LauriPatterson/E+ by way of Getty Photos

McCormick (NYSE:NYSE:MKC) is a worldwide chief within the taste business and simply qualifies as a dividend aristocrat with 36 years of consecutive dividend will increase. I lined McCormick right here at Looking for Alpha final October and since that time the corporate has reported its full 12 months FY 21 outcomes. EPS for the 12 months was above the excessive vary of steerage and the corporate’s share value has risen considerably. I focused a six-month share value of $83.01 and the market has already handed that degree with a present value at this writing of about $97.50. I nonetheless see McCormick as a fantastic firm with potential for future positive factors, however I believe it’s a bit forward of present honest worth. I see the inventory as a maintain with a present honest worth of $86.01.

Supply for picture, knowledge, and data: McCormick

FY 21 Outcomes

McCormick reported report monetary outcomes for FY 21 with positive factors in each its Client and Taste Options segments regardless of the load of provide points and pressures from inflation. Gross sales elevated 13% from the prior 12 months, or 11% in fixed foreign money, reflecting positive factors from the current acquisitions and robust shopper demand.

McCormick believes {that a} shift to extra consumption at residence has been in progress for a number of years, even previous to the stay-at-home necessity created by the pandemic. They be aware a 6% improve in natural gross sales with shoppers persevering with to make use of extra of their merchandise. The truth is, demand was so excessive that the corporate once more pulled down on buyer inventories in Q3 and This fall, which additionally implies that restocking on inventories can be wanted.

McCormick notes the significance of capital investments that have been made over the past a number of years to extend abroad manufacturing capability. They acknowledge that the investments initially have been on the expense of U.S. funding which left some capability considerations early within the pandemic. However they’ve since elevated U.S. manufacturing capability and lessened co-packing expense. With U.S. and worldwide investments, the corporate believes the outcomes signify a aggressive benefit. Additionally, shelf situations are bettering sequentially, together with throughout the fourth quarter, which is the everyday quarter of highest seasonal demand.

Like many different firms and different industries, McCormick is experiencing margin compression from elevated prices in packaging and freight. For these causes the corporate has applied value saving administration initiatives and recognized methods to cut back discretionary spending the place it’s clever to take action. They level to their lengthy historical past of compounded progress thorough durations of short-term pressures and see the present interval as one other a type of occasions. As proof, they be aware a lower of 70 foundation factors in administrative bills fueled by gross sales progress and fewer want for model advertising and marketing.

As talked about, the current acquisitions are already offering advantages. The addition of Cholula and FONA, are mentioned to be creating worth and bringing synergies which might be lowering prices and positively affecting earnings per share. They discovered that transaction and integration prices have been decrease than deliberate, and they’re on schedule with the Cholula synergy goal of $10 million by 2022 and the $7 million FONA goal for 2023.

Inflation is actually a consider most all items presently, and that has effects on McCormick in value of products and processing. The corporate states that it isn’t but identified if 2022 will show to be a 12 months of recession, however they be aware that their firm normally tends to do nicely each in higher financial occasions, and in occasions of a downturn. They use an instance that some buyers could purchase a cheaper reduce of meat because of larger inflation after which purchase extra spices to season.

However as is the character of inflation, the way in which firms cowl prices ultimately could result in larger costs charged to clients. Likewise, McCormick started to go on its prices with costs will increase throughout 2021. The corporate seems to be taking a sluggish and measured strategy as they see future will increase to happen to at the least till mid-2022. The corporate is taking elasticity in consideration, and they’re spreading out the will increase to minimize the influence. That would indicate some short-term absorption of prices which might be negatively affecting margins however might also indicate higher margins to come back later in 2022 as prices are presumably higher lined.

Valuation

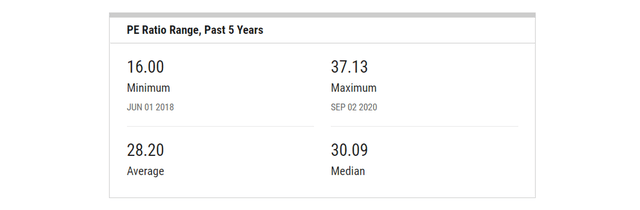

In my prior article, I thought-about the then firm FY 21 steerage of adjusted EPS of $2.97 – $3.02 to make use of for my goal. I used a mid-range issue of $3.00 with a then 5-year common P/E from YCharts of 27.67 to make use of a guess projection for a six-month goal share value of $83.01. As I acknowledged, my goal was since already met and exceeded.

