NoDerog/iStock Unreleased through Getty Photographs

Condiments large McCormick (NYSE:MKC) reported document gross sales development for the monetary yr ended November 2021, with revenues rising 13% YoY to USD 6.3 billion together with a 2% favorable impression from forex. Each main segments contributed with Client section gross sales rising 9% or 7% in fixed forex and Taste Options section gross sales leaping 19% or 16% in fixed forex. Client section gross sales had been pushed by a sustained client shift to at-home cooking in addition to acquisitions development (McCormick acquired Mexico-based scorching sauce model Cholula in November 2020). Taste Options gross sales had been pushed by incremental gross sales from acquisitions (McCormick acquired taste producer FONA Worldwide in December 2020) and gross sales to packaged meals and beverage firms, and meals service prospects.

Gross margins declined to 39.6% in FY 2021, from 41.1% the earlier yr, largely pushed by commodity, packaging and transport inflation, partially offset by the corporate’s Complete Steady Enchancment (CCI) program. Working revenue inched up 2% YoY to USD 1.02 billion in FY 2021, from USD 1.00 billion the earlier yr, whereas working margins dropped to 16% in FY 2021 from 17.8% in FY 2020. The decline was attributed to gross margin compression, strategic funding spending, and better particular fees and transaction integration bills.

Going ahead, McCormick’s sturdy development has room to run. Whereas it’s unclear whether or not close to time period tailwinds from elevated residence cooking pushed by the Covid-pandemic might final lengthy after the pandemic (surveys reveal conflicting outcomes with some indicating shoppers will proceed cooking at residence post-pandemic for well being and value causes whereas different surveys present shoppers are getting drained of the time and inconvenience related to residence cooking), the general condiments market remains to be scrumptious as ever, with long run projections valuing the market at greater than USD 100 billion by 2026, rising at a CAGR of 5.2% between 2020 -2026.

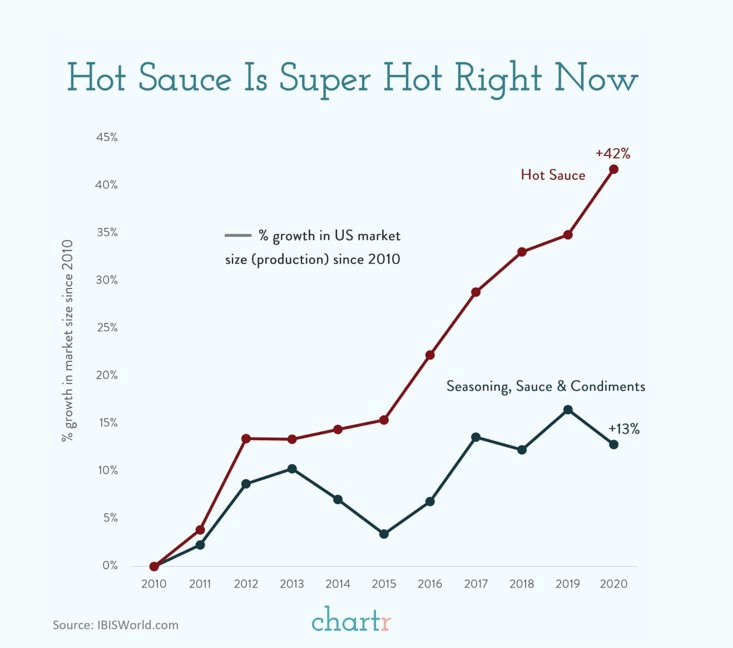

Having acquired some iconic condiment manufacturers recently (notably scorching sauce manufacturers Frank’s RedHot Sizzling Sauce, and Cholula) McCormick is poised to take an even bigger chunk of the rising international condiments market. Within the U.S. the place Frank’s RedHot Sizzling Sauce is the main scorching sauce model in response to Euromonitor and Cholula lately turned quantity 2, scorching sauce, scorching sauce gross sales have grown thrice sooner than the final condiments trade within the U.S. since 2010 in response to IBISWorld.

