Plan Data

The next desk units forth info relating to

fairness compensation plans of the Firm as of Could 31, 2022.

| Fairness Compensation Plan Data | ||||||||

|

Plan Class |

Variety of securities to be issued upon train of (a) |

Weighted-average train worth of excellent choices, (b) |

Variety of securities remaining accessible for future (c) |

|||||

| Fairness compensation plans permitted by safety holders | ||||||||

|

2008 Inventory Choice Plan 2012 Inventory Choice Plan 2015 Inventory Choice Plan 2018 Inventory Choice Plan |

4,750 52,000 90,000 136,250 |

$ 8.06 $11.30 $12.72 $10.75 |

– – – 23,750 |

|||||

| Fairness compensation plans not permitted by safety holders |

|

|||||||

| 2004 Worker Inventory Buy Plan (1) |

– |

– |

217,287 |

|||||

| Whole | 283,000 | 241,037 | ||||||

| (1) | The Firm’s 2004 Worker Inventory Buy Plan (the “Worker Plan”) permits eligible workers to buy shares of the Firm’s widespread inventory at truthful market worth via payroll deductions and with out brokers’ charges. Such purchases are with none contribution on the a part of the Firm. |

OTHER PLANS

The Firm adopted an Worker Inventory Buy Plan

in 2004. As of August 23, 2022, there are 216,932 shares accessible on the market to certified workers. The Firm additionally gives a 401(ok)

plan.

TRANSACTIONS WITH MANAGEMENT AND OTHERS

None.

BOARD DIVERSITY MATRIX

| Board Range Matrix (As of August 22, 2022) | ||

| Whole Variety of Administrators | 5 | |

| Feminine | Male | |

| Administrators | 0 | 5 |

| Variety of Administrators who determine in Any of the Classes Under: | ||

| White | 0 | 5 |

| Army Veterans | 3 | |

The Board of Administrators thinks that the current measurement of the Board, consisting

of 5 administrators, is enough for the scale and operations of the Firm. The Board views the rising the scale of the Board

by including further administrators to be too costly for a enterprise the scale of the Firm. The Board considers the current Board

members to be worthwhile and mandatory for the continued operation of the Board. Consequently, the Board considers its current make-up

to be good for the Firm at the moment.

PROPOSAL 3

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee engaged Lumsden & McCormick,

LLP to function the Firm’s unbiased registered public accounting agency for the fiscal yr ending Could 31, 2023. Though the Audit

Committee just isn’t required to take action, it’s submitting its anticipated choice for ratification to the Annual Assembly with a purpose to verify

the views of the shareholders. The Audit Committee won’t be certain by the vote of the shareholders; nonetheless, if the proposed choice

just isn’t ratified, the Audit Committee will revisit its choice.

A consultant of Lumsden & McCormick, LLP shall be current on the

assembly, shall be accessible to answer acceptable questions and may have the chance to make a press release if she or he needs

to take action.

The Audit Committee approves all skilled companies,

together with tax associated companies, offered to the Firm by Lumsden & McCormick, LLP. Concerning “Audit and Audit-Associated”

companies, the Committee opinions the annual audit plan and approves the estimated audit finances upfront. The mixture charges billed by

Lumsden & McCormick, LLP for skilled companies to the Firm had been $119,000 and $116,000 for the fiscal years ended Could 31, 2022

and 2021.

Audit Charges

The mixture charges billed by Lumsden & McCormick,

LLP for skilled companies rendered in reference to the audit of the Firm’s annual monetary statements, the overview of the Firm’s

quarterly monetary statements and companies which might be usually offered in reference to statutory and regulatory filings or engagements

had been $94,000 and $92,000 for the fiscal years ended Could 31, 2022 and 2021.

Audit-Associated Charges

There have been no mixture charges billed by Lumsden &

McCormick, LLP for skilled assurance and associated companies fairly associated to the efficiency of the audit of the Firm’s monetary

statements, however not included underneath Audit Charges, for the fiscal years ended Could 31, 2022 and 2021.

