Picture supply: Getty Photos

Your subsequent meals supply order could price greater than you deliberate.

Key factors

- Supply apps like DoorDash are handy, however that comfort comes at a value.

- Some apps use sneaky techniques like displaying larger menu costs, which may lead to you paying extra in your subsequent order.

Supply apps add comfort to our lives. Whereas it may be costly to order takeout, many Individuals use supply app providers to get their favourite restaurant dishes delivered to their houses.

Most individuals know that meals supply usually comes at the next worth due to the comfort. Whenever you use apps like DoorDash, paying supply charges is the norm.

However supply app corporations produce other sneaky methods to get you handy over extra cash. Whenever you consider all the additional prices, you might be paying far more than you’d in the event you picked up the identical meal instantly out of your favourite restaurant.

1. The meals itself could price extra

Your favourite supply apps could also be charging greater than you notice.

A method they do that is by itemizing menu gadgets at the next worth. The worth you see on a neighborhood eatery’s restaurant menu could not match the value you see in your supply app of selection. Eating places pay fee charges to be listed in apps like DoorDash and Uber Eats.

Many eating places show in-app menu gadgets at the next worth than ordinary to compensate for these charges. Meals gadgets could also be priced as little as a couple of cents extra, whereas different gadgets could also be priced a lot larger.

In case you order supply continuously by way of apps, these additional expenses can add up over time and negatively influence your checking account stability.

It is a good suggestion to assessment a restaurant’s precise menu and meals costs earlier than putting an order by way of a supply app to make sure that the value you are about to pay is honest.

2. Chances are you’ll be charged supply charges if you assume supply is free

However that is not the solely means supply apps take extra of your hard-earned cash. Chances are you’ll be paying supply expenses, even if you assume you are eligible without spending a dime supply.

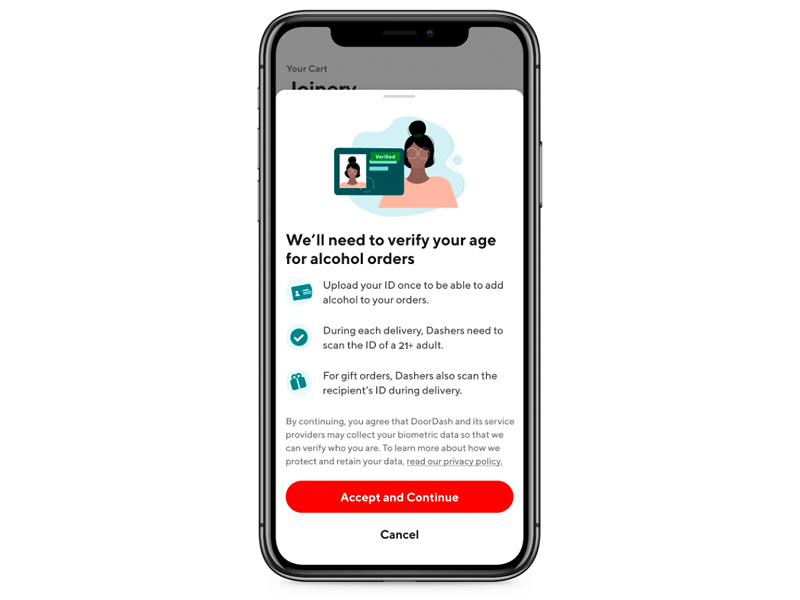

For example, DoorDash has a paid subscription referred to as DashPass. Members can benefit from $0 supply charges on qualifying orders.

Nonetheless, not all eating places proven within the app qualify without spending a dime supply. Which means your membership will not offer you free supply on a regular basis.

In case you’re not paying consideration whereas putting your order throughout the app, you might pay supply charges if you count on supply to be free.

If in case you have a DashPass subscription or an analogous subscription by way of one other supply app, maintain this in thoughts the subsequent time you place an order, so you do not pay greater than you count on.

Persist with a supply and takeout finances

If you wish to benefit from the comfort of supply however do not wish to danger spending greater than you possibly can afford, it is a good suggestion to set and comply with a supply and takeout finances.

Determine how a lot cash you’re feeling comfy spending every week or month, and maintain that in thoughts if you’re within the temper to order takeout. Whereas limiting your takeout spending could take some getting used to, it’s going to get simpler with time.

In case you’re new to budgeting, do not be afraid to start out. The finest budgeting apps simplify the method, permitting you to finances and observe your spending instantly out of your cellphone.

Take a look at these private finance assets for different suggestions that will aid you enhance your monetary scenario.

Alert: highest money again card we have seen now has 0% intro APR till practically 2024

In case you’re utilizing the flawed credit score or debit card, it could possibly be costing you severe cash. Our skilled loves this prime decide, which options a 0% intro APR till practically 2024, an insane money again charge of as much as 5%, and all someway for no annual payment.

In reality, this card is so good that our skilled even makes use of it personally. Click on right here to learn our full assessment without spending a dime and apply in simply 2 minutes.