When the FY 2021 adjusted outcomes have been launched it confirmed that the corporate carried out over the steerage, with an adjusted EPS of $3.05. Additionally, the present common 5-year P/E from YCharts is now 28.20.

Utilizing the up to date knowledge, we may assume a present honest market worth of $86.01 and that’s considerably decrease than the present share value.

I believe there may be appreciable query of how a lot larger inflation could rise, and the corporate doesn’t plan to extend costs too shortly, which may restrict margins. Additionally, as costs rise there could be some query of elasticity of demand. For these causes, I am not inclined to anticipate a P/E that’s above the 5-year common, so I believe the present honest market worth I state is cheap. Though I do acknowledge that the present P/E available in the market as we speak is above common.

As one other test, the present firm steerage for the full-year 2022 is for $3.17 – $3.22 adjusted EPS. When you take the excessive finish at $3.22 and apply the present 5-year common P/E, you would possibly anticipate a share value of round $90.80 which can also be above as we speak’s present share value.

That is to not say that as we speak’s share value isn’t justifiable. As soon as costs are raised and/or as soon as and if prices return to extra regular ranges, then it’s possible you’ll assume that McCormick may see larger EPS ranges. Additionally, McCormick outperformed 2021 steerage and you might assume that would occur once more. The truth is, it is vitally early into 2022 so there may be at all times potential for steerage to be upgraded. Or, in fact, steerage could be downgraded, however usually firms give steerage that they imagine they’ll attain.

Dangers

The corporate offers a full listing of dangers in its annual submitting. I like to recommend studying that in its entirety. Additionally, I listed a number of dangers in my earlier article that I imagine are nonetheless related and needs to be thought-about. I will add a number of extra ideas beneath, and I be aware that any dangers, together with market or world occasions, can result in share values that don’t mirror the thesis of the article.

Provide and freight prices seem like among the many largest margin limiting danger components presently. I believe it’s affordable to anticipate the scenario to enhance over time, and as we hope the pandemic will get additional behind us. However inflation is excessive in comparison with historic ranges, and these situations ought to proceed to be thought-about.

Last Ideas

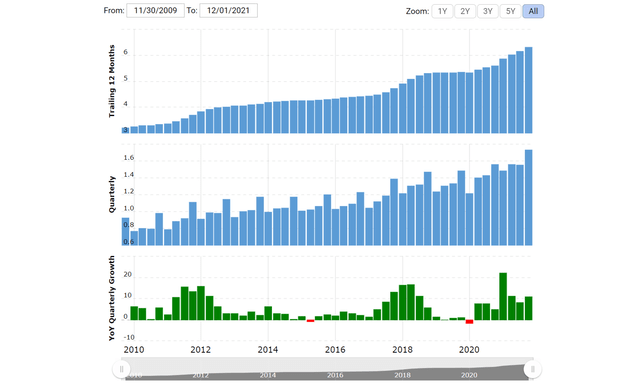

McCormick is a good American firm with a protracted historical past and a gentle report of income progress. The income chart from Macrotrends beneath illustrates the purpose.

Historic Income Information (MacroTrends)

Whereas there are some headwinds, the corporate is making the mandatory changes together with making the most of long-term financing alternatives at low rates of interest with their establishing of $1 billion in notes. And the timing could show to be prudent because it was completed earlier than rates of interest could quickly start to rise.

As acknowledged, McCormick is a dividend aristocrat, and true to kind they not too long ago introduced a 9% improve for the dividend, thus marking their 36 consecutive 12 months of dividend will increase. For a lot of, a reliable rising dividend could make a very good cause alone to carry onto the corporate inventory.

Additionally, I believe it might be clever for McCormick to not be too fast in elevating costs. It could value a bit of within the short-term, if some prices should not absolutely handed on to shoppers, nevertheless it additionally permits time for shoppers to regulate. Or probably, it even permits time to see if inflationary pressures and freight prices pull again ahead of anticipated. And if larger costs are absorbed nicely and different prices decline that suggests the chance to extend margins.

With all issues, and with all firm actions to mitigate headwinds, it might assist clarify why the market is presently awarding a P/E larger than the 5-year common. I can see that as affordable, but when I have been shopping for shares, I’d attempt to purchase them nearer to, or probably beneath my honest market value of $86.01, if such a chance does turn out to be out there. Nonetheless, McCormick is a good firm, and I imagine there are ample justifications to carry the inventory on the present value.

McCormick Manufacturers (McCormick)

In any case, it is a good probability McCormick has one thing you want.