Tax Charges

The mixture charges billed by Lumsden & McCormick,

LLP for skilled companies for tax compliance, tax recommendation and tax planning had been $19,000 and $11,000 for the fiscal years ended Could

31, 2022 and 2021.

All Different Charges

The mixture charges billed by Lumsden & McCormick,

LLP for the skilled companies rendered in reference to the audit of the Firm’s 401(ok) Plan had been $6,000 and $13,000 for

the fiscal years ended 2022 and 2021.

Pre-approval Insurance policies and Procedures

The Audit Committee has adopted a coverage that requires

advance approval of all audit, audit-related, tax companies and different companies carried out by the unbiased auditor. The coverage gives

for pre-approval by the Audit Committee of particularly outlined audit and non-audit companies. Except the precise service has been beforehand

pre-approved with respect to that yr, the Audit Committee should approve the permitted service earlier than the unbiased auditor is engaged

to carry out it.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE

APPOINTMENT OF LUMSDEN & MCCORMICK, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING

MAY 31, 2023, BE RATIFIED AND URGES YOU TO VOTE “FOR” THIS PROPOSAL.

PROPOSAL 4

ADOPTION OF THE 2022 TAYLOR DEVICES, INC. STOCK

OPTION PLAN

The 2022 Taylor Gadgets, Inc. Inventory Choice Plan (“2022

Plan”) gives for the grant of choices to buy widespread inventory within the Firm to sure workers of the Firm in addition to to

the Firm’s administrators. The staff shall be chosen by the Compensation Committee of the Board of Administrators of the Firm, which

is comprised of two or extra Administrators, appointed by the Board, chosen from these administrators who should not workers of the Firm (“Committee”).

The present Compensation Committee members are Messrs. Carey, Burgess and Armenat. If shareholders on the Annual Assembly undertake the 2022

Plan, the Committee will stay the identical. Committee members are eligible to take part within the 2022 Plan on a restricted foundation pursuant

to a predetermined components.

The Committee is allowed to designate an possibility

as both an “Incentive Inventory Choice” or a “Non-Certified Inventory Choice” underneath the provisions of the Inner Income

Code of 1986, as amended (“Code”). If the 2022 Plan is permitted by the shareholders, a most of 260,000 shares of widespread inventory

shall be reserved for the grant of choices.

Incentive Inventory Choices to buy 7,000 shares of

widespread inventory shall be granted yearly to every worker director and Non-Certified Inventory Choices to buy 7,000 shares of widespread inventory

shall be granted yearly to every non-employee director, on April 18th of every yr that the 2022 Plan is in impact, commencing

April 18, 2023. No further choices could also be granted to such people, absent an modification to the 2022 Plan, which modification have to be

permitted by the shareholders. If the President of the Firm determines, in his sole discretion, that on such date the Firm is in

possession of fabric private info in regards to the Firm’s enterprise, the grant shall be delayed till the third day following

publication of such info, or the date of the occasion which renders such info immaterial.

The choice worth shall be 100% of the truthful market

worth of every share of widespread inventory on the date the choice is granted. If an Incentive Inventory Choice is granted to a person proudly owning

(straight or not directly) greater than 10% of the whole mixed voting energy of excellent widespread inventory of the Firm, the acquisition worth

per share shall be 110% of the truthful market worth of the inventory on the date of grant, and the choice, by its phrases, won’t be exercisable

greater than 5 years from the date of grant.

For functions of the 2022 Plan, “truthful market worth”

is the imply between the excessive and low costs for a share of widespread inventory, as quoted by the NASDAQ system for the date of grant. If there

is just one worth quoted for the day of grant, then the truthful market worth shall be such worth; and if no such worth is quoted for the

day of the grant, the truthful market worth shall be the earlier closing worth. Within the occasion no such worth is obtainable, then the truthful market

worth of 1 share of widespread inventory on the date the choice is granted shall be decided by the Committee or by the Board of Administrators.