Whitebox Actual Property

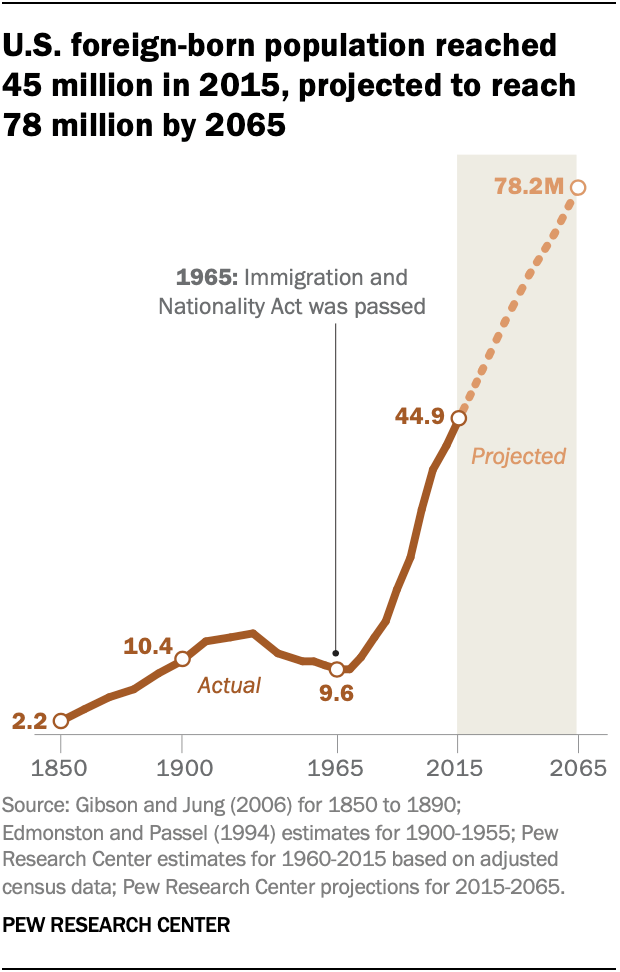

Demand is being pushed by the nation’s vibrant and rising immigrant group, and American millennials who’ve turn out to be scorching sauce followers as effectively. With U.S. immigrants and their descendants anticipated to account for 88% of U.S. inhabitants development via 2065, the U.S. scorching sauce market has basically ample room for development in the long term.

Pew Analysis Heart

Globally, McCormick’s scorching sauce manufacturers have ample room to develop. Leveraging on McCormick’s intensive wholesale relationships with retailers and eating places worldwide due to its core spices and seasonings enterprise, McCormick can broaden distribution for decent sauce manufacturers Cholula and Frank’s RedHot and seize market share within the international scorching sauces market which is anticipated to develop round 5%–7% CAGR in response to figures from a number of analysis companies. Frank’s and Cholula are already being featured on the menus of quick meals chains Subway and Chopt within the U.S., and there may be ample room for growth worldwide.

Margins

Inflation ate into margins with gross, working and internet margins declining in FY 2021.

|

Gross margins |

39.6% |

41.1% |

|

Working margins |

16% |

17.8% |

|

Internet margins |

11% |

12.6% |

Nevertheless, value will increase had been carried out solely in late 2021, and additional will increase are anticipated in late 2022, which suggests the results of value will increase might probably assist margins in FY 2022. Additional profitability enhancements may also be anticipated from value chopping measures from its Complete Steady Enchancment (CCI) program (the corporate is focusing on value financial savings of USD 85 million in 2022), as effectively from the exit of a decrease margin product line in late 2021. Long term, rising gross sales volumes from model constructing and advertising and marketing efforts in addition to distribution growth might probably result in value financial savings from scale economies.

