It has been a difficult yr for tech shares as rising charges and different macro headwinds have pushed buyers towards extra conservative investments. It may be tempting to keep away from the tech sector altogether till the market stabilizes. Nonetheless, buyers ought to recall Warren Buffett’s well-known recommendation: “Be fearful when others are grasping, and grasping when others are fearful.”

With so many tech shares now buying and selling far beneath their all-time highs, there are many alternatives to get grasping. I personally imagine these three unloved tech shares match the invoice and will expertise huge rallies within the close to future: Uber Applied sciences (UBER 0.45%), Coupang (CPNG -0.84%), and Pinduoduo (PDD 1.08%).

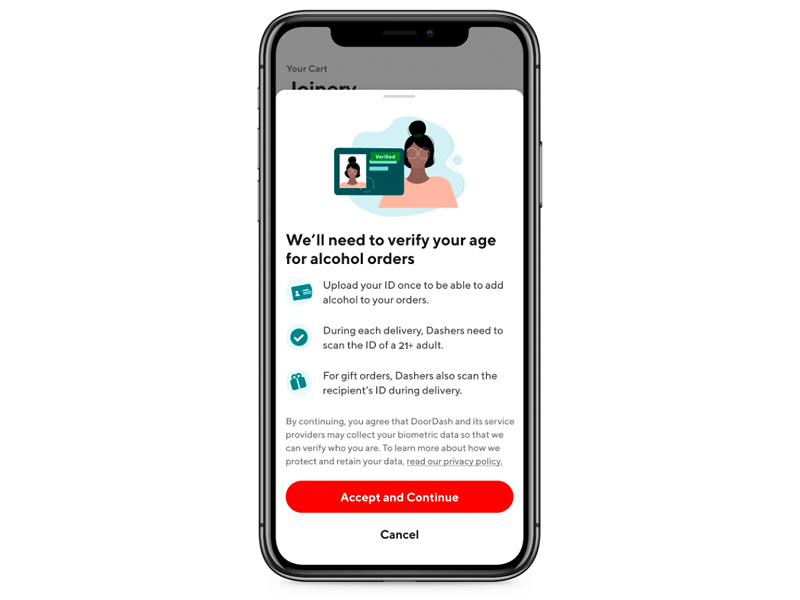

Picture supply: Getty Pictures.

1. Uber Applied sciences

Uber’s inventory at present trades about 35% beneath its preliminary public providing (IPO) value of $45. The bulls retreated because the pandemic quickly disrupted its ride-hailing enterprise, whereas formidable rivals like DoorDash challenged its Uber Eats meals supply phase. Its lack of income additionally made it an unappealing funding as rates of interest rose.

Nonetheless, Uber divested its Southeast Asian, Chinese language, and Indian subsidiaries and its money-losing superior applied sciences group (ATG) over the previous few years to slender its losses. Its ride-hailing enterprise additionally stabilized final yr because the lockdowns ended, and it acquired Postmates to strengthen Uber Eats’ place towards DoorDash.

Because of this, Uber’s revenues at the moment are rising, its web losses are narrowing, and its adjusted EBITDA (earnings earlier than curiosity, taxes, depreciation, and amortization) has remained constructive over the previous 4 quarters. Uber’s income rose 57% to $17.46 billion in 2021, whereas its adjusted EBITDA loss narrowed from $2.53 billion to $774 million. This yr, analysts count on its income to develop one other 79% to $31.2 billion because it generates a constructive adjusted EBITDA of $1.55 billion.

These development charges are spectacular, but Uber’s inventory nonetheless trades at lower than two occasions this yr’s gross sales. However as soon as buyers begin to absolutely recognize Uber’s modifications, its inventory might simply return to its IPO value and proceed climbing.

2. Coupang

Shares of Coupang, South Korea’s prime e-commerce firm, have dropped greater than 50% beneath its IPO value of $35 as buyers fretted over its slowing development and steep losses. Nonetheless, buyers appear to be glossing over its apparent strengths.

About 70% of South Korea’s inhabitants already lives inside seven miles of one in all Coupang’s success facilities, and it continues to develop that logistics community to take care of its edge in next-day deliveries. It additionally locks in its buyers with its Amazon Prime-like “Rocket WOW” subscription service, which provides free transport, reductions, meals and grocery deliveries, and entry to its streaming video platform, Coupang Play, for much less than $4 a month.

Coupang’s income rose 54% to $18.41 billion in 2021, however its adjusted EBITDA loss widened from $357 million to $748 million because it continued to launch new options and develop abroad into Taiwan and Japan.

Analysts count on Coupang’s income to develop simply 14% to $20.96 billion this yr as its development cools off in a post-lockdown market, however additionally they count on its adjusted EBITDA loss to slender to simply $129 million. These development charges might sound unimpressive, however Coupang’s inventory additionally seems dust low-cost at simply 1.4 occasions this yr’s gross sales. Due to this fact, Coupang’s inventory might bounce again rapidly if it stabilizes its gross sales development and meaningfully narrows its losses.

3. Pinduoduo

I am bearish on most Chinese language tech shares as a result of they face unpredictable regulatory headwinds in China and unresolved delisting threats within the U.S. Nonetheless, Pinduoduo would possibly simply be the exception to that rule.

Pinduoduo is China’s third-largest e-commerce firm after Alibaba and JD.com, but it surely’s rising sooner than each. It initially expanded throughout China’s lower-tier cities by letting buyers group up on bulk purchases, and it subsequently entered the agricultural market by straight connecting farmers to shoppers.

Pinduoduo completed final yr with 868.7 million annual energetic consumers, but it surely stays much less uncovered to antitrust headwinds than Alibaba and JD as a result of it generates considerably decrease revenues from every shopper. But, it is nonetheless rising like a weed. In 2021, Pinduoduo’s income rose 58% to $14.74 billion, and it generated a web revenue of $1.22 billion — in comparison with a web lack of $1.1 billion in 2020. Analysts count on its income and web revenue to develop one other 30% and 185%, respectively, this yr.

These are explosive development charges for a inventory that trades at simply 30 occasions ahead earnings and 5 occasions this yr’s gross sales. Merely put, any constructive information about China will seemingly drive Pinduoduo’s inventory larger this yr.

John Mackey, CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Leo Solar has positions in Amazon and Coupang, Inc. The Motley Idiot has positions in and recommends Amazon, Coupang, Inc., DoorDash, Inc., and JD.com. The Motley Idiot recommends Uber Applied sciences. The Motley Idiot has a disclosure coverage.