The truthful market worth of the widespread inventory as of August 22, 2022 was $10.10.

Choices granted underneath the 2022 Plan shall terminate

on the date decided by the Committee and specified within the possibility settlement which can accompany every grant of an possibility, however, in any

occasion, not later than 10 years after the date of grant (or 5 years within the case of an possibility granted to a greater than ten % shareholder).

An possibility held by a person whose employment is terminated shall terminate (1) if the choice holder’s employment is terminated due

to changing into completely and completely disabled, one yr after the date of termination of employment (within the case of Incentive Inventory Choices)

and upon the expiration date (within the case of Non-Certified Inventory Choices); (2) if the choice holder’s employment is terminated as a result of

dying or if the choice holder dies inside three months after termination of employment (a) within the case of an Incentive Inventory Choice, one

yr after the date of termination of employment, and (b) within the case of a Non-Certified Choice, inside one yr from the date of the

possibility holder’s dying; (3) instantly, if employment is terminated for trigger, until another expiration date is fastened by the Committee;

or (4) three months after the date employment terminates for every other cause (within the case of Incentive Inventory Choices), or (within the case

of Non-Certified Inventory Choices), until one other date is fastened by the Committee, 18 months after employment terminates. Whether or not a licensed

go away of absence for navy or governmental service constitutes termination of employment for functions of the 2022 Plan shall be decided

by the Committee. In no occasion, nonetheless, shall any possibility be exercisable after its expiration date.

No possibility granted underneath the 2022 Plan is assignable

or transferable, apart from by will or the legal guidelines of descent and distribution; through the lifetime of the optionee, the choice shall be

exercisable solely by the optionee.

The complete textual content of the 2022 Plan is annexed as Appendix

A.

Accounting Remedy

SEC Rules require the Firm to deal with an possibility

grant and train as a cost in opposition to earnings.

Tax Remedy

The Firm is suggested by counsel that, underneath the

current provisions of the Code and Code rules, the federal earnings tax therapy of inventory choices underneath the 2022 Plan will rely

upon whether or not the choice is (1) an Incentive Inventory Choice supposed to qualify underneath Part 422 of the Code or (2) a Non-Certified Inventory

Choice (all different choices).

The federal earnings tax penalties described on this

part are primarily based on legal guidelines and rules in impact on August 20, 2022, and there’s no assurance that the legal guidelines and rules won’t

change sooner or later and have an effect on the tax penalties of the issues mentioned on this part. Optionees additionally could also be topic to further

taxes underneath state tax legal guidelines which can differ from the relevant federal earnings tax legal guidelines described on this part.

Incentive

Inventory Choices. Usually, no taxable earnings is acknowledged by an worker upon the grant or train of an Incentive Inventory Choice.

If widespread inventory acquired pursuant to the train of an Incentive Inventory Choice is (i) held by the worker for a minimum of two years from

the date of grant and a minimum of one yr from the date the widespread inventory is transferred to that worker, and, (ii) that worker stays

employed by the Firm always from the date of grant of the choice till three months earlier than the date of train (or one yr

earlier than the date of train within the case of a disabled worker or three months earlier than dying within the case of a deceased worker), the worker

won’t acknowledge earnings for normal tax functions upon the train of the choice. Nevertheless, train of an Incentive Inventory Choice might

end in recognition of earnings for various minimal tax functions. Neither the grant nor train of an Incentive Inventory Choice, nor

any acquire derived from the disposition of inventory acquired by the train of an Incentive Inventory Choice will represent taxable “wages”

underneath the Federal Insurance coverage Contributions Act (FICA) and Federal Unemployment Tax Act (FUTA) functions.

Upon the later disposition of the widespread inventory, the

worker will acknowledge long-term capital acquire or loss equal to the distinction between the gross sales worth and the acquisition worth. Beneath these

circumstances, the Firm won’t obtain a tax deduction on the time of both train or disposition. If the widespread inventory acquired

pursuant to the train of an Incentive Inventory Choice just isn’t held by the worker for the time intervals indicated above or in any other case fails

to qualify, the choice shall be handled as a Non-Certified Inventory Choice and the disposition shall be topic to the earnings tax therapy

described beneath underneath “Non-Certified Inventory Choices”.

