The U.S. financial system added extra jobs than anticipated final month regardless of rising inflation and issues about an financial slowdown. However in distinction to this, on account of components analysts consider are particular to industries, a number of corporations lately introduced hiring freezes and layoffs as a part of cost-cutting measures.

In response to a latest survey, greater than half of all U.S. companies intend to put off staff as they put together for a downturn within the financial system. Corporations are involved for numerous causes, together with financial uncertainty, elevated inflation, provide chain disruptions, larger rates of interest, and slower development.

Given their weak financials, historical past of large losses, and bleak development prospects, we expect shares of hard-hit corporations which have lately taken layoff measures, corresponding to Shopify Inc. (SHOP), DoorDash Inc. (DASH), and Peloton Interactive Inc. (PTON), are the perfect averted now.

Shopify Inc. (SHOP)

SHOP provides a cloud-based, multi-channel commerce platform for small and medium-sized companies. Retailers use the corporate’s software program to run their companies throughout their gross sales channels, together with Internet and cellular storefronts, bodily retail places, social media storefronts, and marketplaces.

In July, SHOP introduced that it could be shedding 10% of its workforce. In a memo to staff, CEO Tobi Lutke admitted that he had underestimated the size of the pandemic-driven e-commerce growth and that, amid a broader pullback in on-line spending, Shopify would lower a number of roles.

In the course of the second quarter ended June 30, 2022, SHOP’s income elevated 15.7% year-over-year to $15.7 billion. Nonetheless, its working loss got here in at $190.21 million, in comparison with an working earnings of $139.44 million. The corporate reported a web lack of $1.20 billion, in comparison with a web earnings of $879.09 million within the prior-year quarter. Its loss per share amounted to $0.95.

Analysts anticipate SHOP’s EPS to say no 116.7% in fiscal 2022 and 181.8% within the present quarter ending September 2022. The inventory has declined 80.8% over the previous 12 months and 26.9% over the previous month.

SHOP’s POWR Rankings are in step with this bleak outlook. The inventory has an general score of F, which interprets to a Sturdy Promote in our proprietary score system. The POWR Rankings are calculated by contemplating 118 various factors, with every issue weighted to an optimum diploma.

SHOP has been graded a D for Development, Worth, and Sentiment. Throughout the F-rated Web – Companies business, it’s ranked #29 of 30 shares.

To see extra POWR Rankings for High quality, Stability, and Momentum for SHOP, click on right here.

DoorDash Inc. (DASH)

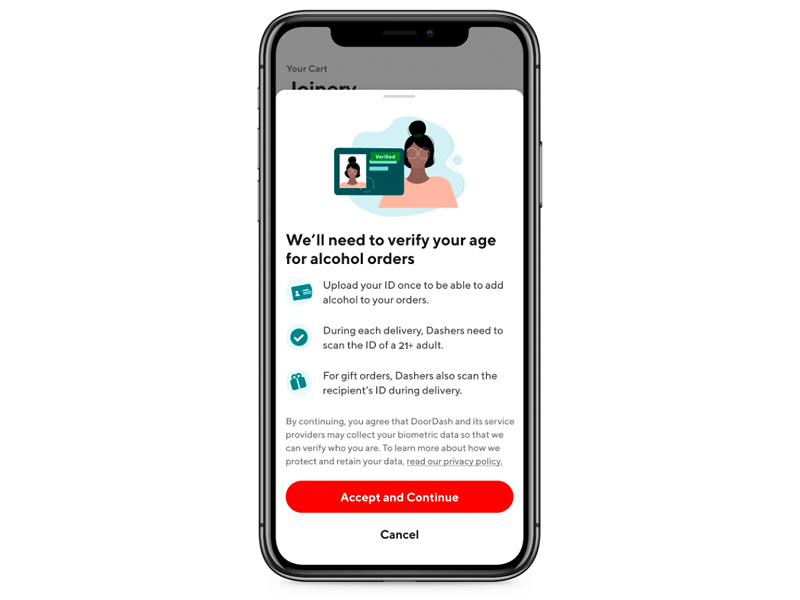

DASH runs a logistics platform that connects retailers, prospects, and dashers in america and worldwide. It runs the DoorDash market, which provides numerous providers that assist retailers remedy mission-critical issues like buyer acquisition, supply, insights, analytics, merchandising, fee processing, and buyer assist.

In July, DASH shut down Chowbotics (its robotics division) and laid off 35 staff. The thought is predicated on the corporate’s incapability to show a revenue throughout the pandemic when revenues skyrocketed to new heights.

DASH’s income elevated 30.1% year-over-year to $1.61 billion for the second quarter ended June 30, 2022. Nonetheless, its working loss elevated 175.8% from the year-ago worth to $273 million. Its web loss surged 157.8% from the prior-year quarter to $263 million. Its loss per share amounted to $0.72.

Its EPS is anticipated to say no 100% within the present quarter ending September 2022 and 60.4% in fiscal 2022. The inventory has declined 69.9% over the previous 12 months and 60.9% year-to-date.

DASH’s weak fundamentals are mirrored in its POWR Rankings. The inventory has an general D score, equating to Promote in our proprietary score system. The inventory has a D grade for Development, Worth, and Sentiment. Within the F-rated Web – Companies business, it’s ranked #24.

Along with the POWR Rankings grades I’ve simply highlighted, you may see the DASH score for Momentum, Stability, and High quality right here.

Peloton Interactive Inc. (PTON)

PTON sells interactive health merchandise in North America and internationally. It sells related health merchandise with touchscreens that stream stay and on-demand lessons beneath the model names Peloton Bike, Peloton Bike+, Peloton Tread, and Peloton Tread+.

Final month, PTON introduced plans to chop roughly 800 jobs to cut back its working footprint and lower prices. Along with job cuts, the corporate introduced that it could elevate costs on sure merchandise and outsource features corresponding to gear deliveries and customer support to third-party distributors. Starting subsequent 12 months, the corporate will even progressively shut a lot of its retail showrooms.

It additionally intends to put off roughly half of its buyer assist employees, based in Plano and Tempe, Arizona. As wanted, third-party corporations shall be used to deal with assist requests.

PTON’s complete income decreased 27.6% year-over-year to $678.7 million for the fourth quarter ended June 30, 2022. Its working loss grew 298.6% from the prior-year quarter to $1.20 billion. The corporate’s web loss surged 297.3% from the year-ago worth to $1.24 billion. Its loss per share grew 250.5% year-over-year to $3.68.

Avenue expects PTON’s revenues to say no 14.4% year-over-year to $3.07 billion in fiscal 2022. As well as, its EPS is anticipated to say no by 76.5% every year over the subsequent 5 years and stay adverse within the present and subsequent years. The inventory has declined 91.2% over the previous 12 months and 26.3% over the previous month.

PTON’s poor prospects are additionally obvious in its POWR Rankings. The inventory has an general F score, which equates to a Sturdy Promote in our proprietary score system.

It additionally has an F grade for High quality and Sentiment and a D for Worth. PTON is ranked #57 of 59 shares within the C-rated Shopper Items business.

Click on right here to see the extra POWR Rankings for PTON (Momentum, Stability, and Development).

SHOP shares had been buying and selling at $30.17 per share on Wednesday afternoon, up $0.33 (+1.11%). Yr-to-date, SHOP has declined -78.10%, versus a -16.43% rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Pragya Pandey

Pragya is an fairness analysis analyst and monetary journalist with a ardour for investing. In school she majored in finance and is at the moment pursuing the CFA program and is a Stage II candidate. Extra…