HONG KONG- A few of Asia’s massive China-focused hedge funds are shopping for extra non-China shares as regulatory scrutiny, coverage uncertainties and a slowing mainland financial system pressure them to chop publicity to offshore Chinese language property.

Beijing’s clampdown on expertise corporations, an actual property debt disaster, Sino-US audit tensions and disruptions from zero-COVID insurance policies, have hit sentiment, portfolio managers stated, including it was troublesome to see how corporations would develop.

“The previous yr has been extraordinarily troublesome for funds which might be primarily based in Hong Kong and specializing in investing in offshore China shares,” stated a Hong Kong-based hedge fund portfolio supervisor, who declined to be recognized because of the sensitivity of the topic.

“Many have needed to reduce publicity to China shares and allocate some positions to the US or Southeast Asia.”

Hedge funds are aggressive customers of leverage and derivatives to generate yields. China-focused funds have historically stored a big portion of portfolios in American Depository Receipts (ADRs) of mainland corporations.

HHLR Advisers, an funding administration agency underneath non-public fairness agency Hillhouse Capital Group, had three non-China corporations in its high 5 US-listed holdings within the second quarter in contrast with only one within the second quarter of 2021, 13F filings to the US Securities and Change Fee present.

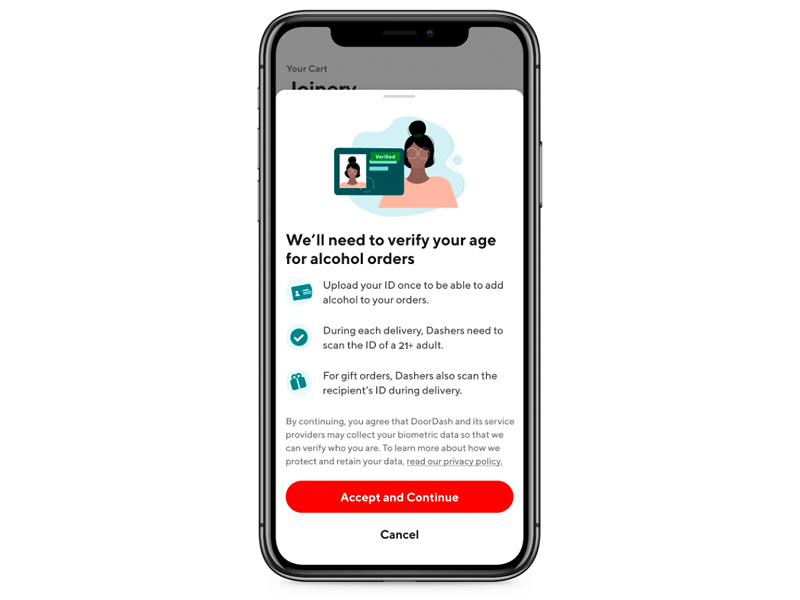

HHLR is without doubt one of the largest offshore China managers and recognized for its heavy positions in US-listed Chinese language shares. Its three high non-China holdings are buyer relationship administration platform supplier Salesforce, meals supply agency DoorDash and gaming and e-commerce firm Sea. Its high holding, comprising 19 p.c of its portfolio in US-listed shares, is Chinese language drug developer BeiGene

Hong Kong-based Aspex Administration which manages greater than $7 billion and focuses on pan-Asian fairness, backed by Hillhouse Founder Zhang Lei, has additionally switched holdings. 4 out of 5 of Aspex’s high buys amongst US-listed corporations within the second quarter had been non-China names, together with DoorDash, semiconductor tools provider Lam Analysis, NVidia and Las Vegas Sands.

Its non-China publicity now accounts for about 31 p.c of its high 10 US-listed holdings, a big improve from about 15 p.c within the first quarter of 2022, or 14 p.c in the identical interval final yr, primarily based on Reuters calculations in accordance with 13F filings.