The Committee might, in its discretion, grant choices

that expire later than three months after termination of employment. Choices exercised later than three months after termination of employment

(besides within the case of incapacity of the worker or dying of the worker inside three months of termination, through which case the relevant

interval is one yr) shall be handled for earnings tax functions as Non-Certified Inventory Choices.

The quantity by which the truthful market worth of the widespread

inventory on the train date of an Incentive Inventory Choice exceeds the acquisition worth shall be an merchandise of “tax choice” for functions

of the federal various minimal tax provisions of the Inner Income Code.

Non-Certified

Inventory Choices. In contrast to an Incentive Inventory Choice, the train of a Non-Certified Inventory Choice leads to the popularity of

earnings for tax functions which is topic to earnings tax withholding and could also be topic to FICA tax withholding. Nevertheless, the train of

a Non-Certified Inventory Choice doesn’t end in an merchandise of “tax choice” for functions of the federal various minimal

earnings tax.

Upon train of a Non-Certified Inventory Choice, an

optionee will acknowledge atypical earnings in an quantity equal to the surplus of the truthful market worth of the widespread inventory over the choice

worth on the date of train. An individual topic to the “short-swing revenue rule” of Part 16(b) of the Securities Change

Act of 1934 (a “Reporting Particular person”), won’t acknowledge atypical earnings underneath the foregoing sentence for as long as the sale

of the inventory at a revenue would topic such Reporting Particular person to swimsuit underneath the short-swing revenue rule.

To

the Firm. Typically, the Firm shall be entitled to a deduction (topic to any common limitations) in reference to

awards underneath the Plan solely at such time, and in such quantity, as optionees acknowledge atypical earnings in reference to the awards. Thus,

within the case of an Incentive Inventory Choice, assuming there isn’t a disqualifying disposition, the Firm won’t be entitled to a deduction

as a result of the optionees won’t acknowledge atypical earnings. If there’s a disqualifying disposition, the optionee shall acknowledge atypical

earnings and the Firm will subsequently be entitled to assert the accessible deduction. As well as, when train of a Non-Certified Inventory

Choice leads to atypical earnings to the optionee, the Firm shall be entitled to assert the accessible deduction.

Acquire

and Loss. If widespread inventory acquired via the train of an Incentive Inventory Choice or a Non-Certified Inventory Choice is bought,

the optionee will usually acknowledge capital acquire (or loss) equal to the quantity by which the proceeds of sale exceed (or are lower than)

the optionee’s foundation in that widespread inventory. For functions of computing acquire, the optionee’s foundation within the widespread inventory will usually be

its possibility worth plus the quantity of atypical earnings acknowledged by the optionee (if any) upon train of the choice. The acquire (or loss)

shall be long run if the widespread inventory acquired underneath the 2022 Plan has been held for greater than 12 months.

If an optionee pays half or the entire train worth

of an Incentive Inventory Choice or a Non-Certified Inventory Choice by surrendering beforehand acquired Firm widespread inventory, then such optionee’s

tax foundation (and capital beneficial properties holding interval) within the surrendered shares carries over to an equal variety of shares bought by train

of the Choice. If the optionee makes use of inventory beforehand acquired as Incentive Inventory Choice inventory for functions of paying for inventory in a later

train however previous to the expiration of the required holding interval for the Incentive Inventory Choice inventory, such trade shall be handled

as a disqualifying disposition for such beforehand acquired inventory. In such a case, the premise of the exchanged shares is the same as the premise

of the beforehand acquired inventory used to train the choice plus the extra compensation acknowledged by the optionee by cause to

the disqualifying disposition. Any possibility shares acquired for consideration apart from the trade of the beforehand acquired inventory will

have a foundation equal to the quantity paid to train the choice.