Financials

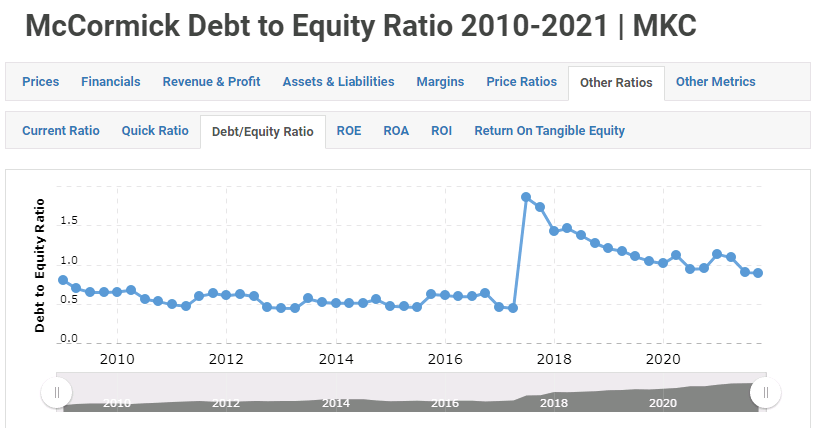

McCormick’s acquisitions since 2017 (RB Meals for USD 4.2 billion in 2017, Cholula for USD 800 million in November 20202, and FONA Worldwide for USD 710 million in December 2020), has left the corporate with a good quantity of debt with a complete debt to fairness ratio of 119 and a long run debt to fairness ratio of 90 for its most up-to-date quarter. The corporate nevertheless has been targeted on paring down this debt, leading to a constant drop on this ratio over the previous few years, though it nonetheless stays elevated in comparison with historic ranges.

