Be taught Extra about EzFill Holdings, Inc. by having access to the newest analysis report.

Regardless of skyrocketing gasoline costs all through the summer time, gasoline stations and different gasoline retailers aren’t precisely flush with money.

Costs have been largely pushed up on the provision aspect as bans on Russian oil — the world’s second-leading oil-producing nation behind the US — got here alongside a fast restoration in demand from newly reopening economies to create a chokehold on crude oil provides across the globe.

Gross margins throughout the retail gasoline trade have averaged 27 cents per gallon during the last 5 years. In any case different bills are taken out, margins might be so razor skinny that retailers are literally promoting at a loss throughout market downturns — just like the notorious crash at the beginning of the pandemic in March 2020.

To make up for that, many retailers depend on comfort shops or different ancillary gross sales like automotive washes and primary upkeep companies to pad slim gasoline revenue margins. EzFill Holdings Inc. EZFL, then again, studies fixing the margin downside by innovating the complete retail mannequin to deliver gasoline distribution into the twenty first century. Right here’s how the pioneering cell fuel-delivery firm beat the trade commonplace with a 49-cent-per-gallon margin, whilst crude oil costs soared.

EzFill Reviews Sturdy Margin Development In Second-Quarter Earnings Launch

In August, EzFill reported second-quarter earnings pushed by elevated demand for its revolutionary on-demand gasoline supply service. Complete gallons delivered elevated from about 591,000 within the first quarter to just about 790,000 within the second quarter.

In the meantime, the corporate added about 40 new fleet prospects with an anticipated want of about 1.2 million gallons per 12 months.

All informed, deliveries for the second quarter introduced in over $3.7 million in income for a mean margin per gallon of cents. That represents a 32% enhance over the 37-cent-per-gallon margin the corporate reported within the second quarter of final 12 months.

On-Demand, Cell Gasoline Supply Reimagines The Retail Gasoline Mannequin

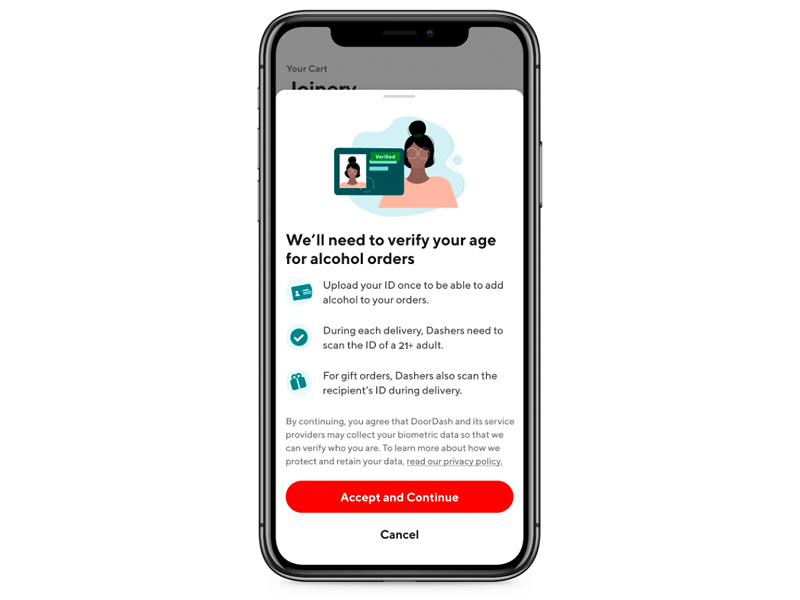

Behind EzFill’s fast progress is arguably its revolutionary gasoline mannequin. Relatively than a community of gasoline stations, the corporate delivers gasoline on to prospects, wherever they’re. Vans carrying gasoline, diesel and different specialty fuels can come to prospects’ houses, workplaces or different areas and fill the automobiles’ tanks. Similar to the DoorDash Inventory DASH mannequin of on demand ordering and supply.

For purchasers, meaning no extra journeys to the gasoline station and no extra operating out of gasoline as they will merely use an app on their cellphone to schedule gasoline deliveries whereas they’re at work or enjoyable at residence.

For companies like Carnival Corp. CCL and Ryder System Inc. R, the cell gasoline supply’s present purchasers, autos, boats and equipment might be fueled up throughout off hours in order that they will begin the subsequent work day with a completely fueled fleet.

That comfort and suppleness helps drive the fast progress in EzFill’s buyer base, however it’s additionally serving to the corporate preserve these wholesome margins. EzFill should buy gasoline day by day and ship it straight from the port or gasoline depot to the shopper, eliminating the necessity for the hazardous and expensive underground gasoline storage that gasoline stations use and the prices related to sustaining a community of gasoline stations.

In the meantime, prescheduled deliveries and purchases enable EzFill to optimize routes to ship gasoline inside scheduled supply home windows in probably the most environment friendly method potential to chop prices on time and gasoline used to make these deliveries.

This submit comprises sponsored promoting content material. This content material is for informational functions solely and isn’t meant to be investing recommendation.

Featured photograph offered by EzFill