Inventory Traits

The widespread inventory to be issued or transferred pursuant

to the 2022 Plan shall be inventory which shall be made accessible, on the discretion of the Board of Administrators of the Firm, both from approved

however unissued shares, or from shares reacquired by the Firm, together with shares bought on the open market.

No preemptive rights are relevant to the shares

lined by the 2022 Plan. The money proceeds to be acquired by the Firm upon train of the choices shall be used for common company

functions.

Variety of Choices

On August 22, 2022, there have been 278,250 choices granted

to optionees and excellent underneath the Taylor Gadgets, Inc. Inventory Choice Plans. 23,750 choices stay accessible for grant underneath the 2018

Plan. The choices underneath the 2018 Plan shall be along with choices accessible underneath the 2022 Plan. The Firm intends to grant the remaining

choices underneath the 2018 Plan to eligible optionees through the fiscal yr ending Could 31, 2023.

Decision

With a view to undertake the 2022 Plan, shareholders are

requested to approve and undertake the next decision on the Annual Assembly of Shareholders:

RESOLVED, that the 2022 Taylor Gadgets, Inc. Inventory

Choice Plan, connected as Appendix A to the Firm’s Proxy Assertion and furnished to shareholders in reference to the Annual Assembly

of Shareholders of the Firm held on October 21, 2022, be, and hereby is, permitted and adopted.

If permitted and adopted, the 2022 Plan will turn into

efficient on the date of adoption by shareholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU

VOTE “FOR” THIS PROPOSAL.

GENERAL INFORMATION

Voting

Beneath

the Enterprise Company Legislation of New York (“BCL”) and the Firm’s By-laws, the presence, in individual or by proxy, of a

majority of the excellent widespread shares is important to represent a quorum of the shareholders to take motion on the Annual Assembly.

The shares that are current or represented by a proxy shall be counted for quorum functions no matter whether or not or not a dealer with

discretionary authority fails to train discretionary voting authority (a “dealer non-vote”) with respect to any explicit

matter. A shareholder attending the digital annual assembly shall be deemed to be current in individual on the assembly for quorum functions.

A nominee standing for election have to be elected by

a plurality of votes forged on the Annual Assembly, and if elected, serve within the class of administrators to which he’s elected. Withheld votes

and dealer non-votes may have no impact on the vote for a nominee.

Some other actions correctly introduced earlier than the assembly,

together with Proposal 3, ratification of Lumsden & McCormick, LLP because the Firm’s unbiased registered public accounting agency

for the fiscal yr ending Could 31, 2023, requires a majority of the votes forged on the assembly by shareholders entitled to vote. Abstentions

may have the identical impact as a vote in opposition to the motion. Dealer non-votes may have no impact on the vote upon the motion.

For voting functions, all proxies marked “for,”

“in opposition to,” “abstain,” or “withhold authority” shall be counted in accordance with such instruction as to

every merchandise.

Bills

The bills of this solicitation, together with the prices

of getting ready and mailing this Proxy Assertion and accompanying materials, shall be borne by the Firm. The Firm has retained the companies

of Regan & Associates, Inc. if wanted to help within the solicitation of proxies underneath a contract offering for the cost of $9,000,

together with out-of-pocket bills. Along with solicitation by mail, Regan & Associates, Inc. and common workers of the Firm

might solicit proxies in individual, by mail or by phone, however no worker of the Firm will obtain any compensation for solicitation

actions along with his or her common compensation. Bills may additionally embrace the costs and bills of brokerage homes, nominees,

custodians and fiduciaries for forwarding proxies and proxy supplies to helpful house owners of shares.

Shareholder Proposals for the 2023 Annual Assembly

Procedures for a nomination by a shareholder for election

as a director are described underneath “Nominees by Shareholders” on web page 8 of this Proxy Assertion.