Macrotrends

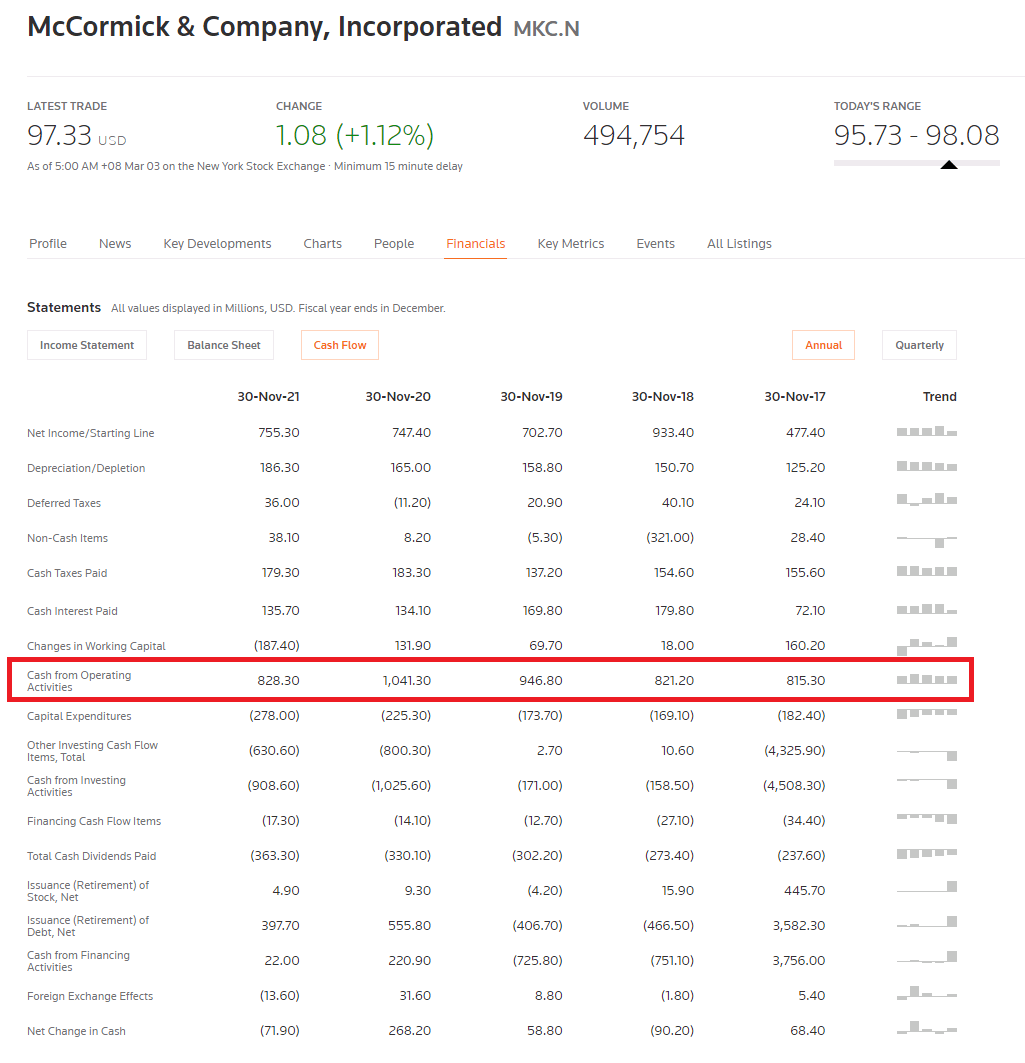

With working money flows on an uptrend over the previous a number of years (except FY 2021 when working money flows declined partly on account of elevated working capital wants, primarily from greater stock stockpiling, a defensive measure in opposition to provide chain bottlenecks), going ahead McCormick might possible be capable to handle its debt together with fulfilling different investing and financing wants reminiscent of CAPEX, and dividend funds (the corporate’s share repurchase program was curtailed in an effort to deleverage its steadiness sheet).

Reuters

In FY 2021, McCormick generated USD 820 million in working money flows (which features a USD 150 million lower in money circulate on account of extra purchases of inventories), spent almost USD 280 million in CAPEX, and barely greater than USD 360 million in dividend funds.

That left about USD 180 million. Along with its money reserves of USD 350 million and present receivables of USD 550 million, McCormick has barely greater than USD 1 billion to service present liabilities of about USD 3.2 billion and long run debt of USD 3.9 billion. That is fairly a good place nevertheless a gentle enhance in money flows and continued monetary self-discipline might assist McCormick handle or the corporate can probably elevate fairness capital if wanted.

Dangers

McCormick’s growth from spices and into different condiments together with mustard and notably scorching sauce, pits it in opposition to larger condiments giants reminiscent of Kraft Heinz (KHC) and Unilever (UL), each of whom are considerably larger than McCormick. Kraft Heinz’s revenues of USD 26 billion and Unilever’s revenues of GBP 45 million are respectively about 4 and ten instances larger than McCormick’s. They’re more likely to have larger R&D, and advertising and marketing budgets, enabling them to outspend McCormick on product innovation, model constructing, and acquisitions. Ketchup king Heinz as an example has been quickly increasing its line of mustards, and barbeque condiment product traces, and is experimenting with a brand new line of “mashups” that mix basic flavors.

Though McCormick presently holds the mustard crown within the U.S. with French’s Mustard, and the recent sauce crown within the U.S. with Frank’s and Cholula, condiments remains to be a comparatively open market worldwide and even within the U.S., smaller gamers are carving out their very own market niches (Yellowbird Meals as an example has emerged because the number one scorching sauce vendor in Entire Meals and Amazon). The opportunity of larger rivals buying and creating considered one of these rising manufacturers or spending closely to construct their very own manufacturers can’t be dominated out. With McCormick comparatively constrained by way of debt, McCormick might not have the steadiness sheet flexibility to make one other acquisition if wanted, enabling rivals to scoop up potential winners.

A heavy debt burden additionally introduces rate of interest danger. The Federal Reserve is reportedly planning to elevate charges in March to counter rising inflation. Nevertheless, with an curiosity protection ratio of greater than 8 instances, McCormick’s moderately predictable money flows, and robust market place, this danger is more likely to have a comparatively small impression on the corporate total.

Abstract

McCormick is increasing past spices and into different condiments notably scorching sauces for development. Leveraging on its portfolio of market main condiment manufacturers together with its established relationships with retailers and meals service institutions worldwide, McCormick has great potential to seize market share within the international condiments market and drive prime line in addition to backside line development. With McCormick’s growth technique largely hinged on acquisitions, the corporate’s debt burden has elevated as effectively. Nevertheless, given administration’s give attention to deleveraging, steadily rising money flows, McCormick’s sturdy market place and its portfolio of market main condiment manufacturers, there may be cause to be cautiously optimistic of a continued enchancment in its steadiness sheet going ahead.