Proposals of shareholders supposed to be offered

to the yr 2023 Annual Assembly of Shareholders have to be acquired by the Company Secretary of the Firm no later than Could 12, 2023,

for inclusion within the Proxy Assertion and type of proxy. Shareholders wishing to suggest a matter for consideration on the 2023 Annual

Assembly of Shareholders should observe sure specified advance discover procedures set forth within the Firm’s by-laws, a replica of which is

accessible upon written request to: Mark V. McDonough, Company Secretary, Taylor Gadgets, Inc., 90 Taylor Drive, North Tonawanda, New

York 14120.

The by-laws designate procedures for the calling and

conduct of a gathering of shareholders, together with, however not restricted to, specifying who might name the assembly, what enterprise could also be performed,

the procedures with respect to the making of shareholder proposals, and the procedures and necessities for shareholder nomination of

administrators.

Delinquent Part 16(a) Experiences

Part 16(a) of the Change Act requires the Firm’s

govt officers, administrators, and helpful house owners of greater than 10 % of the Firm’s inventory to file preliminary stories of possession

and stories of modifications of possession of the Firm’s widespread inventory with the Securities and Change Fee and the Firm.

Monetary and Different Data

The monetary statements of the Firm for the fiscal

yr ended Could 31, 2022, are contained within the Firm’s 2022 Annual Report which accompanies this Proxy Assertion.

OTHER MATTERS

The Board of Administrators is aware of of no different issues to

be voted upon on the Annual Assembly. If every other issues correctly come earlier than the Annual Assembly, it’s the intention of the individuals

named within the enclosed type of proxy to vote on such issues in accordance with their judgment.

|

By Order of the Board of Administrators

|

||

| /s/Mark V. McDonough | ||

| Dated: | September 6, 2022 | Mark V. McDonough |

| North Tonawanda, New York | Company Secretary | |

[THIS PAGE INTENTIONALLY LEFT BLANK]

APPENDIX A

TAYLOR DEVICES, INC.

TEXT OF THE 2022 TAYLOR DEVICES, INC.

STOCK OPTION PLAN AS PROPOSED

1. PURPOSES

OF THE PLAN

The aim of the Taylor Gadgets, Inc. 2022 Inventory

Choice Plan (“Plan”) is to offer a way by which these workers of the Firm who’re largely liable for the administration,

development, and safety of the enterprise, and who’re making and might proceed to make substantial contributions to the success of the enterprise,

could also be inspired to accumulate a bigger inventory possession within the Firm thus rising their proprietary curiosity within the enterprise, offering

them with better incentive for his or her continued employment, and selling the pursuits of the Firm and all its shareholders. Accordingly,

the Firm will, every now and then through the time period of the Plan, grant to such workers as could also be chosen within the method offered in

the Plan, choices to buy shares of Widespread Inventory of the Firm topic to the circumstances offered within the Plan. An additional goal

of the Plan is to compensate non-employee Administrators for his or her service and supply them with a stake available in the market worth of Firm Widespread

Inventory.

2. DEFINITIONS

Except the context clearly signifies

in any other case, the next phrases have the meanings set forth beneath.

(a) “Board

of Administrators” or “Board” means the Board of Administrators of the Firm.

(b) “Code”

means the Inner Income Code of 1986, as amended.

(c) “Committee”

means the Compensation Committee of the Firm as described in Part 3 of the Plan.

(d) “Widespread

Inventory” means the widespread inventory of the Firm, $0.025 par worth.

(e) “Firm”

means Taylor Gadgets, Inc., a New York company with its principal office at 90 Taylor Drive, North Tonawanda, New York.

(f) “Grant

Date” as used with respect to a selected Choice, means the date as of which such Choice is granted by the Board or Committee pursuant

to the Plan.

(g) “Incentive

Inventory Choice” means an Choice that qualifies as an Incentive Inventory Choice as described in Part 422 of the Code.

(h) “Non-Certified

Inventory Choice” means any Choice granted underneath the Plan apart from an Incentive Inventory Choice.

(i) “Choice”

means an possibility granted pursuant to Part 5 of the Plan to buy shares of Widespread Inventory and which shall be designated as both an

Incentive Inventory Choice or a Non-Certified Inventory Choice.

(j) “Optionee”

means a person to whom an Incentive Inventory Choice or a Non-Certified Inventory Choice is granted pursuant to the Plan.

(ok) “Everlasting

and Whole Incapacity,” as utilized to an Optionee, signifies that the Optionee has (1) established to the satisfaction of the Firm

that the Optionee is unable, with or with out affordable lodging, to interact in any substantial gainful exercise by cause of any

medically determinable bodily or psychological impairment which might be anticipated to end in dying or which has lasted or might be anticipated to

final for a steady interval of not lower than twelve months, all inside the which means of Part 22(e)(3) of the Code, and (2) happy

any requirement imposed by the Committee.

(l) “Plan”

means the Taylor Gadgets, Inc. 2022 Inventory Choice Plan as set forth herein and as could also be amended every now and then.

(m) “Subsidiary”

means any inventory company of which a majority of the voting widespread or capital inventory is owned, straight or not directly, by the Firm

and any firm designated as such by the Committee, however solely through the interval of such possession or designation.

3. ADMINISTRATION

OF THE PLAN

(a) The

Plan shall be administered by the Committee, which shall be composed of two or extra Administrators who’re appointed by the Board of Administrators

and chosen from these Administrators who should not workers of the Firm or a Subsidiary. The Board might every now and then take away members

from or add members to the Committee. Vacancies on the Committee, howsoever brought about, shall be crammed by the Board. The Board shall choose

one of many Committee’s members as Chairman. The Committee shall maintain conferences at such instances and locations as it might decide, topic to

such guidelines as to procedures not inconsistent with the provisions of the Plan as are prescribed by the Board, set forth within the Firm’s

By-laws as relevant to the Government Committee, and as prescribed by the Committee itself. A majority of the approved variety of members

of the Committee shall represent a quorum for the transaction of enterprise. Acts diminished to or permitted in writing by a majority of the

members of the Committee then serving shall be legitimate acts of the Committee.

(b) The

Committee shall be vested with full authority to make such guidelines and rules because it deems mandatory or fascinating to manage the

Plan and to interpret the provisions of the Plan. Any willpower, determination, or motion of the Committee in reference to the development,

interpretation, administration, or software of the Plan shall be closing, conclusive, and binding upon all Optionees and any individual claiming

underneath or via an Optionee until in any other case decided by the Board.

(c) Any

willpower, determination, or motion of the Committee offered for within the Plan could also be made or taken by motion of the Board, if it so determines,

with the identical drive and impact as if such willpower, determination, or motion had been made or taken by the Committee. No member of the

Committee or of the Board shall be chargeable for any willpower, determination or motion made in good religion with respect to the Plan or any

Choice granted underneath the Plan. The truth that a member of the Board who just isn’t then a member of the Committee shall on the time be, or

shall theretofore have been, or thereafter could also be an individual who has acquired or is eligible to obtain an Choice shall not disqualify him

or her from participating in and voting at any time as a member of the Board in favor or in opposition to any modification or repeal of the Plan, offered

that such vote shall be in accordance with the suggestions of the Committee.

4. STOCK

SUBJECT TO THE PLAN

(a) The

Widespread Inventory to be issued or transferred underneath the Plan would be the Firm’s Widespread Inventory which shall be made accessible, on the discretion

of the Board, both from approved however unissued Widespread Inventory or from Widespread Inventory reacquired by the Firm, together with shares bought

within the open market.

(b) The

mixture variety of shares of Widespread Inventory which can be issued underneath the Plan shall not exceed 260,000 shares. Within the occasion that any excellent

Choice underneath the Plan for any cause expires or is terminated, the shares of Widespread Inventory allocable to the unexercised portion of such

Choice might once more be made topic to Choice underneath the Plan.

5. GRANT

OF THE OPTIONS

(a) Administrators

On April 18th of every

yr, commencing April 18, 2023, Incentive Inventory Choices to buy 7,000 shares of Widespread Inventory shall be granted yearly to every of